As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the property & casualty insurance industry, including Mercury General (NYSE: MCY) and its peers.

Property & Casualty (P&C) insurers protect individuals and businesses against financial loss from damage to property or from legal liability. This is a cyclical industry, and the sector benefits when there is 'hard market', characterized by strong premium rate increases that outpace loss and cost inflation, resulting in robust underwriting margins. The opposite is true in a 'soft market'. Interest rates also matter, as they determine the yields earned on fixed-income portfolios. On the other hand, P&C insurers face a major secular headwind from the increasing frequency and severity of catastrophe losses due to climate change. Furthermore, the liability side of the business is pressured by 'social inflation'—the trend of rising litigation costs and larger jury awards.

The 33 property & casualty insurance stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 1.5%.

In light of this news, share prices of the companies have held steady as they are up 4.2% on average since the latest earnings results.

Mercury General (NYSE: MCY)

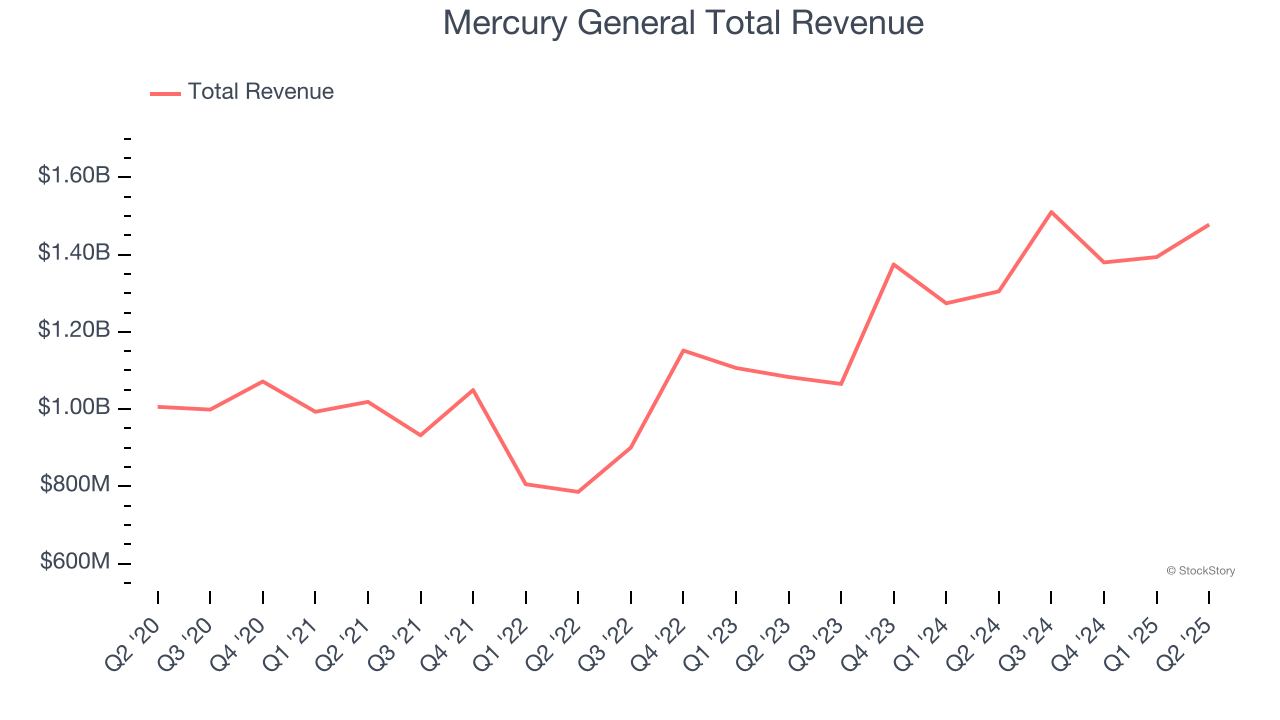

Founded in 1961 and maintaining a network of over 6,300 independent agents across the country, Mercury General (NYSE: MCY) is an insurance company that primarily sells automobile insurance policies through independent agents in 11 states, with a strong focus on California.

Mercury General reported revenues of $1.48 billion, up 13.2% year on year. This print exceeded analysts’ expectations by 2%. Overall, it was a stunning quarter for the company with a beat of analysts’ EPS and net premiums earned estimates.

Interestingly, the stock is up 11.7% since reporting and currently trades at $78.48.

Is now the time to buy Mercury General? Access our full analysis of the earnings results here, it’s free.

