Let’s dig into the relative performance of SMART (NASDAQ: SGH) and its peers as we unravel the now-completed Q3 processors and graphics chips earnings season.

The biggest demand drivers for processors (CPUs) and graphics chips at the moment are secular trends related to 5G and Internet of Things, autonomous driving, and high performance computing in the data center space, specifically around AI and machine learning. Like all semiconductor companies, digital chip makers exhibit a degree of cyclicality, driven by supply and demand imbalances and exposure to PC and Smartphone product cycles.

The 9 processors and graphics chips stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.7% while next quarter’s revenue guidance was in line.

While some processors and graphics chips stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3% since the latest earnings results.

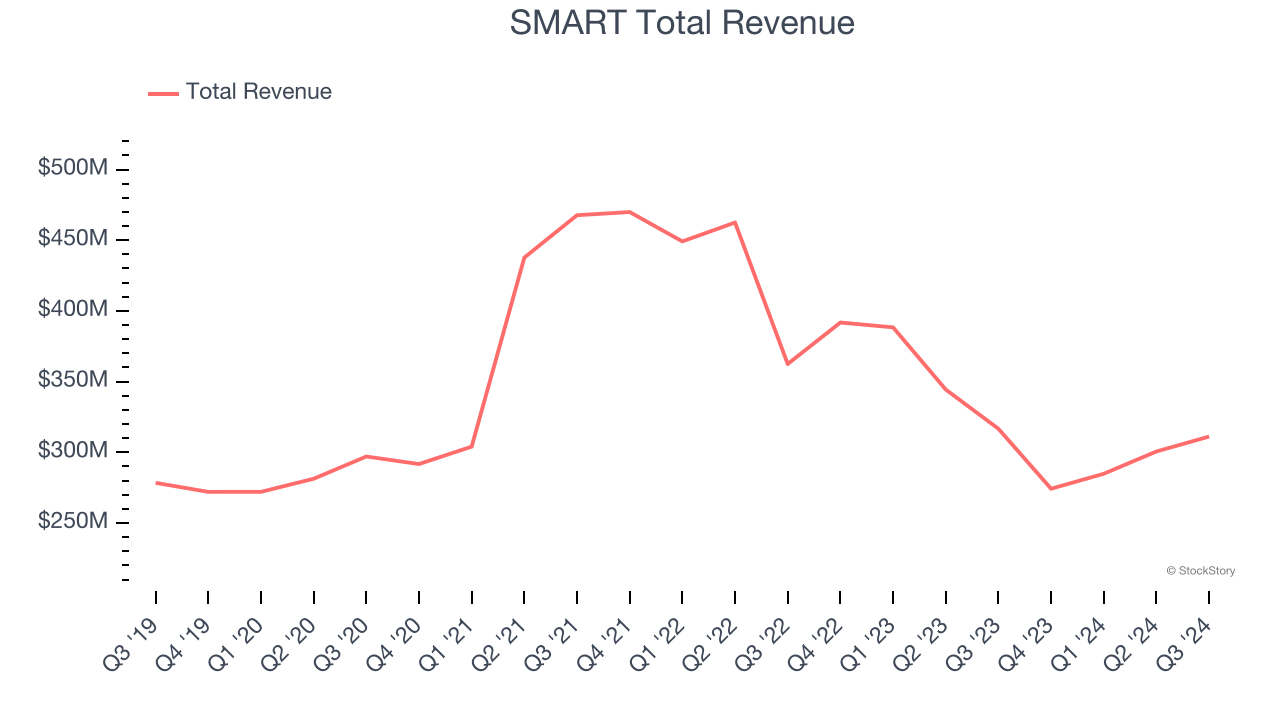

Weakest Q3: SMART (NASDAQ: SGH)

Based in the US, SMART Global Holdings (NASDAQ: SGH) is a diversified semiconductor company offering memory, digital, and LED products.

SMART reported revenues of $311.1 million, down 1.7% year on year. This print fell short of analysts’ expectations by 4.3%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ adjusted operating income and EPS estimates.

SMART delivered the weakest performance against analyst estimates of the whole group. The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $21.

Read our full report on SMART here, it’s free.

