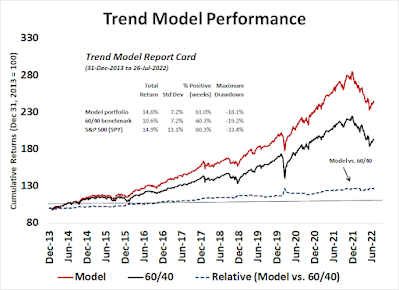

- 1 year: Model portfolio -8.1% vs. 60/40 -9.8%

- 2 years: Model portfolio 7.1% vs. 60/40 4.2%

- 3 years: Model portfolio 10.2% vs. 60/40 7.1%

- 5 years: Model portfolio 10.9% vs. 60/40 7.8%

The Trend Model turned neutral from bullish in January 2022 and turned bearish in March. Amidst all the gloom about a global recession, it's time to become more constructive on equities. The signal has been upgraded to neutral from bearish.

Here's why.

The full post can be found here.