Over the past six months, Paychex’s shares (currently trading at $133.93) have posted a disappointing 13.3% loss, well below the S&P 500’s 16% gain. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Given the weaker price action, is this a buying opportunity for PAYX? Find out in our full research report, it’s free.

Why Does Paychex Spark Debate?

Once known as the go-to service for small business payroll needs, Paychex (NASDAQ: PAYX) provides payroll processing, HR services, employee benefits administration, and insurance solutions to small and medium-sized businesses.

Two Positive Attributes:

1. Operating Margin Reveals a Well-Run Organization

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Paychex has been a well-oiled machine over the last year. It demonstrated elite profitability for a software business, boasting an average operating margin of 39.6%.

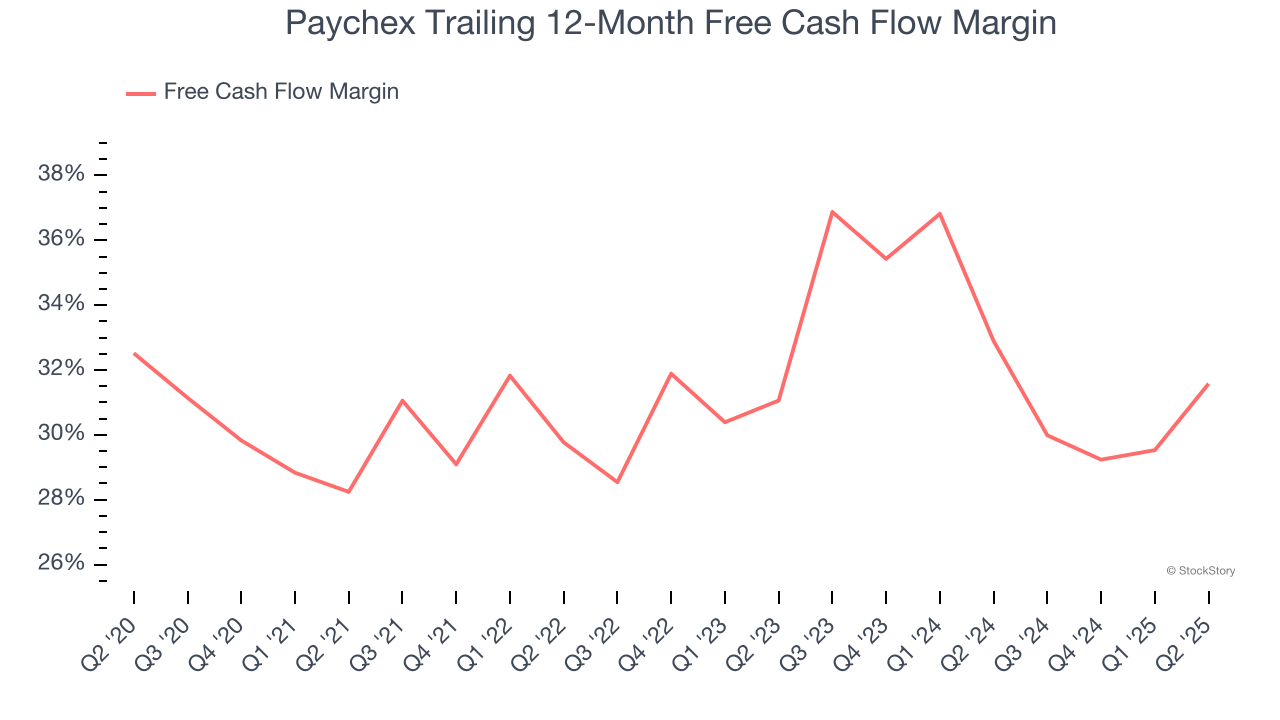

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Paychex has shown terrific cash profitability, enabling it to reinvest, return capital to investors, and stay ahead of the competition while maintaining an ample cushion. The company’s free cash flow margin was among the best in the software sector, averaging an eye-popping 31.6% over the last year.

One Reason to be Careful:

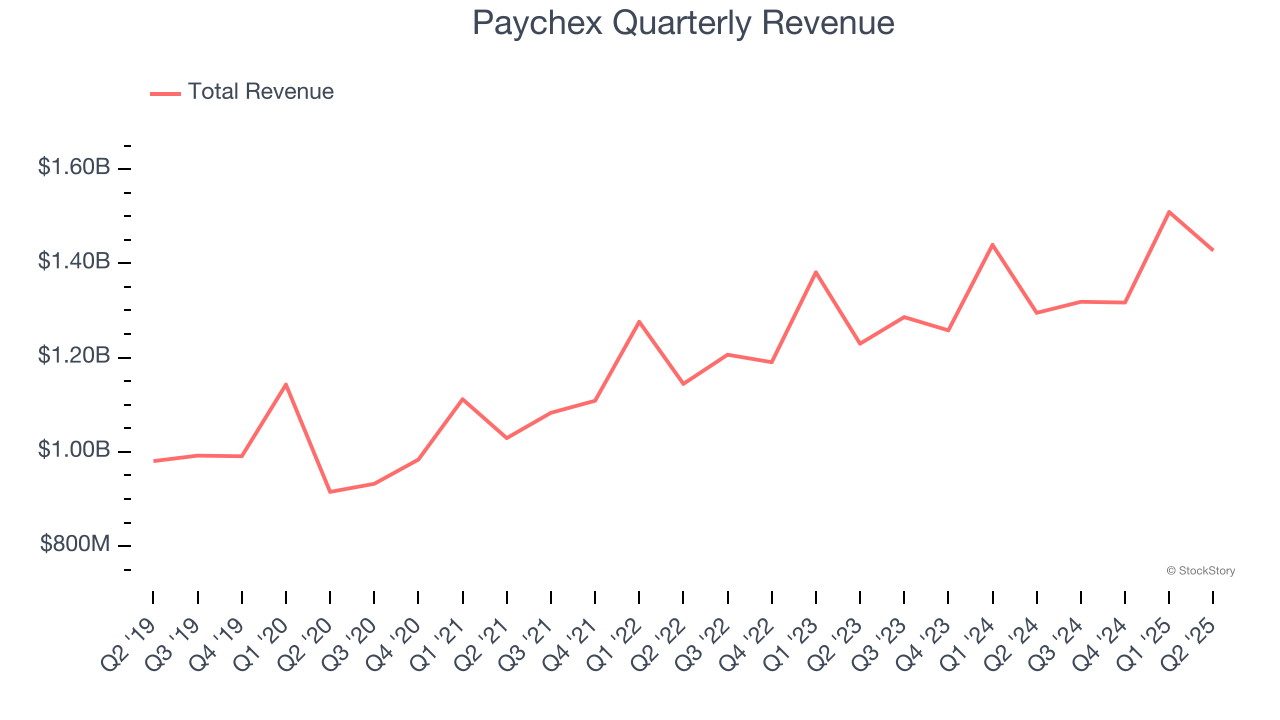

Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, Paychex’s 6.5% annualized revenue growth over the last three years was weak. This wasn’t a great result compared to the rest of the software sector, but there are still things to like about Paychex.

Final Judgment

Paychex has huge potential even though it has some open questions. With the recent decline, the stock trades at 7.4× forward price-to-sales (or $133.93 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free.

High-Quality Stocks for All Market Conditions

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.