Wrapping up Q3 earnings, we look at the numbers and key takeaways for the air freight and logistics stocks, including Expeditors (NYSE: EXPD) and its peers.

The growth of e-commerce and global trade continues to drive demand for expedited shipping services, presenting opportunities for air freight companies. The industry continues to invest in advanced technologies such as automated sorting systems and real-time tracking solutions to enhance operational efficiency. Despite the advantages of speed and global reach, air freight and logistics companies are still at the whim of economic cycles. Consumer spending, for example, can greatly impact the demand for these companies’ offerings while fuel costs can influence profit margins.

The 6 air freight and logistics stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was 0.7% below.

Thankfully, share prices of the companies have been resilient as they are up 6.1% on average since the latest earnings results.

Best Q3: Expeditors (NYSE: EXPD)

Expeditors (NYSE: EXPD) offers air and ocean freight as well as brokerage services.

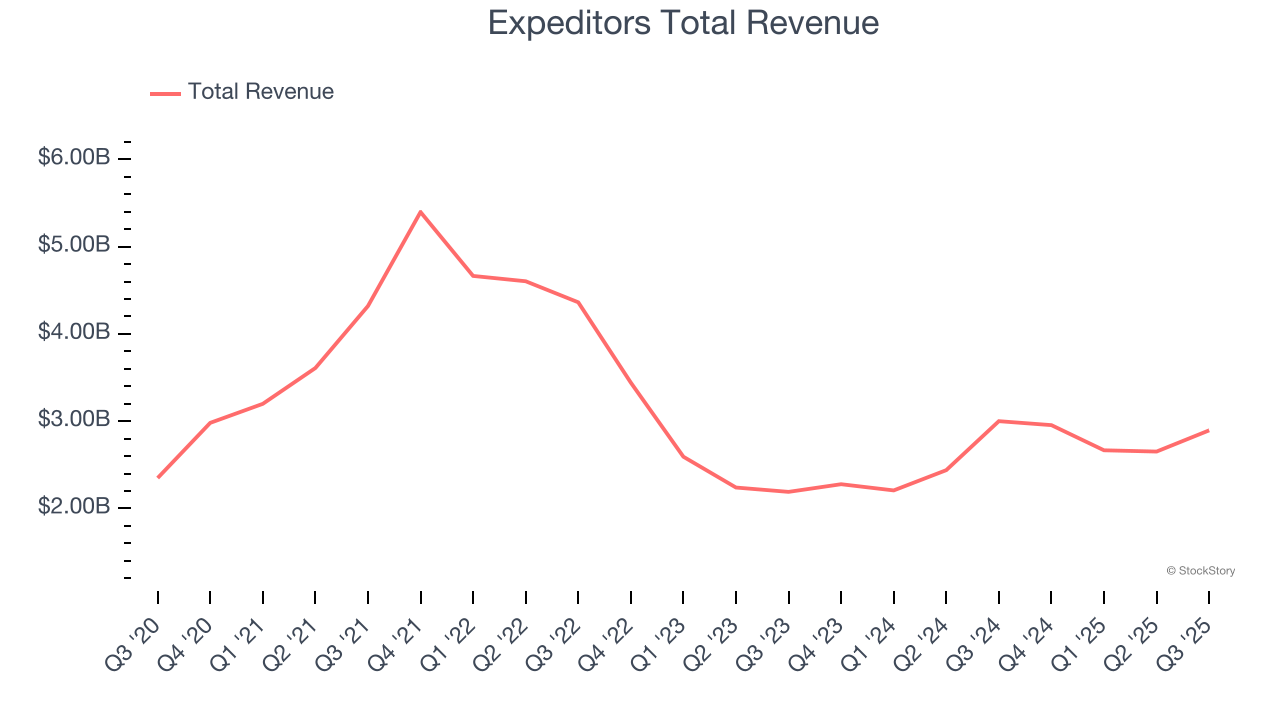

Expeditors reported revenues of $2.89 billion, down 3.5% year on year. This print exceeded analysts’ expectations by 8.6%. Overall, it was a stunning quarter for the company with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ adjusted operating income estimates.

Expeditors scored the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 14.2% since reporting and currently trades at $139.80.

Is now the time to buy Expeditors? Access our full analysis of the earnings results here, it’s free for active Edge members.

United Parcel Service (NYSE: UPS)

Trademarking its recognizable UPS Brown color, UPS (NYSE: UPS) offers package delivery, supply chain management, and freight forwarding services.

