Oncology (cancer) diagnostics company NeoGenomics (NASDAQ: NEO) missed Wall Street’s revenue expectations in Q4 CY2024, but sales rose 10.6% year on year to $172 million. On the other hand, the company’s full-year revenue guidance of $740 million at the midpoint came in 0.7% above analysts’ estimates. Its non-GAAP profit of $0.04 per share was $0.01 above analysts’ consensus estimates.

Is now the time to buy NeoGenomics? Find out by accessing our full research report, it’s free.

NeoGenomics (NEO) Q4 CY2024 Highlights:

- Revenue: $172 million vs analyst estimates of $173.8 million (10.6% year-on-year growth, 1% miss)

- Adjusted EPS: $0.04 vs analyst estimates of $0.03 ($0.01 beat)

- Adjusted EBITDA: $11.87 million vs analyst estimates of $10.64 million (6.9% margin, 11.6% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $740 million at the midpoint, beating analyst estimates by 0.7% and implying 12% growth (vs 11.7% in FY2024)

- EBITDA guidance for the upcoming financial year 2025 is $56.5 million at the midpoint, above analyst estimates of $55.58 million

- Operating Margin: -10.7%, up from -11.9% in the same quarter last year

- Free Cash Flow was -$1.80 million, down from $10.73 million in the same quarter last year

- Market Capitalization: $1.77 billion

“Our business continued to perform well throughout 2024 and we have now achieved nine consecutive quarters of double digit revenue growth and improved adjusted EBITDA over 1,000% for the year,” said Chris Smith, Chief Executive Officer of NeoGenomics.

Company Overview

Founded in 2001, NeoGenomics (NASDAQ: NEO) provides genetic and molecular testing services to support cancer diagnosis and treatment decisions, specializing in clinical testing, molecular oncology, and pharmacogenomics (impact of genes on drugs and vice versa).

Testing & Diagnostics Services

The testing and diagnostics services industry plays a crucial role in disease detection, monitoring, and prevention, serving hospitals, clinics, and individual consumers. This sector benefits from stable demand, driven by an aging population, increased prevalence of chronic diseases, and growing awareness of preventive healthcare. Recurring revenue streams come from routine screenings, lab tests, and diagnostic imaging, with reimbursement from Medicare, Medicaid, private insurance, and out-of-pocket payments. However, the industry faces challenges such as pricing pressures, regulatory compliance, and the need for continuous investment in new testing technologies. Looking ahead, industry tailwinds include the expansion of personalized medicine, increased adoption of at-home and rapid diagnostic tests, and advancements in AI-driven diagnostics that enhance accuracy and efficiency. However, headwinds such as reimbursement uncertainties, competition from decentralized testing solutions, and regulatory scrutiny over test validity and cost-effectiveness may impact profitability. Adapting to evolving healthcare models and integrating automation will be key for sustaining growth and maintaining operational efficiency.

