As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at home construction materials stocks, starting with Owens Corning (NYSE: OC).

Traditionally, home construction materials companies have built economic moats with expertise in specialized areas, brand recognition, and strong relationships with contractors. More recently, advances to address labor availability and job site productivity have spurred innovation that is driving incremental demand. However, these companies are at the whim of residential construction volumes, which tend to be cyclical and can be impacted heavily by economic factors such as interest rates. Additionally, the costs of raw materials can be driven by a myriad of worldwide factors and greatly influence the profitability of home construction materials companies.

The 12 home construction materials stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.5%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 8.8% since the latest earnings results.

Best Q4: Owens Corning (NYSE: OC)

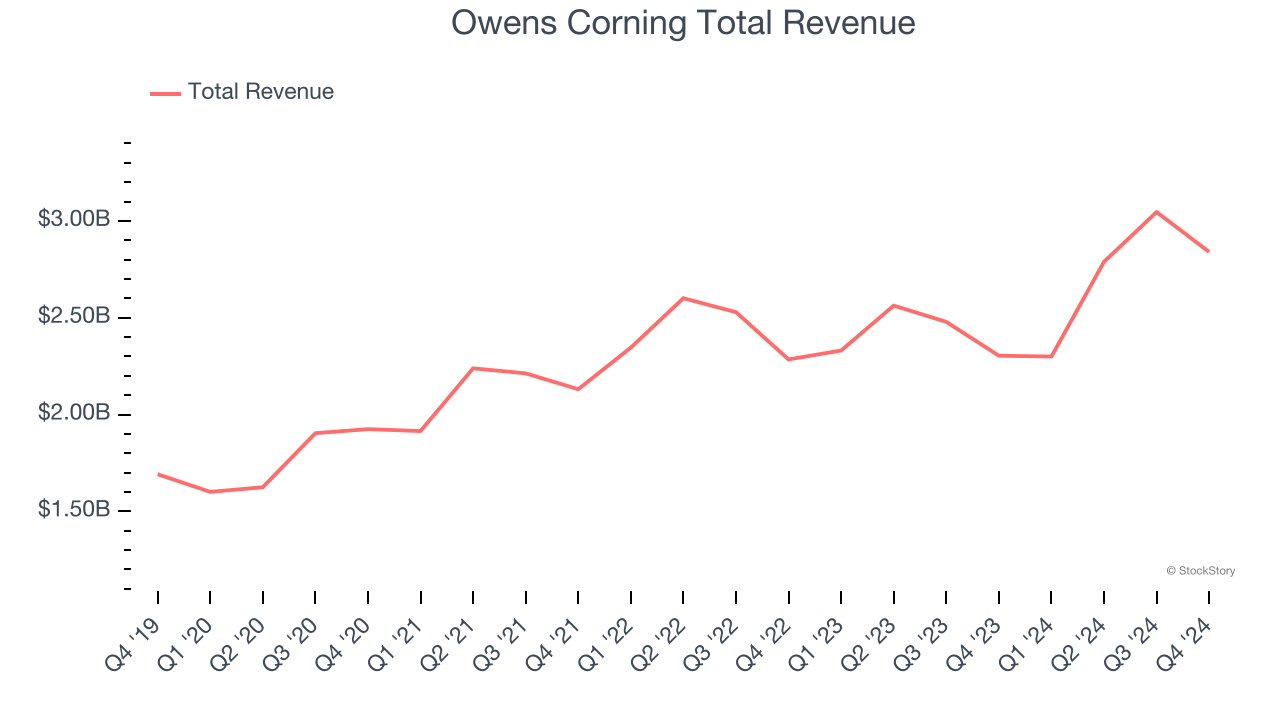

Credited with the discovery of fiberglass, Owens Corning (NYSE: OC) supplies building and construction materials to the United States and international markets.

Owens Corning reported revenues of $2.84 billion, up 23.3% year on year. This print exceeded analysts’ expectations by 2.7%. Overall, it was a stunning quarter for the company with an impressive beat of analysts’ organic revenue and EBITDA estimates.

“2024 was a transformative year for Owens Corning as we successfully executed three major strategic moves to reshape and focus the company on building products in North America and Europe, while consistently delivering higher, more resilient earnings and cash flow,” said Chair and Chief Executive Officer Brian Chambers.

The stock is down 16% since reporting and currently trades at $139.12.

Is now the time to buy Owens Corning? Access our full analysis of the earnings results here, it’s free.

