As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q4. Today, we are looking at it services & consulting stocks, starting with Grid Dynamics (NASDAQ: GDYN).

IT Services & Consulting companies stand to benefit from increasing enterprise demand for digital transformation, AI-driven automation, and cybersecurity resilience. Many enterprises can't attack these topics alone and need IT services and consulting on everything from technical advice to implementation. Challenges in meeting these needs will include finding talent in specialized and evolving IT fields. While AI and automation can enhance productivity, they also threaten to commoditize certain consulting functions. Another ongoing challenge will be pricing pressures from offshore IT service providers, which have lower labor costs and increasingly equal access to advanced technology like AI.

The 8 it services & consulting stocks we track reported a strong Q4. As a group, revenues beat analysts’ consensus estimates by 0.6% while next quarter’s revenue guidance was 0.6% above.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 12.3% since the latest earnings results.

Best Q4: Grid Dynamics (NASDAQ: GDYN)

Founded during the early days of cloud computing in 2006, Grid Dynamics (NASDAQ: GDYN) is a technology consulting firm that helps large enterprises modernize their operations through cloud computing, artificial intelligence, and digital engineering services.

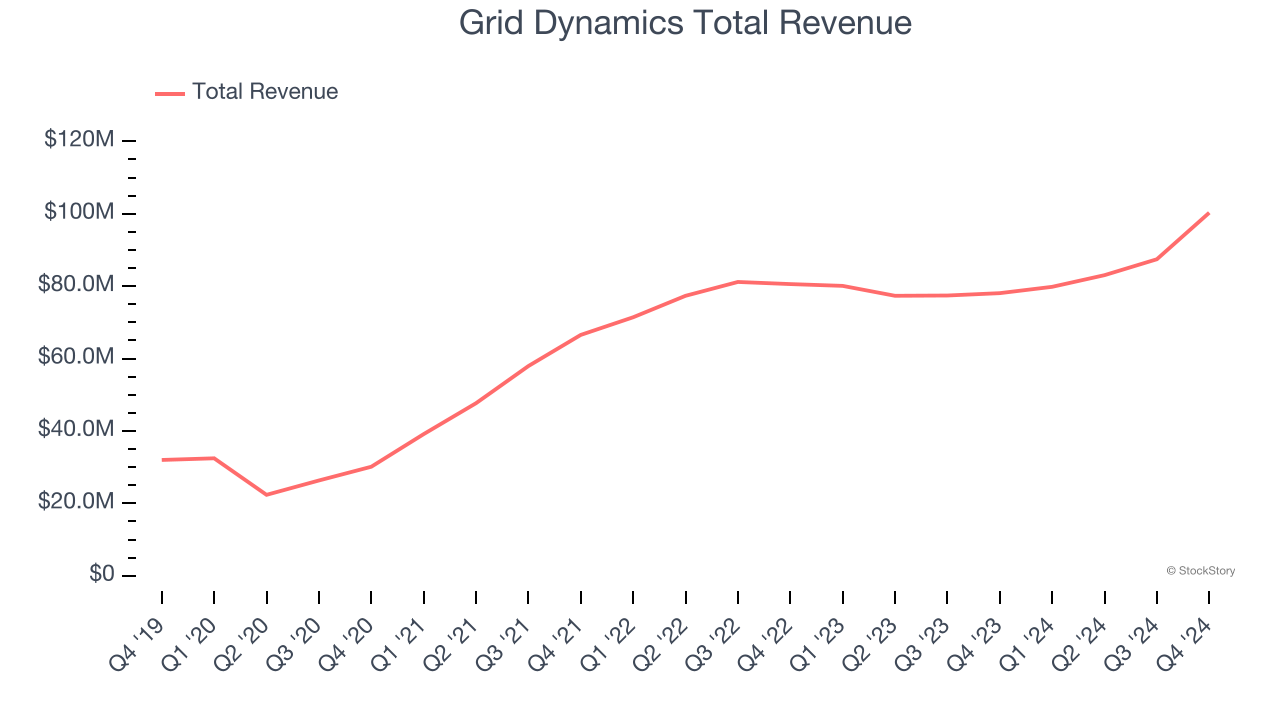

Grid Dynamics reported revenues of $100.3 million, up 28.5% year on year. This print exceeded analysts’ expectations by 4.3%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EPS estimates and full-year revenue guidance exceeding analysts’ expectations.

Grid Dynamics achieved the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 14.1% since reporting and currently trades at $17.61.

Is now the time to buy Grid Dynamics? Access our full analysis of the earnings results here, it’s free.

Gartner (NYSE: IT)

Founded in 1979 as a technology research firm and now serving executives across all business functions, Gartner (NYSE: IT) is a research and advisory firm that provides actionable insights, guidance, and tools to help executives make better decisions about technology and business strategies.