Sales Growth

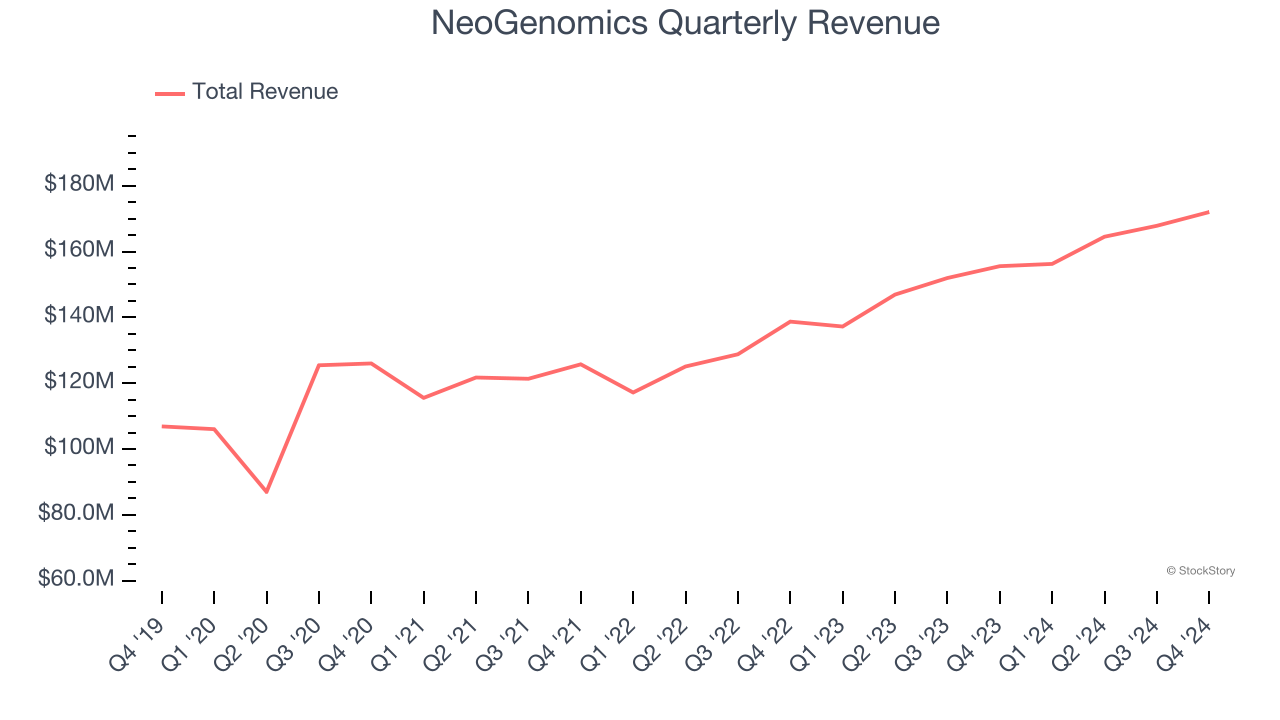

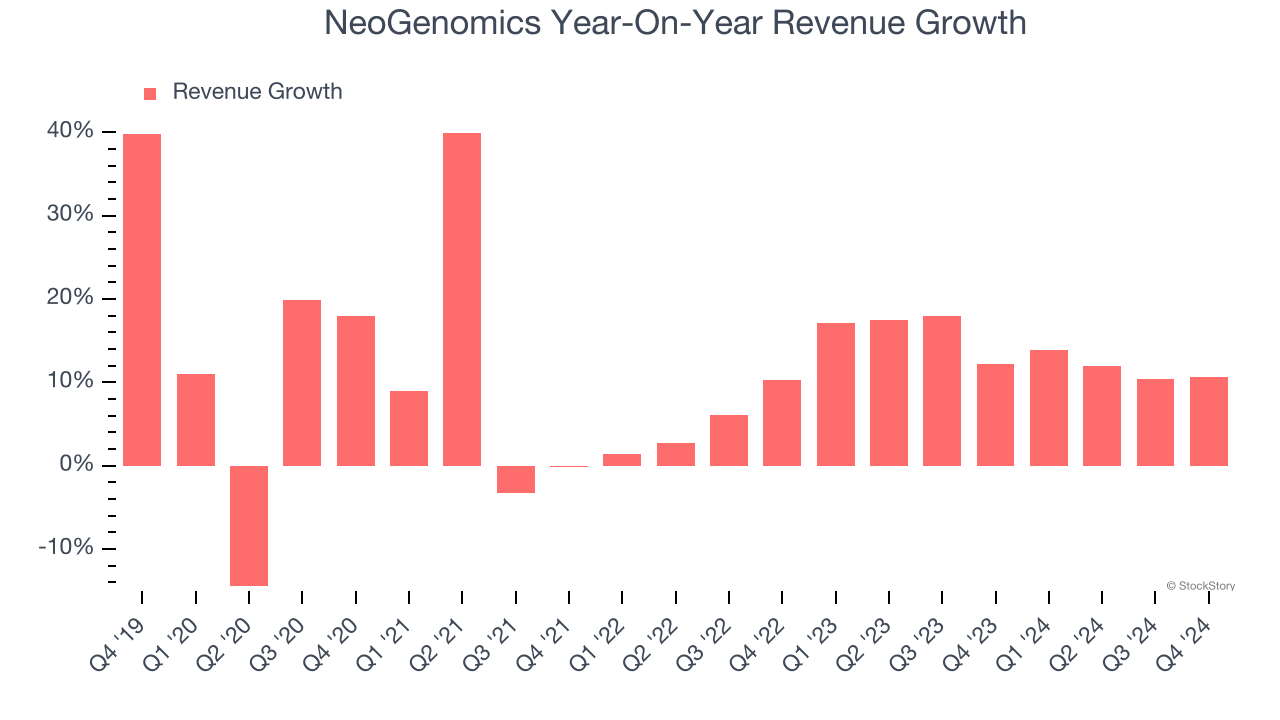

A company’s long-term performance is an indicator of its overall quality. While any business can experience short-term success, top-performing ones enjoy sustained growth for years. Over the last five years, NeoGenomics grew its sales at a decent 10.1% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. NeoGenomics’s annualized revenue growth of 13.8% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

We can better understand the company’s revenue dynamics by analyzing its most important segment, Clinical services. Over the last two years, NeoGenomics’s Clinical services revenue averaged 16.8% year-on-year growth. This segment has outperformed its total sales during the same period, lifting the company’s performance.

This quarter, NeoGenomics’s revenue grew by 10.6% year on year to $172 million but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 11.2% over the next 12 months, a slight deceleration versus the last two years. Despite the slowdown, this projection is admirable and indicates the market is baking in success for its products and services.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

