Online home goods retailer Wayfair (NYSE: W) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 8.1% year on year to $3.12 billion. Its non-GAAP profit of $0.70 per share was 59.3% above analysts’ consensus estimates.

Is now the time to buy Wayfair? Find out by accessing our full research report, it’s free for active Edge members.

Wayfair (W) Q3 CY2025 Highlights:

- Revenue: $3.12 billion vs analyst estimates of $3.01 billion (8.1% year-on-year growth, 3.5% beat)

- Adjusted EPS: $0.70 vs analyst estimates of $0.44 (59.3% beat)

- Adjusted EBITDA: $208 million vs analyst estimates of $163.3 million (6.7% margin, 27.4% beat)

- Operating Margin: 1.2%, up from -2.6% in the same quarter last year

- Free Cash Flow Margin: 3%, down from 7% in the previous quarter

- Active Customers: 21 million, down 700,000 year on year

- Market Capitalization: $11.21 billion

Company Overview

Founded in 2002 by Niraj Shah, Wayfair (NYSE: W) is a leading online retailer of mass-market home goods in the US, UK, Canada, and Germany.

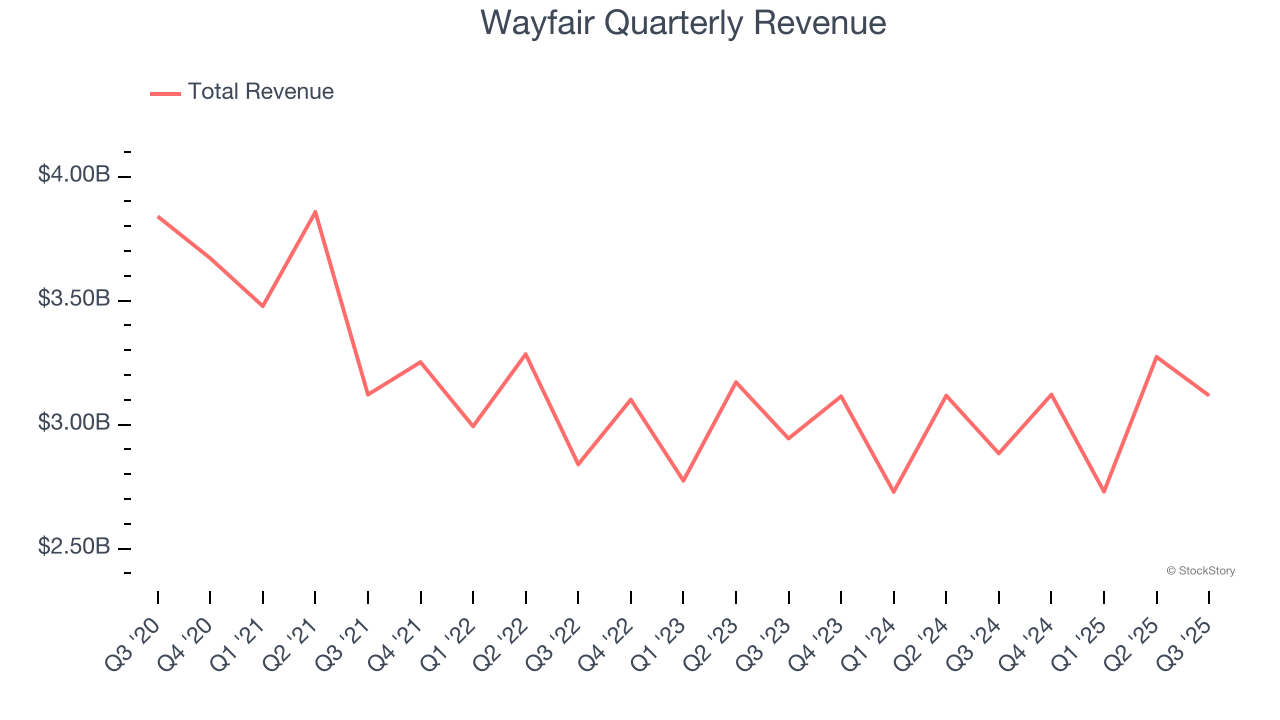

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Unfortunately, Wayfair struggled to consistently increase demand as its $12.24 billion of sales for the trailing 12 months was close to its revenue three years ago. This wasn’t a great result and suggests it’s a low quality business.

