Since May 2025, Insulet has been in a holding pattern, posting a small return of 3% while floating around $335.74. The stock also fell short of the S&P 500’s 11.9% gain during that period.

Is now the time to buy PODD? Or does the price properly account for its business quality and fundamentals? Find out in our full research report, it’s free for active Edge members.

Why Are We Positive On PODD?

Revolutionizing diabetes care with its tubeless "Pod" technology, Insulet (NASDAQ: PODD) develops and manufactures innovative insulin delivery systems for people with diabetes, primarily through its Omnipod product line.

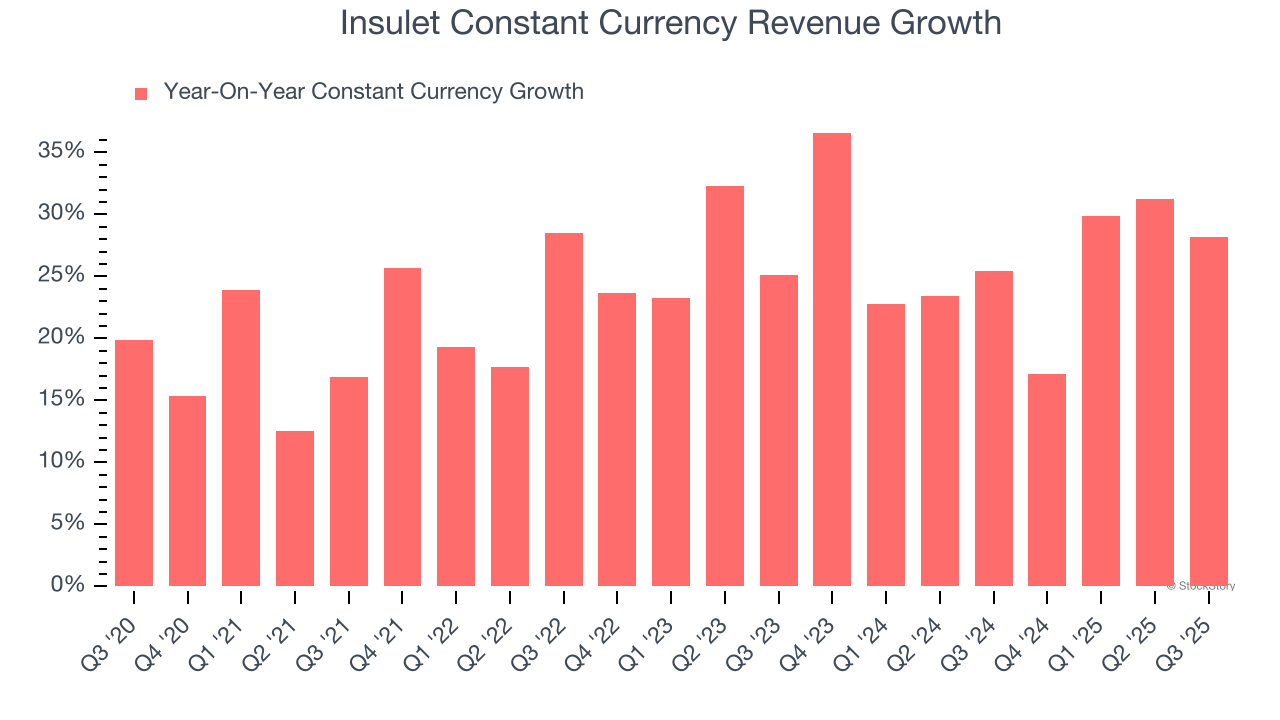

1. Constant Currency Revenue Propels Growth

In addition to reported revenue, constant currency revenue is a useful data point for analyzing Patient Monitoring companies. This metric excludes currency movements, which are outside of Insulet’s control and are not indicative of underlying demand.

Over the last two years, Insulet’s constant currency revenue averaged 26.8% year-on-year growth. This performance was fantastic and shows it can expand quickly on a global scale regardless of the macroeconomic environment.