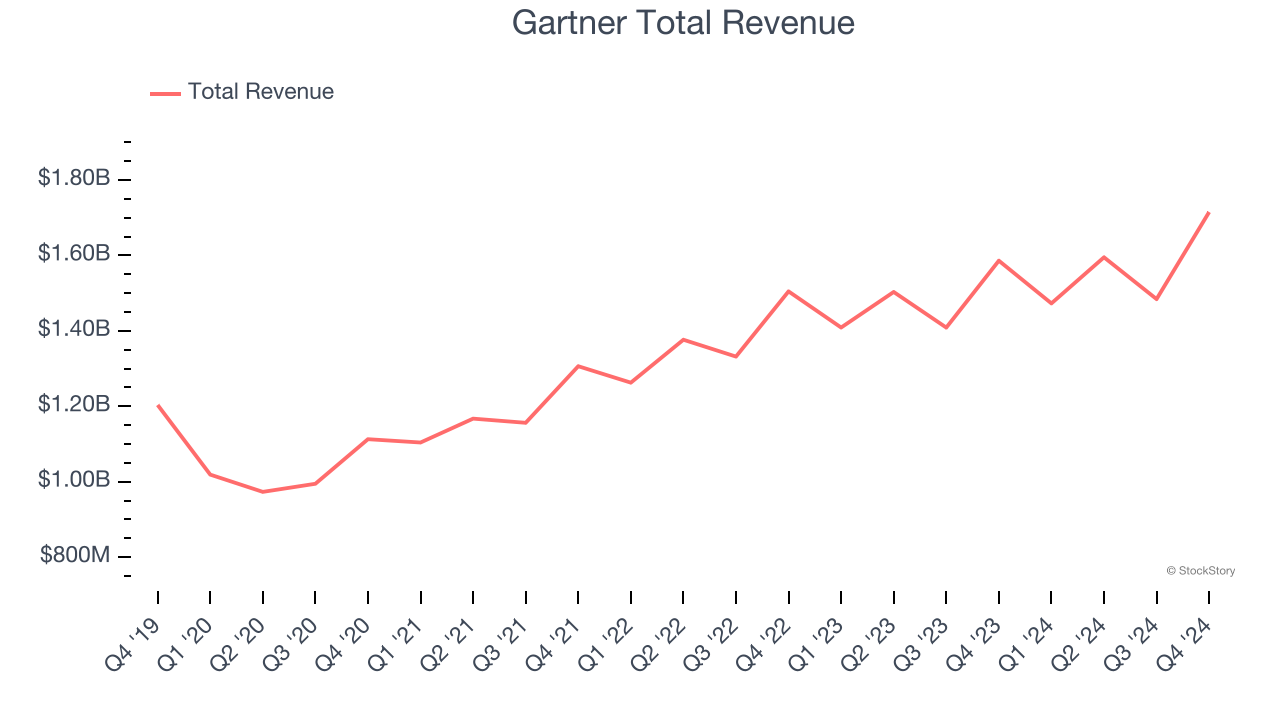

Gartner reported revenues of $1.72 billion, up 8.1% year on year, outperforming analysts’ expectations by 1.4%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates and a narrow beat of analysts’ constant currency revenue estimates.

Although it had a fine quarter compared to its peers, the market seems unhappy with the results as the stock is down 14.8% since reporting. It currently trades at $467.

Is now the time to buy Gartner? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: ASGN (NYSE: ASGN)

Evolving from its roots in IT staffing to become a comprehensive technology solutions provider, ASGN (NYSE: ASGN) provides IT consulting services and staffing solutions to Fortune 1000 companies and government agencies, specializing in digital transformation and technology implementation.

ASGN reported revenues of $985 million, down 8.3% year on year, falling short of analysts’ expectations by 1.5%. It was a slower quarter as it posted a significant miss of analysts’ EPS guidance for next quarter.

ASGN delivered the slowest revenue growth in the group. As expected, the stock is down 16.9% since the results and currently trades at $72.99.

Read our full analysis of ASGN’s results here.

Kyndryl (NYSE: KD)

Born from IBM's managed infrastructure services business in a 2021 spinoff, Kyndryl Holdings (NYSE: KD) is the world's largest IT infrastructure services provider that designs, builds, and manages technology environments for enterprise customers.

Kyndryl reported revenues of $3.74 billion, down 4.9% year on year. This result missed analysts’ expectations by 2%. Zooming out, it was actually a very strong quarter as it logged a solid beat of analysts’ EPS estimates and revenue guidance for next quarter exceeding analysts’ expectations.

Kyndryl had the weakest performance against analyst estimates among its peers. The stock is down 9.9% since reporting and currently trades at $34.15.

Read our full, actionable report on Kyndryl here, it’s free.

Cognizant (NASDAQ: CTSH)

Originally established as an in-house technology unit of Dun & Bradstreet before becoming independent in 1996, Cognizant (NASDAQ: CTSH) is a professional services company that helps businesses modernize their technology, reimagine processes, and transform digital experiences.

Cognizant reported revenues of $5.08 billion, up 6.8% year on year. This number met analysts’ expectations. More broadly, it was a decent quarter as it also recorded an impressive beat of analysts’ EPS estimates.

Cognizant had the weakest full-year guidance update among its peers. The stock is down 1.7% since reporting and currently trades at $82.15.

Read our full, actionable report on Cognizant here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.