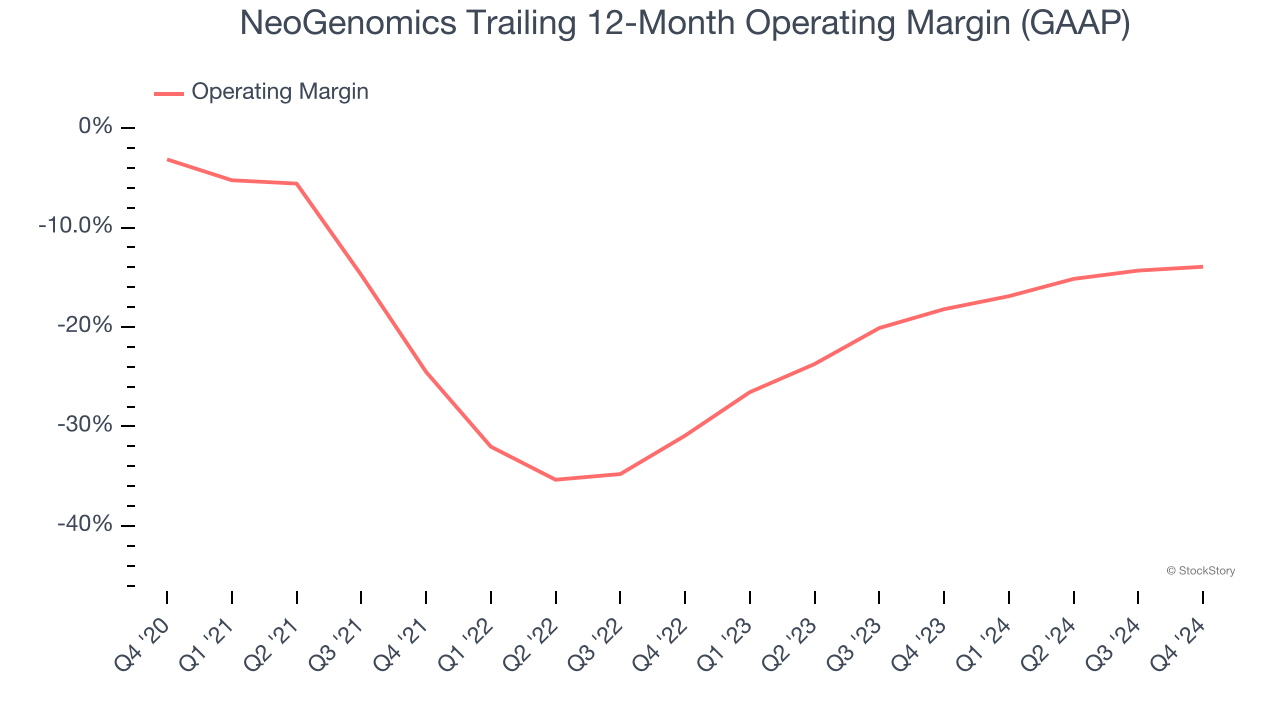

NeoGenomics’s high expenses have contributed to an average operating margin of negative 18.2% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

Analyzing the trend in its profitability, NeoGenomics’s operating margin decreased by 10.8 percentage points over the last five years, but it rose by 17 percentage points on a two-year basis. Still, shareholders will want to see NeoGenomics become more profitable in the future.

In Q4, NeoGenomics generated a negative 10.7% operating margin. The company's consistent lack of profits raise a flag.

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

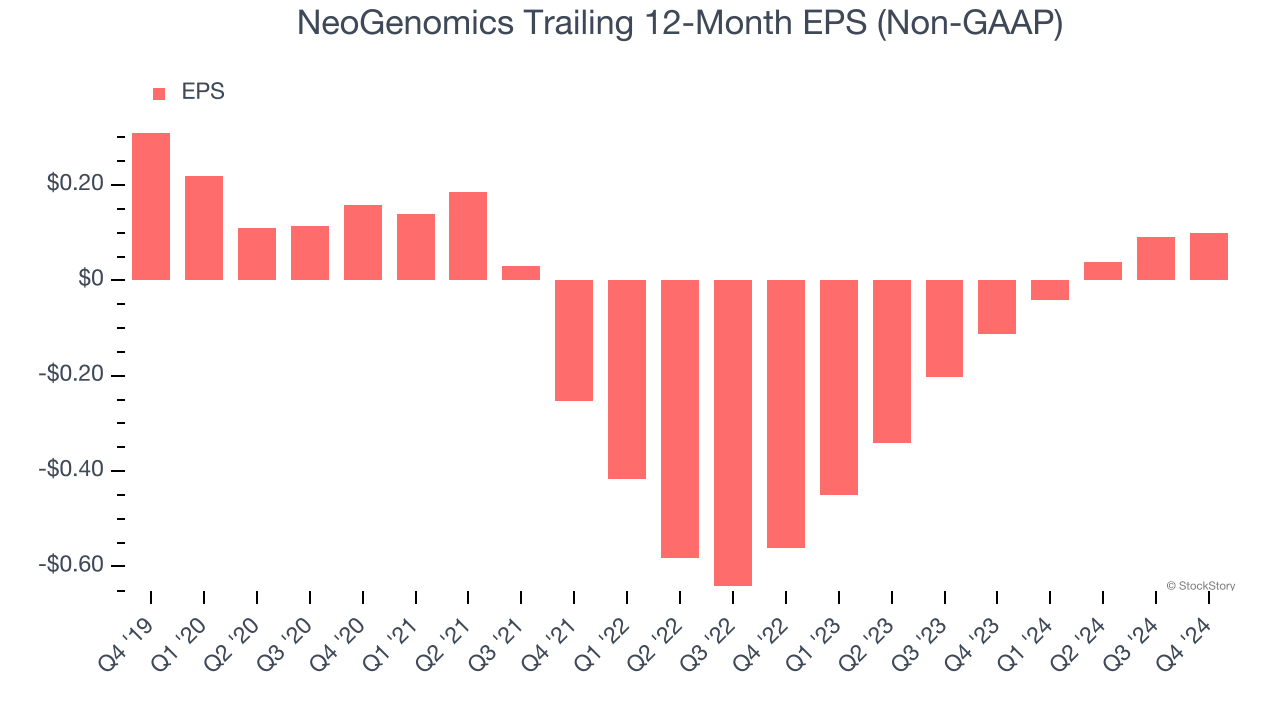

Sadly for NeoGenomics, its EPS declined by 20.3% annually over the last five years while its revenue grew by 10.1%. This tells us the company became less profitable on a per-share basis as it expanded.

