As the Q2 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the gig economy industry, including Angi (NASDAQ: ANGI) and its peers.

The iPhone changed the world, ushering in the era of the “always-on” internet and “on-demand” services - anything someone could want is just a few taps away. Likewise, the gig economy sprang up in a similar fashion, with a proliferation of tech-enabled freelance labor marketplaces, which work hand and hand with many on demand services. Individuals can now work on demand too. What began with tech-enabled platforms that aggregated riders and drivers has expanded over the past decade to include food delivery, groceries, and now even a plumber or graphic designer are all just a few taps away.

The 6 gig economy stocks we track reported a satisfactory Q2. As a group, revenues beat analysts’ consensus estimates by 2.5% while next quarter’s revenue guidance was 0.5% below.

Luckily, gig economy stocks have performed well with share prices up 13.4% on average since the latest earnings results.

Best Q2: Angi (NASDAQ: ANGI)

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

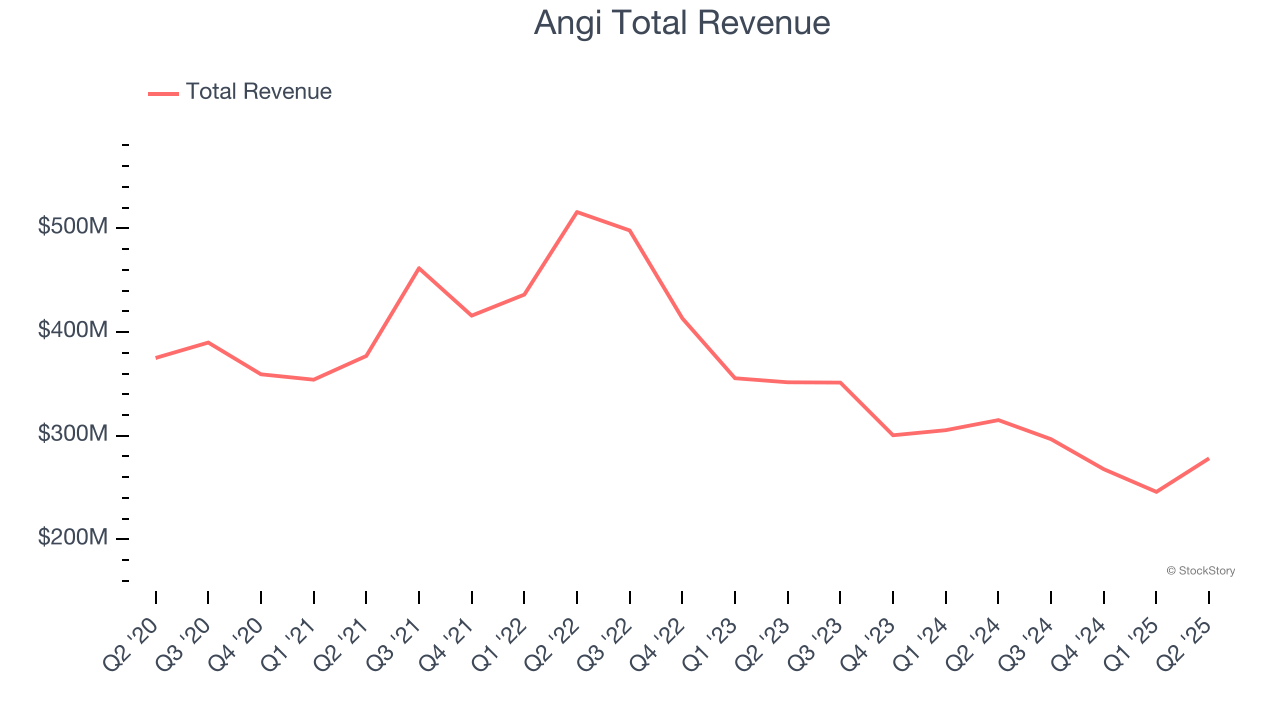

Angi reported revenues of $278.2 million, down 11.7% year on year. This print exceeded analysts’ expectations by 6.5%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ service requests and EBITDA estimates.

Angi scored the biggest analyst estimates beat but had the slowest revenue growth of the whole group. The company reported 4.56 million service requests, down 7.6% year on year. Unsurprisingly, the stock is up 14.9% since reporting and currently trades at $18.

Is now the time to buy Angi? Access our full analysis of the earnings results here, it’s free.

Upwork (NASDAQ: UPWK)

Formed through the 2013 merger of Elance and oDesk, Upwork (NASDAQ: UPWK) is an online platform where businesses and independent professionals connect to get work done.