Trex (NYSE: TREX)

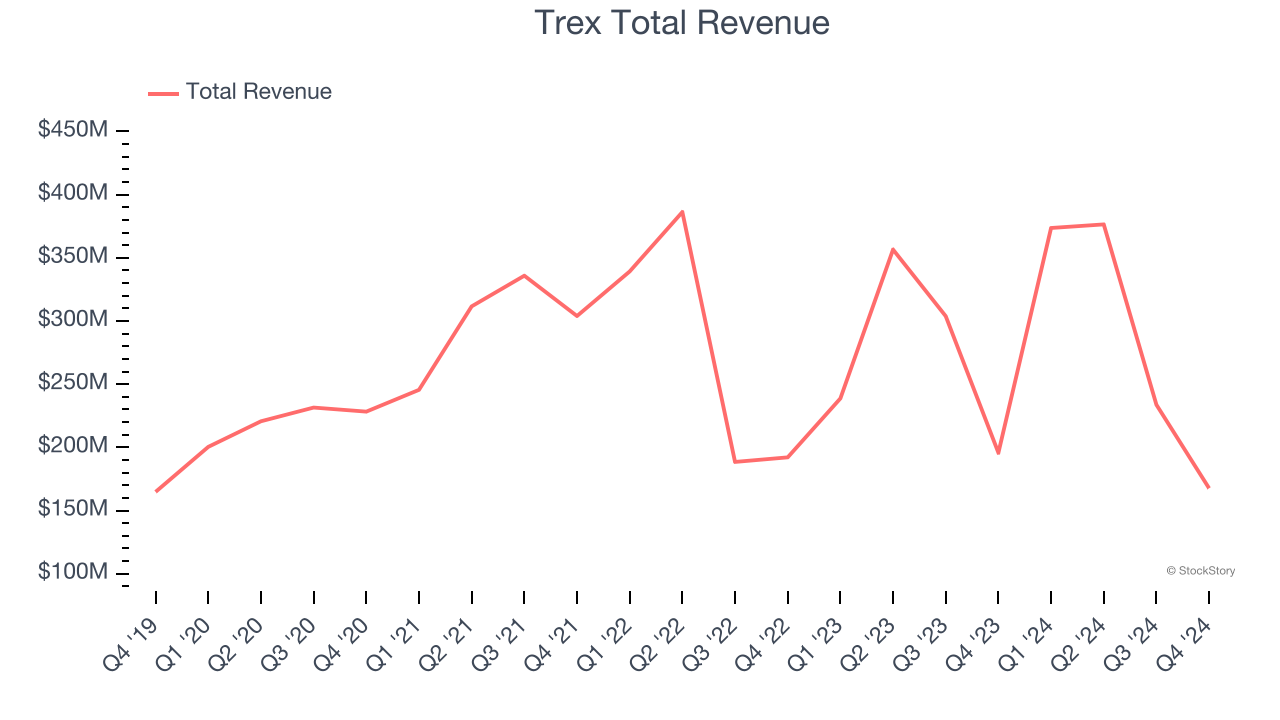

Addressing the demand for aesthetically-pleasing and unique outdoor living spaces, Trex Company (NYSE: TREX) makes wood-alternative decking, railing, and patio furniture.

Trex reported revenues of $167.6 million, down 14.4% year on year, outperforming analysts’ expectations by 4.4%. The business had a stunning quarter with a solid beat of analysts’ organic revenue estimates and an impressive beat of analysts’ EPS estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 11.5% since reporting. It currently trades at $54.63.

Is now the time to buy Trex? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: American Woodmark (NASDAQ: AMWD)

Starting as a small millwork shop, American Woodmark (NASDAQ: AMWD) is a cabinet manufacturing company that helps customers from inspiration to installation.

American Woodmark reported revenues of $397.6 million, down 5.8% year on year, falling short of analysts’ expectations by 3.3%. It was a disappointing quarter as it posted full-year EBITDA guidance missing analysts’ expectations.

As expected, the stock is down 17.6% since the results and currently trades at $58.66.

Read our full analysis of American Woodmark’s results here.

Quanex (NYSE: NX)

Starting in the seamless tube industry, Quanex (NYSE: NX) manufactures building products like window, door, kitchen, and bath cabinet components.

Quanex reported revenues of $400 million, up 67.3% year on year. This result surpassed analysts’ expectations by 4.6%. Overall, it was an exceptional quarter as it also recorded an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ EBITDA estimates.

Quanex delivered the fastest revenue growth among its peers. The stock is down 10.3% since reporting and currently trades at $18.33.

Read our full, actionable report on Quanex here, it’s free.

Simpson (NYSE: SSD)

Aiming to build safer and stronger buildings, Simpson (NYSE: SSD) designs and manufactures structural connectors, anchors, and other construction products.

Simpson reported revenues of $517.4 million, up 3.1% year on year. This print topped analysts’ expectations by 4.3%. It was an exceptional quarter as it also logged an impressive beat of analysts’ EBITDA estimates and a decent beat of analysts’ EPS estimates.

The stock is down 4% since reporting and currently trades at $160.12.

Read our full, actionable report on Simpson here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.