As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the consumer subscription industry, including Udemy (NASDAQ: UDMY) and its peers.

Consumers today expect goods and services to be hyper-personalized and on demand. Whether it be what music they listen to, what movie they watch, or even finding a date, online consumer businesses are expected to delight their customers with simple user interfaces that magically fulfill demand. Subscription models have further increased usage and stickiness of many online consumer services.

The 8 consumer subscription stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.3% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 18.2% since the latest earnings results.

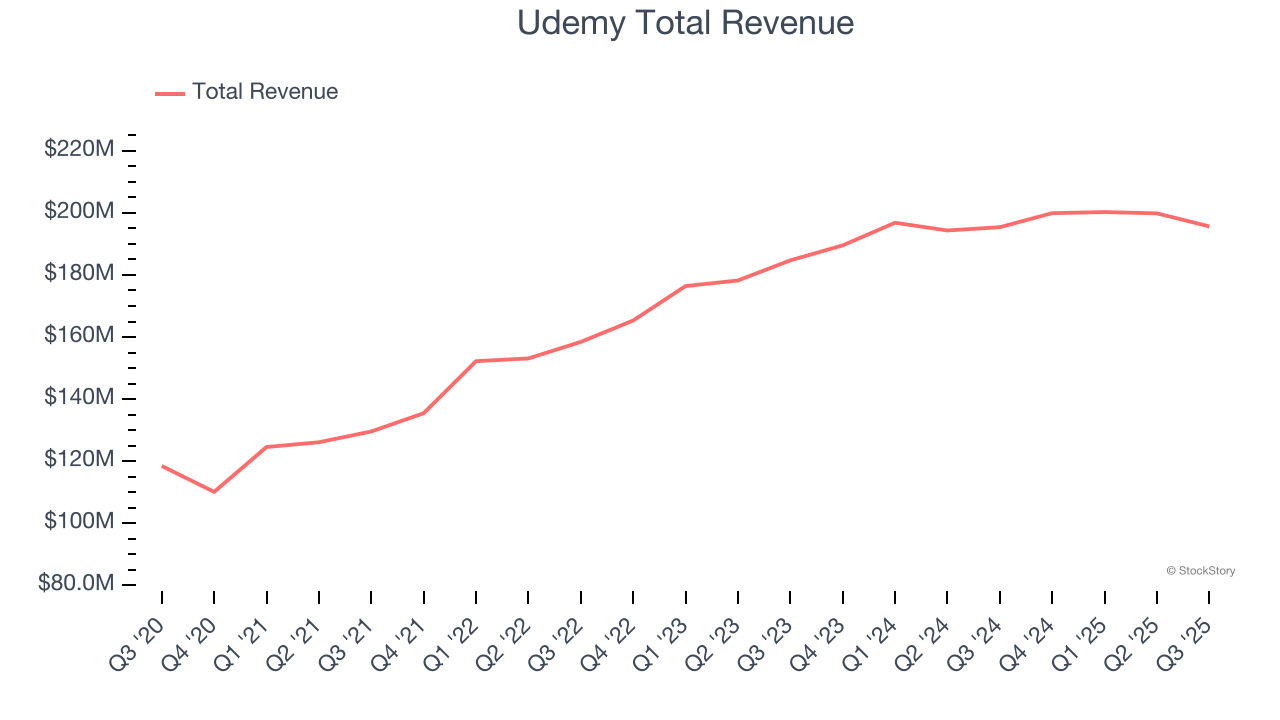

Udemy (NASDAQ: UDMY)

With courses ranging from investing to cooking to computer programming, Udemy (NASDAQ: UDMY) is an online learning platform that connects learners with expert instructors who specialize in a wide range of topics.

Udemy reported revenues of $195.7 million, flat year on year. This print exceeded analysts’ expectations by 1.4%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ EBITDA estimates but revenue guidance for next quarter missing analysts’ expectations significantly.

“Our Q3 results demonstrate strong momentum as Udemy evolves towards becoming the world's leading AI-powered skills acceleration platform,” said Hugo Sarrazin, President and CEO of Udemy.

Unsurprisingly, the stock is down 18.7% since reporting and currently trades at $5.19.

Is now the time to buy Udemy? Access our full analysis of the earnings results here, it’s free.

