Website building platform Wix (NASDAQ: WIX) announced better-than-expected revenue in Q3 CY2025, with sales up 13.6% year on year to $505.2 million. The company expects next quarter’s revenue to be around $526 million, close to analysts’ estimates. Its non-GAAP profit of $1.68 per share was 12.6% above analysts’ consensus estimates.

Is now the time to buy Wix? Find out by accessing our full research report, it’s free for active Edge members.

Wix (WIX) Q3 CY2025 Highlights:

- Revenue: $505.2 million vs analyst estimates of $502.3 million (13.6% year-on-year growth, 0.6% beat)

- Adjusted EPS: $1.68 vs analyst estimates of $1.49 (12.6% beat)

- Adjusted Operating Income: $89.93 million vs analyst estimates of $95.97 million (17.8% margin, 6.3% miss)

- Revenue Guidance for Q4 CY2025 is $526 million at the midpoint, roughly in line with what analysts were expecting

- Operating Margin: -1.5%, down from 5.8% in the same quarter last year

- Free Cash Flow Margin: 25.2%, down from 30.1% in the previous quarter

- Market Capitalization: $7.07 billion

“Our goal has always been to give people the power to access advanced technology without the barriers of complexity,” said Avishai Abrahami, Co-founder and CEO of Wix.

Company Overview

Powering over 263 million registered users worldwide with its AI-driven tools, Wix (NASDAQ: WIX) provides a cloud-based platform that helps individuals and businesses create and manage professional websites without requiring coding skills.

Revenue Growth

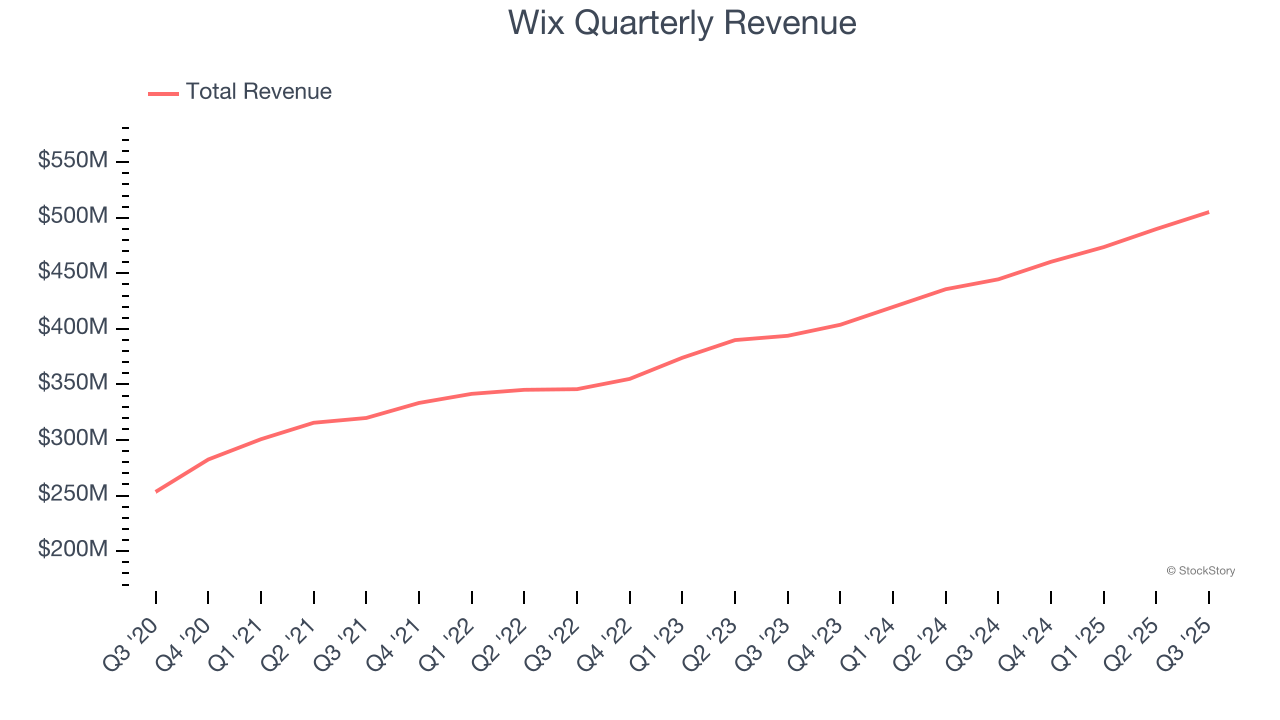

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Wix grew its sales at a 16.2% annual rate. Although this growth is acceptable on an absolute basis, it fell slightly short of our standards for the software sector, which enjoys a number of secular tailwinds.

Long-term growth is the most important, but within software, a half-decade historical view may miss new innovations or demand cycles. Wix’s recent performance shows its demand has slowed as its annualized revenue growth of 12.9% over the last two years was below its five-year trend.

This quarter, Wix reported year-on-year revenue growth of 13.6%, and its $505.2 million of revenue exceeded Wall Street’s estimates by 0.6%. Company management is currently guiding for a 14.2% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 13.9% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its newer products and services will not catalyze better top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Wix is quite efficient at acquiring new customers, and its CAC payback period checked in at 32.1 months this quarter. The company’s rapid recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Wix’s Q3 Results

Revenue beat slightly but operating income missed. Revenue guidance for next quarter was just in line. Zooming out, we think this was a mixed quarter. Investors were likely hoping for more, and shares traded down 5.6% to $119.75 immediately after reporting.

Is Wix an attractive investment opportunity right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.