Last week’s headline exclaimed “5,000 or Bust!”. I still believe that’s true as its easily within reach from today’s close at 4,954 (SPY).

The problem is that I don’t expect much more upside from there until the Fed starts lowering rates. If that isn’t coming in March...then how long do we need to wait???

That discussion will be at the heart of today’s Reitmeister Total Return commentary. Plus, we will plot a course to profits even if the overall market is lackluster for a while.

Market Commentary

Chairman Powell threw investors for a loop last Wednesday when he made it clear that rate cuts are highly unlikely to start at the March 21st meeting. Since then, stocks have been more volatile and less bullish.

I have even seen some market commentators calling for a nasty correction or worse. That doesn’t seem necessary. Kind of like when you pull your car up to a red light that you know at some point is going to turn green.

You don’t get out of your car and sit on the curb. Instead, you keep your eyes straight ahead and ready to step on the gas pedal once again.

When will that light for stocks turn green again?

Unfortunately, the combination of Powell’s speech and 3 strong economic reports (Government Jobs, ISM Mfg, ISM Services) pushes it out to the May 1st meeting at a minimum. Right now, investors put 65% odds of that happening. And 97% chance of cuts by the time of the June 28th meeting.

These outcomes are most certainly possible. However, I sense estimates of the rate cuts are a tad too optimistic given the facts in hand. And let’s not forget the immense patience the Fed has exhibited to date leading investors to more than once push out the date of the first cut.

Until that first cut is in hand seems like the perfect setting for a trading range scenario where 5,000 will provide a pretty tight lid on stock prices. The downside is likely 4,800 which was a previous point of stubborn resistance before the recent break above on January 18th.

Stocks never really idle in these trading ranges. More likely it is a volatile time with constant sector rotations and changes in market leadership.

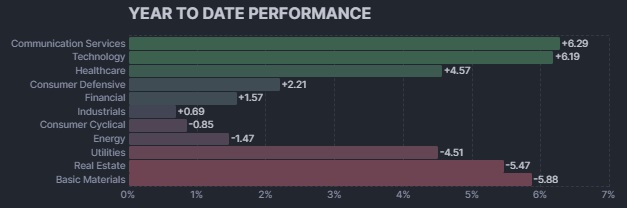

Often the strongest groups becomes the weakest and the weakest becomes the strongest. If that is the case, then let’s check out what sectors are hot and not so far in 2024:

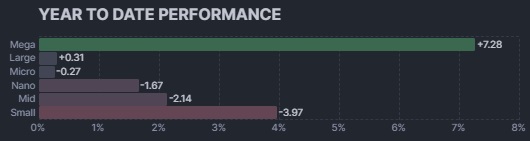

Also wise to check in with the year to date view based upon market cap:

To no one’s surprise mega cap tech stocks are soaking up most of the gains with other groups languishing. This was the picture for the stock market for much of 2023 until the script got flipped in the latter stages of the year.

I sense a similar change of leadership is going to take place at some point this year. Trading ranges offer as good of an opportunity of any for that changing of the guard. Meaning this all may be soon at hand.

So yes, in my Reitmeister Total Return portfolio I continue to have a small stock bias. But not just any small caps will do. They need to show operational excellence as best expressed through a beat and raise earnings report this quarter.

On top of that pullbacks and sector rotation periods usually have a greater eye towards value than during the big bull runs. Add this altogether and its prime time for POWR Rating stocks.

That being consistent growth companies exhibiting operational excellence while trading at reasonable prices. This has always been the most consistent path to stock market profits and no reason for that not to be the case in 2024.

What are my favorite POWR Ratings stocks now?

Find 12 of them in the next section...

What To Do Next?

Discover my current portfolio of 12 stocks packed to the brim with the outperforming benefits found in our exclusive POWR Ratings model. (Nearly 4X better than the S&P 500 going back to 1999)

This includes 5 under the radar small caps recently added with tremendous upside potential.

Plus I have 1 special ETF that is incredibly well positioned to outpace the market in the weeks and months ahead.

This is all based on my 43 years of investing experience seeing bull markets...bear markets...and everything between.

If you are curious to learn more, and want to see these lucky 13 hand selected trades, then please click the link below to get started now.

Steve Reitmeister’s Trading Plan & Top Picks >

Wishing you a world of investment success!

Steve Reitmeister…but everyone calls me Reity (pronounced “Righty”)

CEO, StockNews.com and Editor, Reitmeister Total Return

SPY shares were unchanged in after-hours trading Tuesday. Year-to-date, SPY has gained 3.93%, versus a % rise in the benchmark S&P 500 index during the same period.

About the Author: Steve Reitmeister

Steve is better known to the StockNews audience as “Reity”. Not only is he the CEO of the firm, but he also shares his 40 years of investment experience in the Reitmeister Total Return portfolio. Learn more about Reity’s background, along with links to his most recent articles and stock picks.

The post Are Stocks Stuck til Summer? appeared first on StockNews.com