Best Q2: Root (NASDAQ: ROOT)

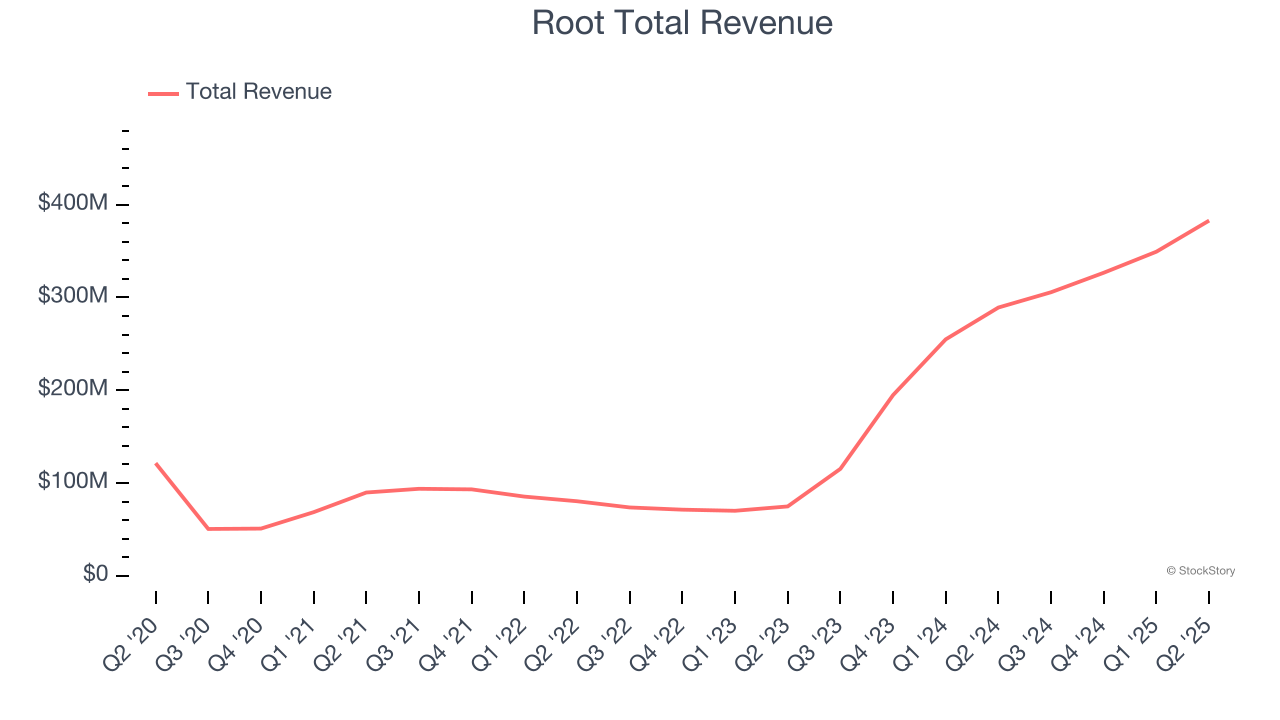

Pioneering a data-driven approach that rewards good driving habits, Root (NASDAQ: ROOT) is a technology-driven auto insurance company that uses mobile apps to acquire customers and data science to price policies based on individual driving behavior.

Root reported revenues of $382.9 million, up 32.4% year on year, outperforming analysts’ expectations by 7.5%. The business had an incredible quarter with a beat of analysts’ EPS and net premiums earned estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 18.8% since reporting. It currently trades at $100.

Is now the time to buy Root? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Selective Insurance Group (NASDAQ: SIGI)

Founded in 1926 during the early days of automobile insurance, Selective Insurance Group (NASDAQ: SIGI) is a property and casualty insurance company that sells commercial, personal, and excess and surplus lines insurance products through independent agents.

Selective Insurance Group reported revenues of $127.9 million, down 89.3% year on year, falling short of analysts’ expectations by 90.3%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS and book value per share estimates.

Selective Insurance Group delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 14.8% since the results and currently trades at $77.11.

Read our full analysis of Selective Insurance Group’s results here.

First American Financial (NYSE: FAF)

Tracing its roots back to 1889 when California was experiencing its first major real estate boom, First American Financial (NYSE: FAF) provides title insurance, settlement services, and risk solutions for residential and commercial real estate transactions across the United States and internationally.

First American Financial reported revenues of $1.84 billion, up 14.2% year on year. This number surpassed analysts’ expectations by 4.9%. Overall, it was a very strong quarter as it also logged a beat of analysts’ EPS estimates.

The stock is up 15.8% since reporting and currently trades at $66.74.

Read our full, actionable report on First American Financial here, it’s free.

CNA Financial (NYSE: CNA)

With roots dating back to 1853 and majority ownership by Loews Corporation, CNA Financial (NYSE: CNA) is a commercial property and casualty insurance provider offering coverage for businesses, including professional liability, surety bonds, and specialized risk management services.

CNA Financial reported revenues of $3.72 billion, up 5.6% year on year. This result missed analysts’ expectations by 0.8%. Taking a step back, it was still a very strong quarter as it logged a beat of analysts’ EPS estimates.

The stock is up 6.4% since reporting and currently trades at $46.67.

Read our full, actionable report on CNA Financial here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.