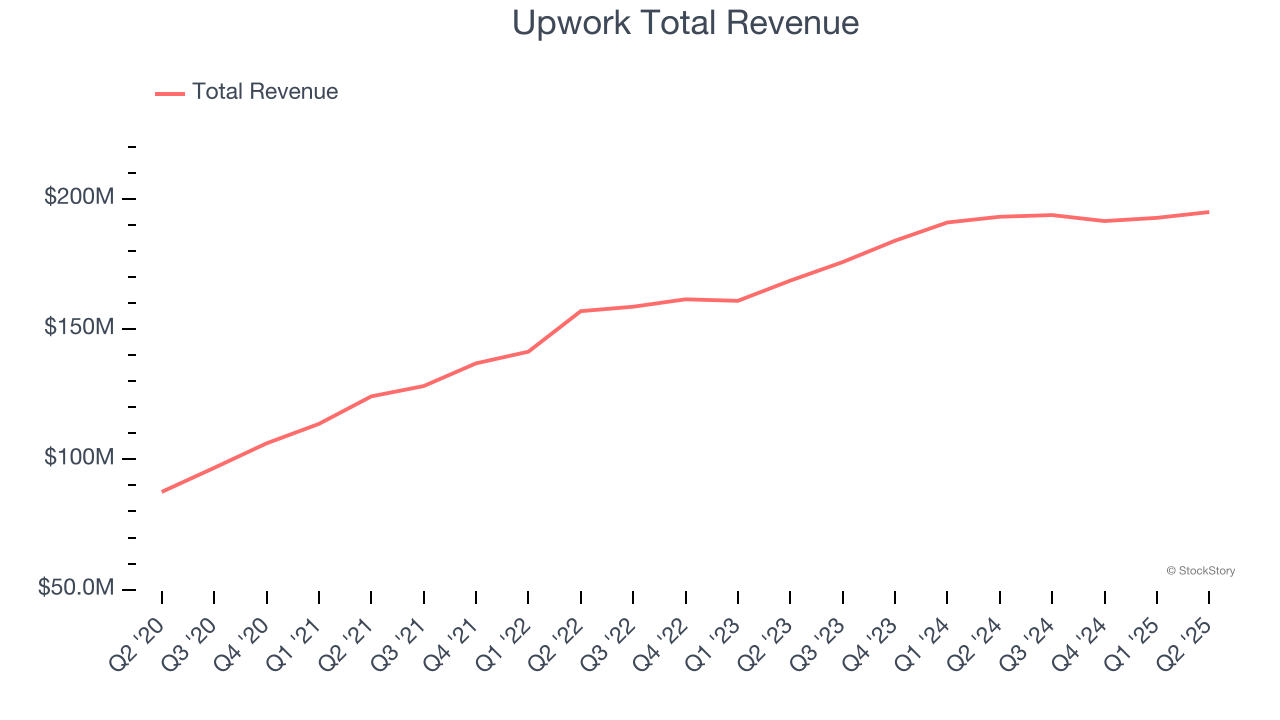

Upwork reported revenues of $194.9 million, flat year on year, outperforming analysts’ expectations by 3.9%. The business had a strong quarter with an impressive beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Upwork pulled off the highest full-year guidance raise among its peers. On a dimmer note, the company reported 796,000 active customers, down 8.3% year on year. The market seems happy with the results as the stock is up 34.1% since reporting. It currently trades at $16.10.

Is now the time to buy Upwork? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Fiverr (NYSE: FVRR)

Based in Tel Aviv, Fiverr (NYSE: FVRR) operates a fixed price global freelance marketplace for digital services.

Fiverr reported revenues of $108.6 million, up 14.8% year on year, exceeding analysts’ expectations by 0.9%. Still, it was a slower quarter as it posted a decline in its buyers and a slight miss of analysts’ number of active buyers estimates.

Fiverr delivered the weakest full-year guidance update in the group. The company reported 3.43 million active buyers, down 10.9% year on year. As expected, the stock is down 4.6% since the results and currently trades at $23.85.

Read our full analysis of Fiverr’s results here.

DoorDash (NASDAQ: DASH)

Founded by Stanford students with the intent to build “the local, on-demand FedEx", DoorDash (NYSE: DASH) operates an on-demand food delivery platform.

DoorDash reported revenues of $3.28 billion, up 24.9% year on year. This result topped analysts’ expectations by 3.8%. Overall, it was a strong quarter as it also logged strong growth in its requests and a decent beat of analysts’ EBITDA estimates.

DoorDash scored the fastest revenue growth among its peers. The company reported 761 million service requests, up 19.8% year on year. The stock is flat since reporting and currently trades at $256.45.

Read our full, actionable report on DoorDash here, it’s free.

Uber (NYSE: UBER)

Notoriously funded with $7.7 billion from the Softbank Vision Fund, Uber (NYSE: UBER) operates a platform of on-demand services such as ride-hailing, food delivery, and freight.

Uber reported revenues of $12.65 billion, up 18.2% year on year. This number beat analysts’ expectations by 1.4%. Overall, it was a satisfactory quarter as it also produced strong growth in its users.

The company reported 180 million users, up 15.4% year on year. The stock is up 6.2% since reporting and currently trades at $95.

Read our full, actionable report on Uber here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.