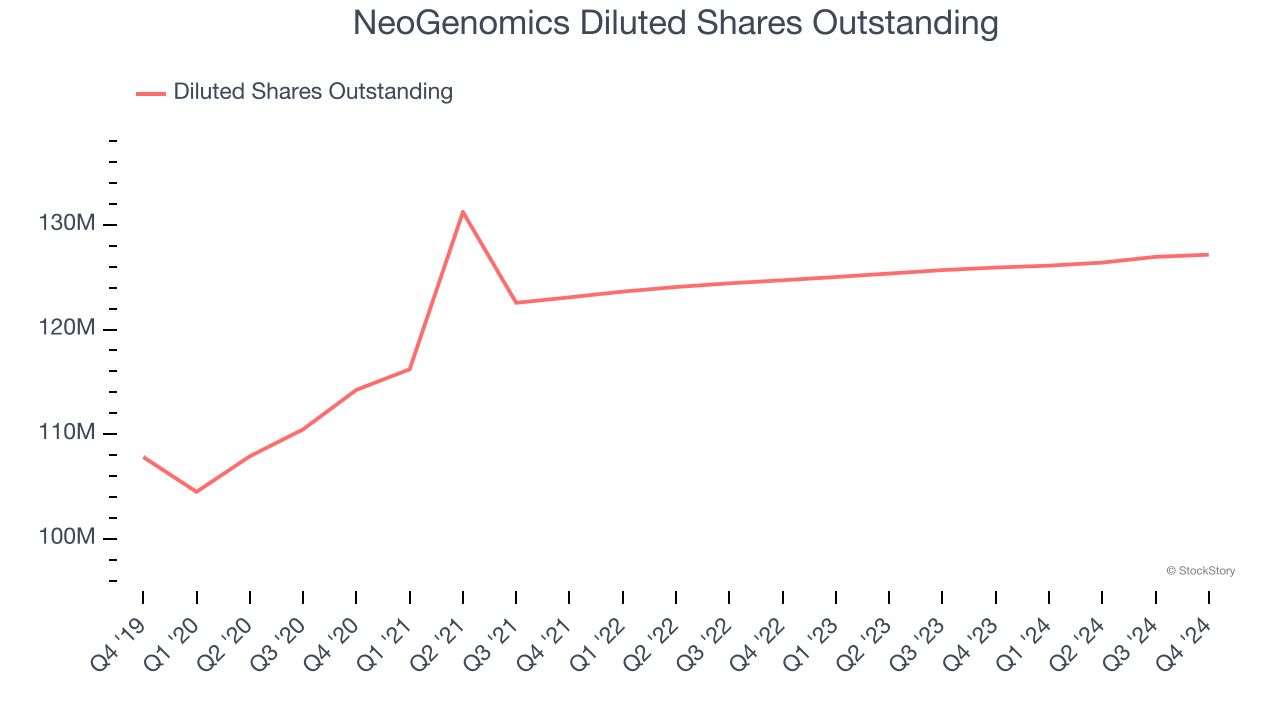

We can take a deeper look into NeoGenomics’s earnings to better understand the drivers of its performance. As we mentioned earlier, NeoGenomics’s operating margin improved this quarter but declined by 10.8 percentage points over the last five years. Its share count also grew by 17.9%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q4, NeoGenomics reported EPS at $0.04, up from $0.03 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects NeoGenomics to perform poorly. Analysts forecast its full-year EPS of $0.10 will hit $0.20.

Key Takeaways from NeoGenomics’s Q4 Results

We were impressed by how significantly NeoGenomics blew past analysts’ EPS expectations this quarter. We were also glad its full-year revenue guidance was slightly higher than Wall Street’s estimates. On the other hand, its revenue slightly missed. Overall, this quarter had some key positives. The stock traded up 4.6% to $15.10 immediately after reporting.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.