This quarter, Wayfair reported year-on-year revenue growth of 8.1%, and its $3.12 billion of revenue exceeded Wall Street’s estimates by 3.5%.

Looking ahead, sell-side analysts expect revenue to grow 3% over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Active Customers

Buyer Growth

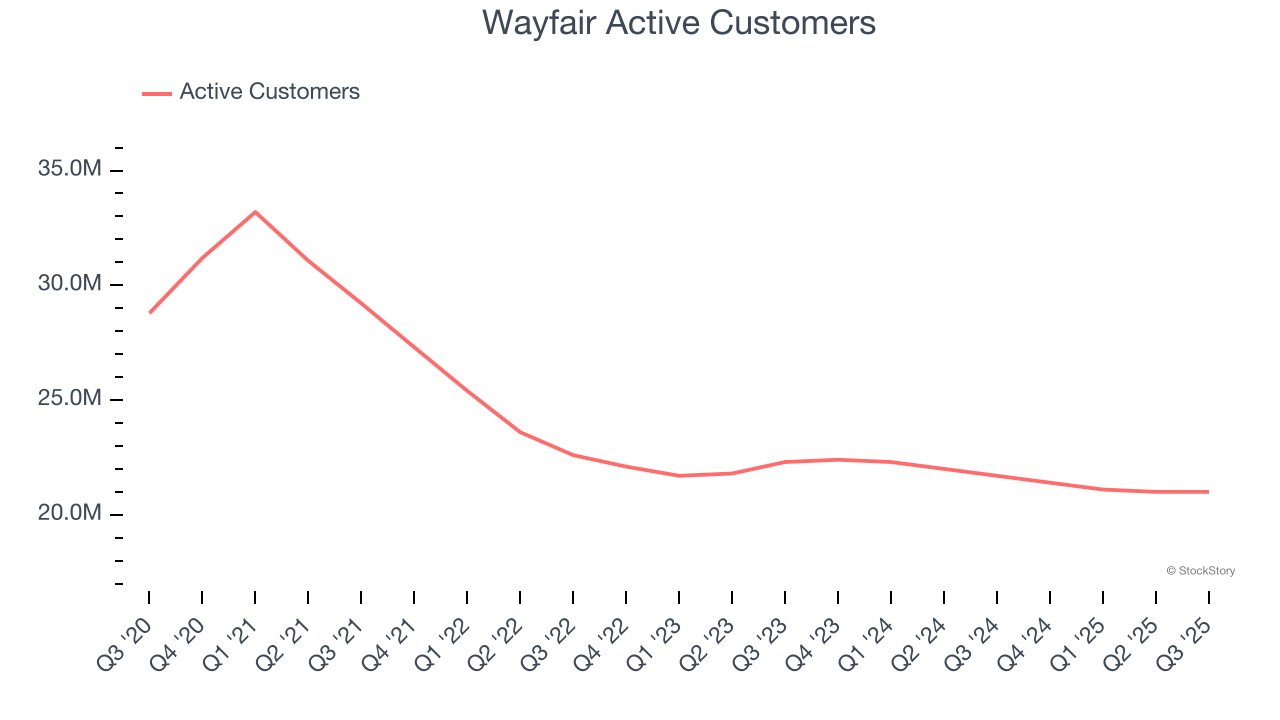

As an online retailer, Wayfair generates revenue growth by expanding its number of users and the average order size in dollars.

Wayfair struggled with new customer acquisition over the last two years as its active customers have declined by 1.9% annually to 21 million in the latest quarter. This performance isn't ideal because internet usage is secular, meaning there are typically unaddressed market opportunities. If Wayfair wants to accelerate growth, it likely needs to enhance the appeal of its current offerings or innovate with new products.