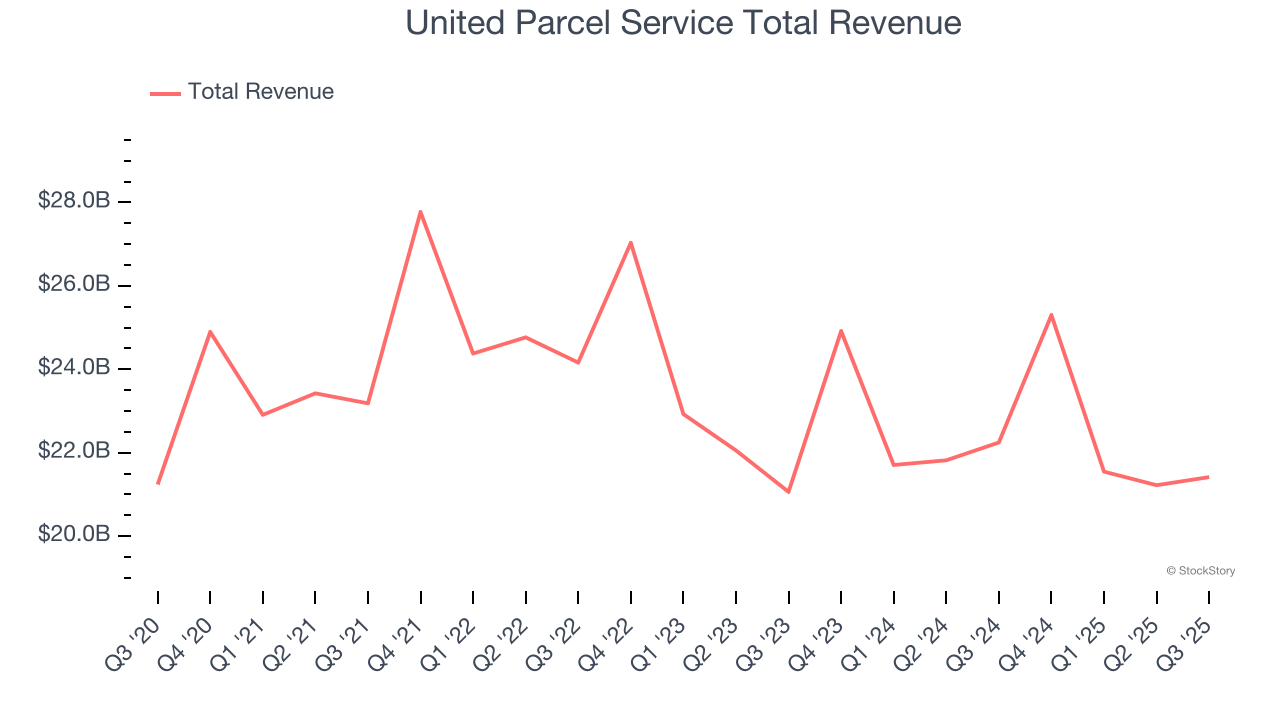

United Parcel Service reported revenues of $21.42 billion, down 3.7% year on year, outperforming analysts’ expectations by 2.5%. The business had an exceptional quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems content with the results as the stock is up 4.1% since reporting. It currently trades at $92.99.

Is now the time to buy United Parcel Service? Access our full analysis of the earnings results here, it’s free for active Edge members.

Slowest Q3: Hub Group (NASDAQ: HUBG)

Started with $10,000, Hub Group (NASDAQ: HUBG) is a provider of intermodal, truck brokerage, and logistics services, facilitating transportation solutions for businesses worldwide.

Hub Group reported revenues of $934.5 million, down 5.3% year on year, exceeding analysts’ expectations by 0.7%. Still, it was a mixed quarter as it posted a significant miss of analysts’ sales volume estimates.

As expected, the stock is down 1% since the results and currently trades at $35.09.

Read our full analysis of Hub Group’s results here.

FedEx (NYSE: FDX)

Sporting one of the largest air cargo fleets in the world, FedEx (NYSE: FDX) is a global provider of parcel and cargo delivery services.

FedEx reported revenues of $22.24 billion, up 3.1% year on year. This print topped analysts’ expectations by 2.7%. Overall, it was a strong quarter as it also logged a solid beat of analysts’ adjusted operating income estimates and an impressive beat of analysts’ revenue estimates.

The stock is up 15.3% since reporting and currently trades at $261.74.

Read our full, actionable report on FedEx here, it’s free for active Edge members.

C.H. Robinson Worldwide (NASDAQ: CHRW)

Engaging in contracts with tens of thousands of transportation companies, C.H. Robinson (NASDAQ: CHRW) offers freight transportation and logistics services.

C.H. Robinson Worldwide reported revenues of $4.14 billion, down 10.9% year on year. This result came in 2.1% below analysts' expectations. In spite of that, it was a strong quarter as it put up an impressive beat of analysts’ adjusted operating income estimates and a solid beat of analysts’ EBITDA estimates.

C.H. Robinson Worldwide had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is up 17.2% since reporting and currently trades at $151.68.

Read our full, actionable report on C.H. Robinson Worldwide here, it’s free for active Edge members.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.