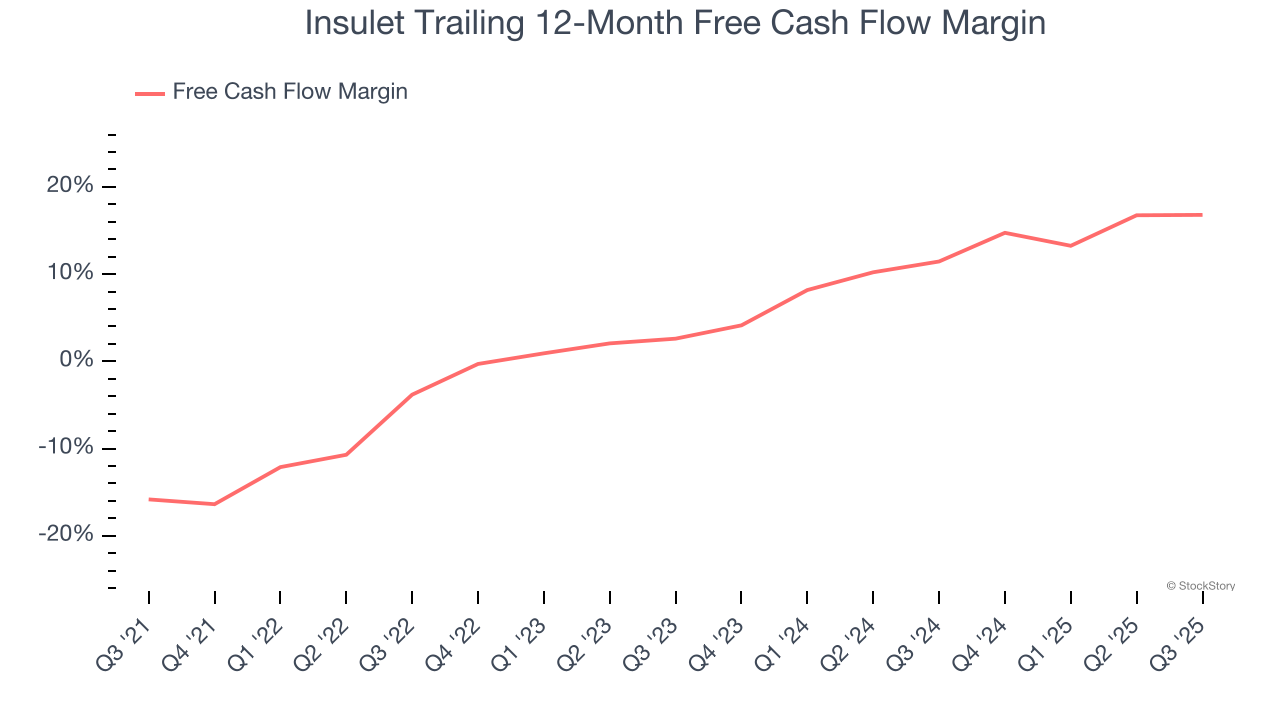

2. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Insulet’s margin expanded by 32.6 percentage points over the last five years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Insulet’s free cash flow margin for the trailing 12 months was 16.8%.

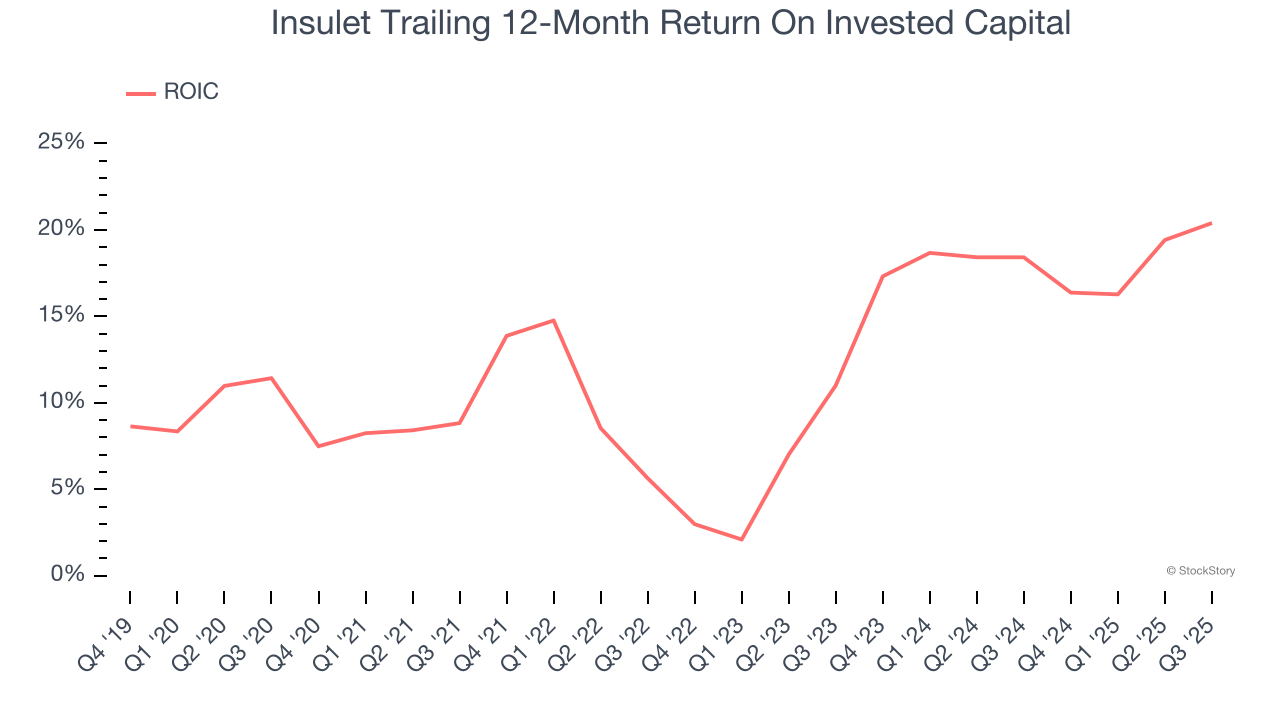

3. New Investments Bear Fruit as ROIC Jumps

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Fortunately, Insulet’s ROIC has increased significantly over the last few years. This is a great sign when paired with its already strong returns. It could suggest its competitive advantage or profitable growth opportunities are expanding.

Final Judgment

These are just a few reasons why we're bullish on Insulet. With its shares underperforming the market lately, the stock trades at 57.8× forward P/E (or $335.74 per share). Is now a good time to initiate a position? See for yourself in our full research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.