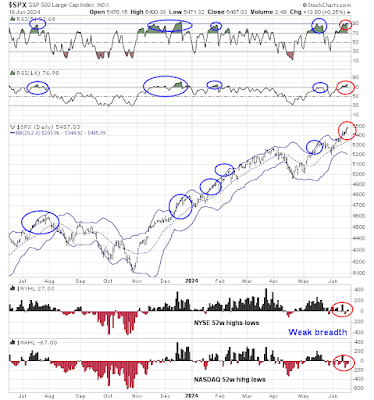

The S&P 500 has gone on another upper Bollinger Band ride, accompanied by a severely overbought reading on the 5-day RSI, which is over 90%. Overbought conditions are often not bearish, but a manifestation of strong price momentum, otherwise known as a "good overbought" signal. That's bullish, right?

Here is what's different this time. The overbought condition occurred along with signs of weak breadth, as evidenced by a series of negative net highs-lows on both the NYSE and the NASDAQ even as the index made new all-time highs. The full post can be found here.