In Q3, Wayfair’s active customers once again decreased by 700,000, a 3.2% drop since last year. The quarterly print was lower than its two-year result, suggesting its new initiatives aren’t moving the needle for buyers yet.

Revenue Per Buyer

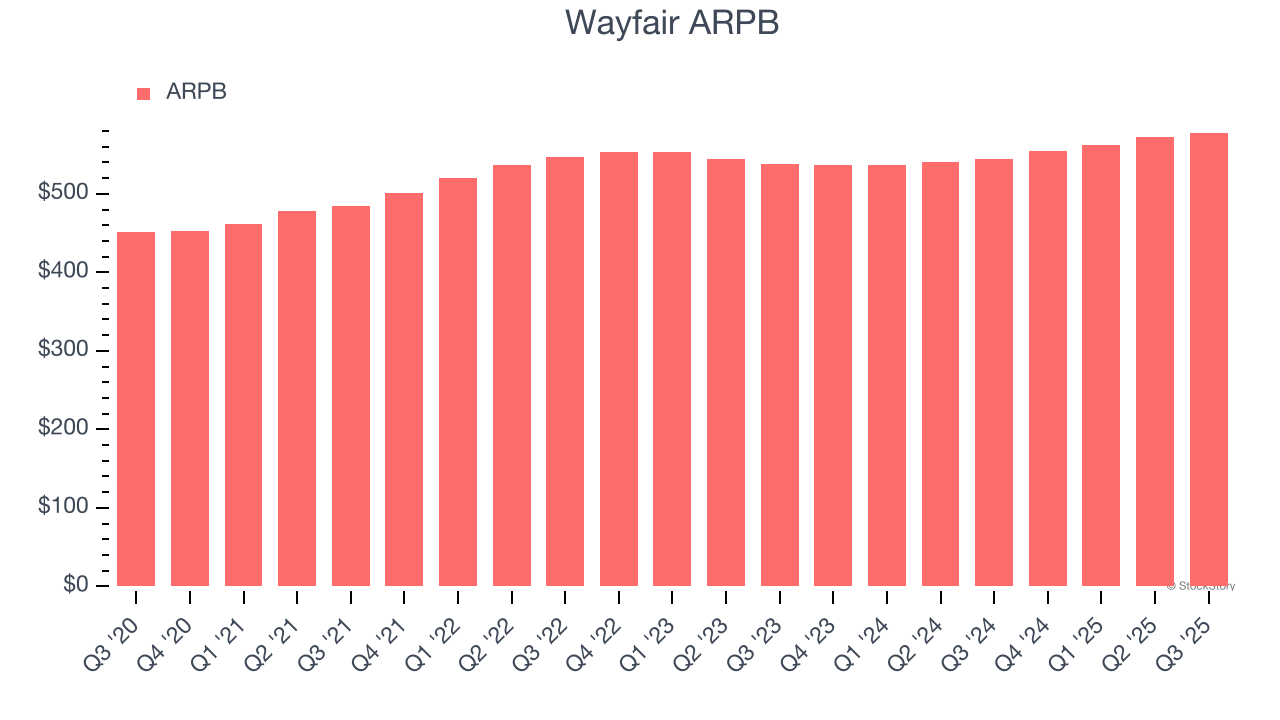

Average revenue per buyer (ARPB) is a critical metric to track because it measures how much customers spend per order.

Wayfair’s ARPB growth has been subpar over the last two years, averaging 1.8%. This raises questions about its platform’s health when paired with its declining active customers. If Wayfair wants to grow its buyers, it must either develop new features or lower its monetization of existing ones.

This quarter, Wayfair’s ARPB clocked in at $578. It grew by 6.1% year on year, faster than its active customers.

Key Takeaways from Wayfair’s Q3 Results

We were impressed by how significantly Wayfair blew past analysts’ EBITDA expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. On the other hand, its number of active customers slightly missed. Zooming out, we think this was a still quite a good quarter. The stock traded up 12.8% to $97.55 immediately after reporting.

Big picture, is Wayfair a buy here and now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.