Business automation software provider Upland Software (NASDAQ: UPLD) met Wall Street’s revenue expectations in Q4 CY2024, but sales fell by 5.8% year on year to $68.03 million. On the other hand, next quarter’s revenue guidance of $62 million was less impressive, coming in 7.7% below analysts’ estimates. Its non-GAAP profit of $0.41 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Upland? Find out by accessing our full research report, it’s free.

Upland (UPLD) Q4 CY2024 Highlights:

- Revenue: $68.03 million vs analyst estimates of $68.06 million (5.8% year-on-year decline, in line)

- Adjusted EPS: $0.41 vs analyst estimates of $0.20 (significant beat)

- Adjusted EBITDA: $14.9 million vs analyst estimates of $14.64 million (21.9% margin, 1.8% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $243.5 million at the midpoint, missing analyst estimates by 8.2% and implying -11.4% growth (vs -7.7% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $59.5 million at the midpoint, above analyst estimates of $58.61 million

- Operating Margin: -2.9%, up from -13% in the same quarter last year

- Free Cash Flow Margin: 13.3%, up from 6.3% in the previous quarter

- Market Capitalization: $78.48 million

Company Overview

Founder Jack McDonald’s second software rollup, Upland Software (NASDAQ: UPLD) is a one stop shop for sales and marketing software, project management, HR, and contact center services for small and medium sized businesses.

Marketing Software

Whether or not companies market their products through social media, all businesses need to meet customers where they are; and increasingly, that is social media. As more and more people use a greater number of social media platforms, social media management software become more valuable to their customers.

Sales Growth

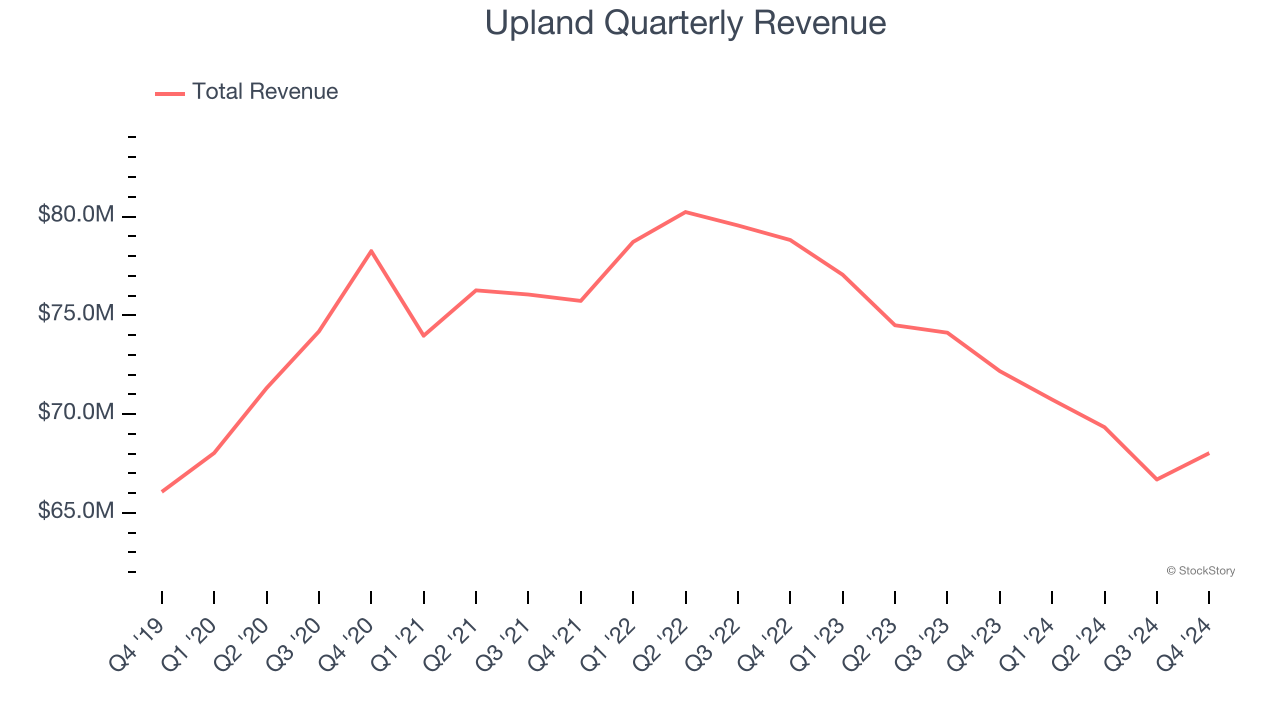

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Upland struggled to consistently generate demand over the last three years as its sales dropped at a 3.1% annual rate. This wasn’t a great result and is a sign of lacking business quality.

This quarter, Upland reported a rather uninspiring 5.8% year-on-year revenue decline to $68.03 million of revenue, in line with Wall Street’s estimates. Company management is currently guiding for a 12.4% year-on-year decline in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to decline by 3.2% over the next 12 months, similar to its three-year rate. This projection doesn't excite us and indicates its newer products and services will not accelerate its top-line performance yet.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Upland’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Upland’s products and its peers.

Key Takeaways from Upland’s Q4 Results

It was great to see Upland’s full-year EBITDA guidance top analysts’ expectations. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next year suggests a significant slowdown in demand and its full-year revenue guidance fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 8.9% to $2.60 immediately following the results.

Upland may have had a tough quarter, but does that actually create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.