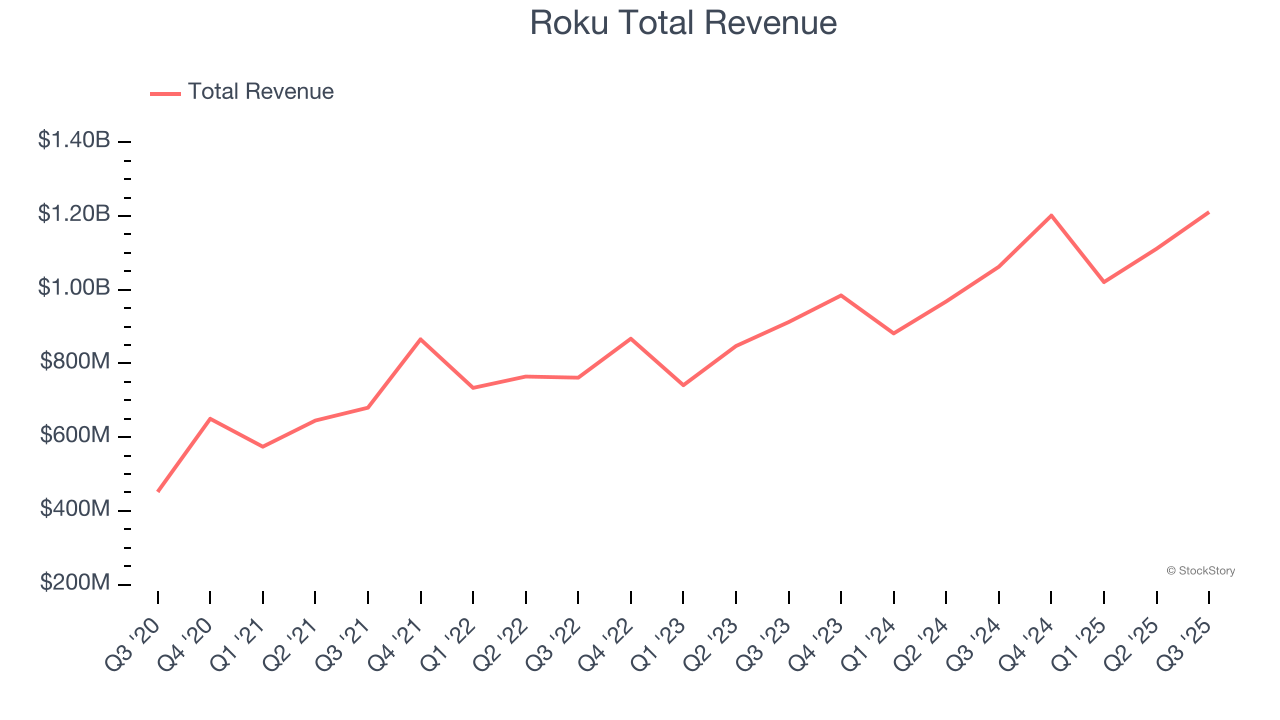

Best Q3: Roku (NASDAQ: ROKU)

With a name meaning six in Japanese because it was the founder's sixth company that he started, Roku (NASDAQ: ROKU) makes hardware players that offer access to various online streaming TV services.

Roku reported revenues of $1.21 billion, up 14% year on year, in line with analysts’ expectations. The business had a strong quarter with EBITDA guidance for next quarter exceeding analysts’ expectations and full-year EBITDA guidance exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 14.1% since reporting. It currently trades at $107.47.

Is now the time to buy Roku? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Bumble (NASDAQ: BMBL)

Started by the co-founder of Tinder, Whitney Wolfe Herd, Bumble (NASDAQ: BMBL) is a leading dating app built with women at the center.

Bumble reported revenues of $246.2 million, down 10% year on year, in line with analysts’ expectations. It was a softer quarter as it posted a decline in its buyers and a significant miss of analysts’ number of paying users estimates.

As expected, the stock is down 34.1% since the results and currently trades at $3.58.

Read our full analysis of Bumble’s results here.

Duolingo (NASDAQ: DUOL)

Founded by a Carnegie Mellon computer science professor and his Ph.D. student, Duolingo (NASDAQ: DUOL) is a mobile app helping people learn new languages.

Duolingo reported revenues of $271.7 million, up 41.1% year on year. This print beat analysts’ expectations by 4.3%. More broadly, it was a satisfactory quarter as it also logged an impressive beat of analysts’ EBITDA estimates but EBITDA guidance for next quarter missing analysts’ expectations.

Duolingo delivered the biggest analyst estimates beat and fastest revenue growth among its peers. The company reported 135.3 million users, up 19.6% year on year. The stock is down 39.8% since reporting and currently trades at $157.35.

Read our full, actionable report on Duolingo here, it’s free.

Coursera (NYSE: COUR)

Founded by two Stanford University computer science professors, Coursera (NYSE: COUR) is an online learning platform that offers courses, specializations, and degrees from top universities and organizations around the world.

Coursera reported revenues of $194.2 million, up 10.3% year on year. This result topped analysts’ expectations by 2.1%. Zooming out, it was a satisfactory quarter as it also produced an impressive beat of analysts’ EBITDA estimates but EBITDA guidance for next quarter missing analysts’ expectations significantly.

Coursera scored the highest full-year guidance raise among its peers. The company reported 191 million active customers, up 17.8% year on year. The stock is down 36.2% since reporting and currently trades at $6.73.

Read our full, actionable report on Coursera here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.