The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how IDEX (NYSE: IEX) and the rest of the gas and liquid handling stocks fared in Q4.

Gas and liquid handling companies possess the technical know-how and specialized equipment to handle valuable (and sometimes dangerous) substances. Lately, water conservation and carbon capture–which requires hydrogen and other gasses as well as specialized infrastructure–have been trending up, creating new demand for products such as filters, pumps, and valves. On the other hand, gas and liquid handling companies are at the whim of economic cycles. Consumer spending and interest rates, for example, can greatly impact the industrial production that drives demand for these companies’ offerings.

The 12 gas and liquid handling stocks we track reported a slower Q4. As a group, revenues missed analysts’ consensus estimates by 1%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 8% since the latest earnings results.

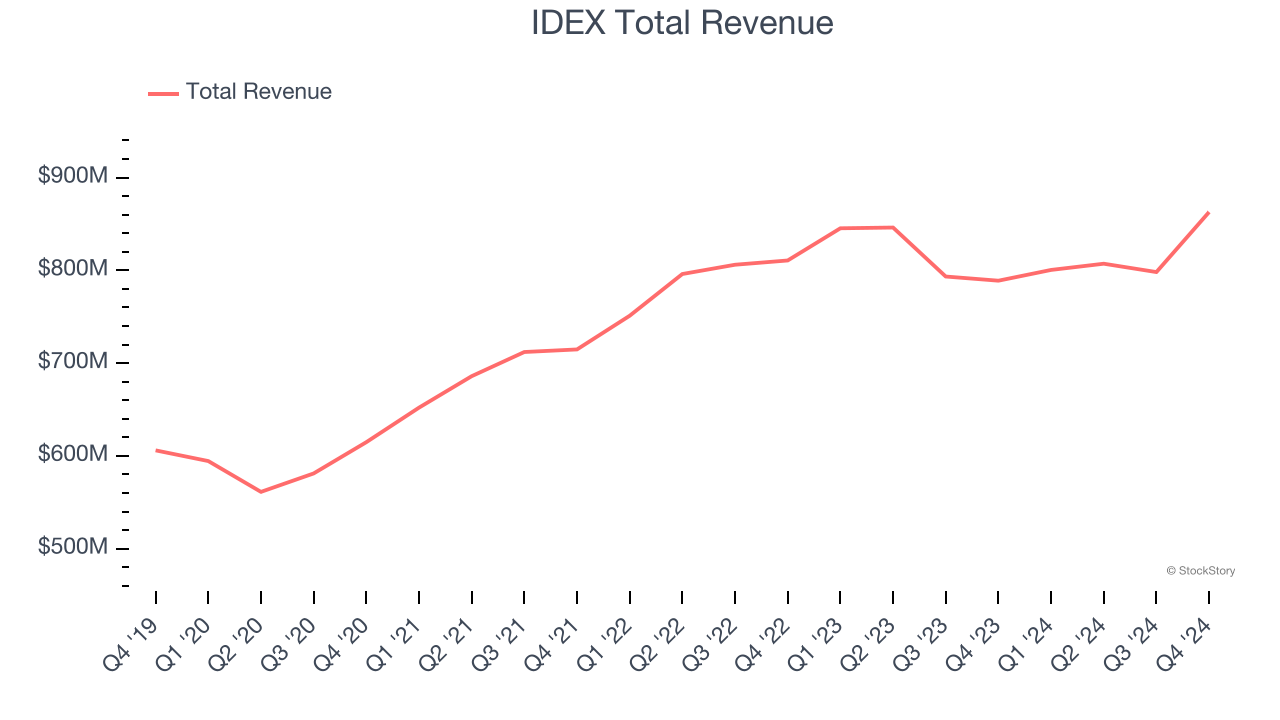

IDEX (NYSE: IEX)

Founded in 1988, IDEX (NYSE: IEX) is a global manufacturer specializing in highly engineered products such as pumps, flow meters, and fluidics systems for various industries.

IDEX reported revenues of $862.9 million, up 9.4% year on year. This print fell short of analysts’ expectations by 0.6%. Overall, it was a slower quarter for the company with EPS guidance for next quarter missing analysts’ expectations and a miss of analysts’ EBITDA estimates.

“IDEX teams drove a strong finish to the year and continued to deliver on their commitments to customers in an increasingly uncertain environment. Our company continues to write its next chapter, positioning us for dynamic growth in markets powered by global megatrends. Our 80/20 mindset allows us to adjust resources and self-fund the buildout of scale as we bring newly-acquired and longtime IDEX companies together to grow within advantaged markets,” said Eric D. Ashleman, IDEX Corporation Chief Executive Officer and President.

The stock is down 14.8% since reporting and currently trades at $185.99.

Read our full report on IDEX here, it’s free.