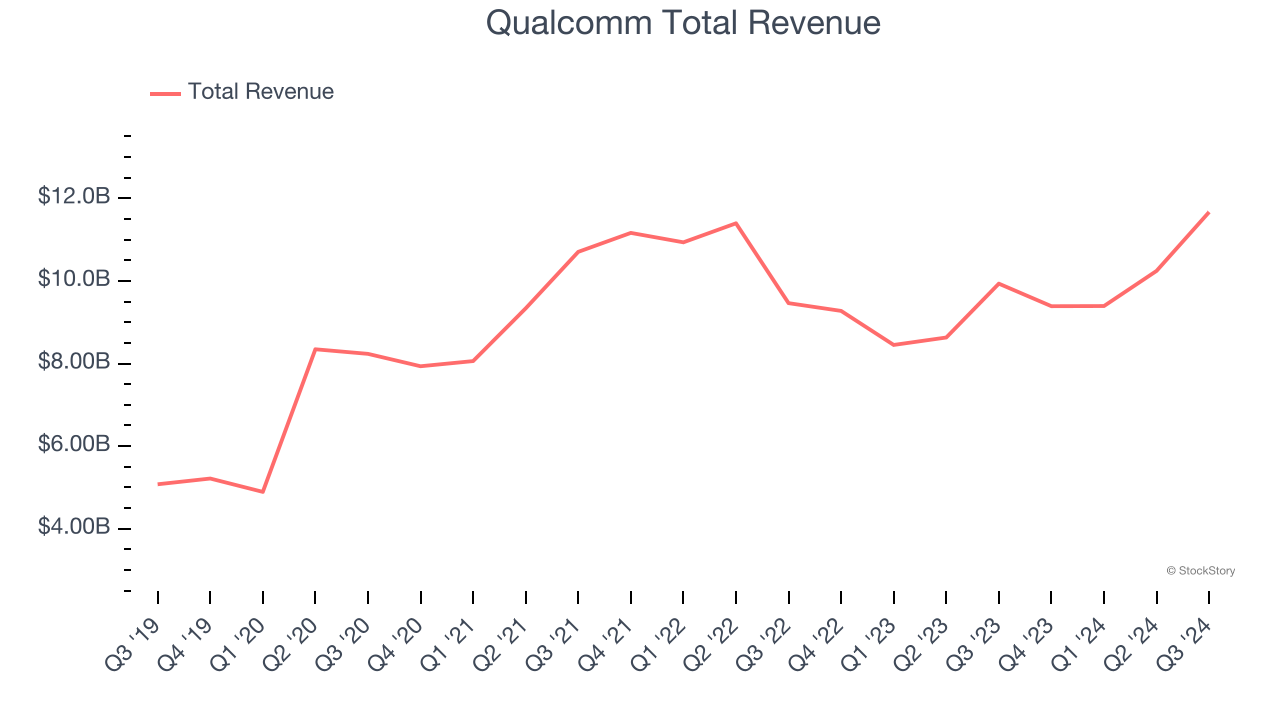

Best Q3: Qualcomm (NASDAQ: QCOM)

Having been at the forefront of developing the standards for cellular connectivity for over four decades, Qualcomm (NASDAQ: QCOM) is a leading innovator and a fabless manufacturer of wireless technology chips used in smartphones, autos and internet of things appliances.

Qualcomm reported revenues of $11.67 billion, up 17.5% year on year, outperforming analysts’ expectations by 6.7%. The business had an exceptional quarter with a significant improvement in its inventory levels and a solid beat of analysts’ EPS estimates.

Qualcomm pulled off the biggest analyst estimates beat among its peers. Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 12.3% since reporting. It currently trades at $154.33.

Is now the time to buy Qualcomm? Access our full analysis of the earnings results here, it’s free.

Lattice Semiconductor (NASDAQ: LSCC)

A global leader in its category, Lattice Semiconductor (NASDAQ: LSCC) is a semiconductor designer specializing in customer-programmable chips that enhance CPU performance for intensive tasks such as machine learning.

Lattice Semiconductor reported revenues of $117.4 million, down 31.2% year on year, in line with analysts’ expectations. It was a slower quarter as it posted a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EPS estimates.

Lattice Semiconductor delivered the slowest revenue growth in the group. Interestingly, the stock is up 8.6% since the results and currently trades at $59.08.

Read our full analysis of Lattice Semiconductor’s results here.

Intel (NASDAQ: INTC)

Inventor of the x86 processor that powered decades of technological innovation in PCs, data centers, and numerous other markets, Intel (NASDAQ: INTC) is a leading manufacturer of computer processors and graphics chips.

Intel reported revenues of $14.26 billion, down 7.4% year on year. This print beat analysts’ expectations by 3.3%. Overall, it was a very strong quarter as it also put up an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is up 6.4% since reporting and currently trades at $21.37.

Read our full, actionable report on Intel here, it’s free.

Broadcom (NASDAQ: AVGO)

Originally the semiconductor division of Hewlett Packard, Broadcom (NASDAQ: AVGO) is a semiconductor conglomerate spanning wireless communications, networking, and data storage as well as infrastructure software focused on mainframes and cybersecurity.

Broadcom reported revenues of $14.92 billion, up 24.7% year on year. This number surpassed analysts’ expectations by 2.1%. It was a strong quarter as it also produced an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

The stock is up 7.2% since reporting and currently trades at $192.37.

Read our full, actionable report on Broadcom here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.