Customer experience software provider Sprinklr (NYSE: CXM) beat Wall Street’s revenue expectations in Q4 CY2024, with sales up 4.3% year on year to $202.5 million. Guidance for next quarter’s revenue was better than expected at $202 million at the midpoint, 0.8% above analysts’ estimates. Its non-GAAP profit of $0.10 per share was 41.1% above analysts’ consensus estimates.

Is now the time to buy Sprinklr? Find out by accessing our full research report, it’s free.

Sprinklr (CXM) Q4 CY2024 Highlights:

- Revenue: $202.5 million vs analyst estimates of $200.5 million (4.3% year-on-year growth, 1% beat)

- Adjusted EPS: $0.10 vs analyst estimates of $0.07 (41.1% beat)

- Adjusted Operating Income: $25.88 million vs analyst estimates of $18.1 million (12.8% margin, 43% beat)

- Management’s revenue guidance for the upcoming financial year 2026 is $822.5 million at the midpoint, in line with analyst expectations and implying 3.3% growth (vs 8.9% in FY2025)

- Adjusted EPS guidance for the upcoming financial year 2026 is $0.39 at the midpoint, beating analyst estimates by 2.4%

- Operating Margin: 5.2%, down from 9.5% in the same quarter last year

- Free Cash Flow Margin: 0.8%, down from 2.4% in the previous quarter

- Market Capitalization: $2.06 billion

Company Overview

Initially focused only on social media management, Sprinklr (NYSE: CXM) is a leading provider of unified customer experience management software.

Customer Experience Software

The Internet has given customers more choice on whom to conduct business with and has also given them the power to easily share their experiences with other customers. These twin dynamics effectively have increased pressure on companies to both improve their customer service and also monitor their brand reputation online, driving the need for customer experience software offerings.

Sales Growth

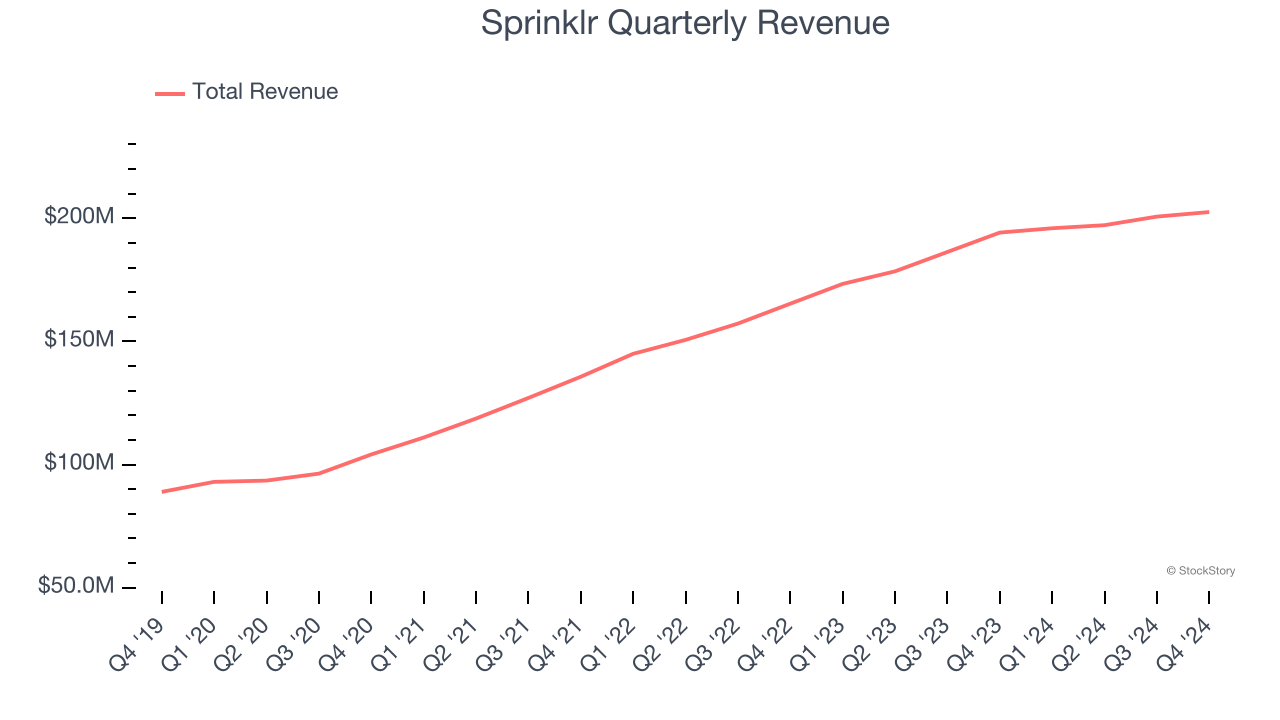

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last three years, Sprinklr grew its sales at a 17.4% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

This quarter, Sprinklr reported modest year-on-year revenue growth of 4.3% but beat Wall Street’s estimates by 1%. Company management is currently guiding for a 3.1% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 2.9% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and implies its products and services will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period measures the months a company needs to recoup the money spent on acquiring a new customer. This metric helps assess how quickly a business can break even on its sales and marketing investments.

It’s relatively expensive for Sprinklr to acquire new customers as its CAC payback period checked in at 185.8 months this quarter. The company’s slow recovery of its sales and marketing expenses indicates it operates in a highly competitive market and must invest to stand out, even if the return on that investment is low.

Key Takeaways from Sprinklr’s Q4 Results

We liked that Sprinklr’s full-year EPS guidance exceeded Wall Street’s estimates. On the other hand, its revenue guidance for next year suggests a significant slowdown in demand and was only in line with expectations. Overall, we think this was a mixed quarter. The stock traded down 3.7% to $7.77 immediately following the results.

Should you buy the stock or not? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.