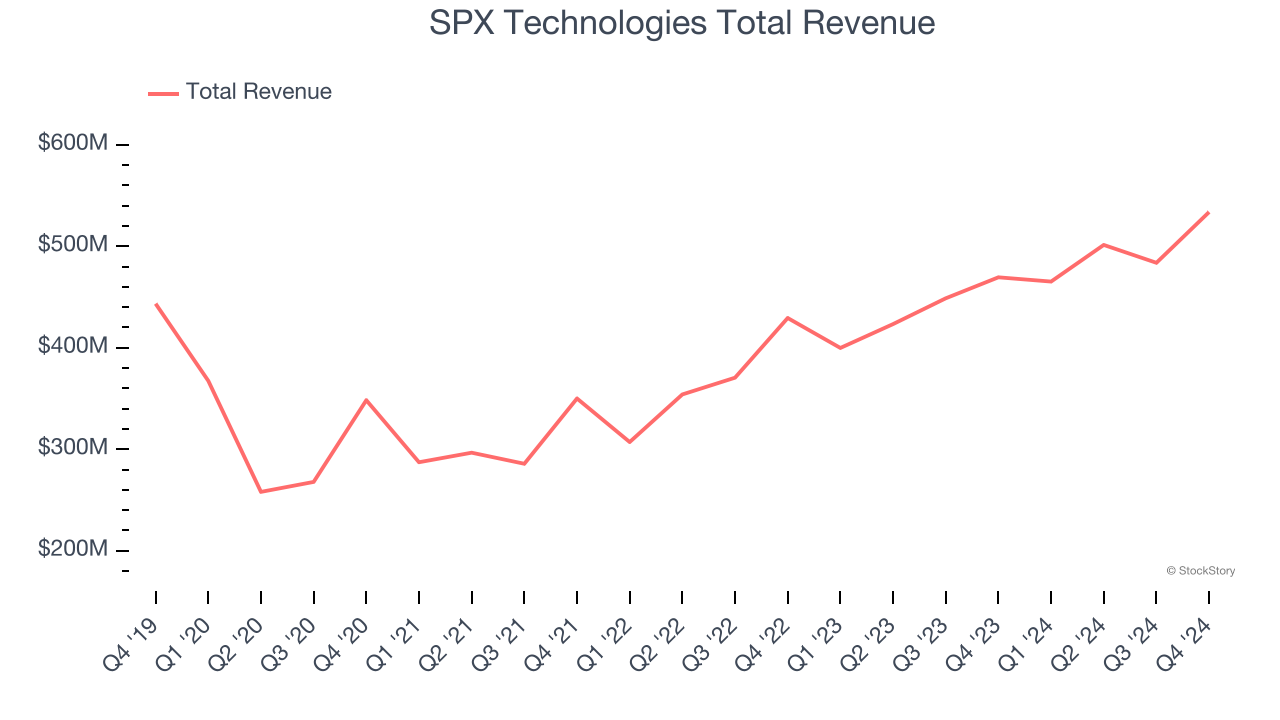

Best Q4: SPX Technologies (NYSE: SPXC)

SPX Technologies (NYSE: SPXC) is an industrial conglomerate catering to the energy, manufacturing, automotive, and aerospace sectors.

SPX Technologies reported revenues of $533.7 million, up 13.7% year on year, in line with analysts’ expectations. The business had a very strong quarter with an impressive beat of analysts’ EBITDA and organic revenue estimates.

SPX Technologies scored the fastest revenue growth among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 1.1% since reporting. It currently trades at $134.97.

Is now the time to buy SPX Technologies? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Graco (NYSE: GGG)

Founded in 1926, Graco (NYSE: GGG) is an industrial company specializing in the development and manufacturing of fluid-handling systems and products.

Graco reported revenues of $548.7 million, down 3.2% year on year, falling short of analysts’ expectations by 1.4%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 1.4% since the results and currently trades at $84.82.

Read our full analysis of Graco’s results here.

Flowserve (NYSE: FLS)

Manufacturing the largest pump ever built for nuclear power generation, Flowserve (NYSE: FLS) manufactures and sells flow control equipment for various industries.

Flowserve reported revenues of $1.18 billion, up 1.3% year on year. This number lagged analysts' expectations by 1.7%. Overall, it was a slower quarter as it also recorded a significant miss of analysts’ EPS estimates and full-year EPS guidance slightly missing analysts’ expectations.

The stock is down 24.8% since reporting and currently trades at $47.42.

Read our full, actionable report on Flowserve here, it’s free.

Donaldson (NYSE: DCI)

Playing a vital role in the historic Apollo 11 mission, Donaldson (NYSE: DCI) manufacturers and sells filtration equipment for various industries.

Donaldson reported revenues of $870 million, flat year on year. This result missed analysts’ expectations by 4.2%. It was a softer quarter as it also produced a significant miss of analysts’ constant currency revenue estimates and a miss of analysts’ adjusted operating income estimates.

The stock is up 1% since reporting and currently trades at $69.96.

Read our full, actionable report on Donaldson here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.