Roblox Inc. (NYSE: RBLX) is a unique online platform with three main functions: a game-creation platform, a game-playing platform, and a social networking platform. Users can create games and monetize them with its user-friendly tools and resources using the Roblox Studio.

Users can also play the games created by other users and developers on the platform. Users can socialize and interact with each other through in-game chats, private messaging, virtual events, and groups. The combination of functions has helped accelerate its daily active user (DAUs) growth by 21% YoY to 79.5 million. Even more ambitious is its goal of reaching one billion DAUs.

Roblox operates in the computer and technology sector, competing with game engines and developers, including Unity Software Inc. (NYSE: U), Electronic Arts Inc. (NASDAQ: EA), and its top competitor among retro blocky character games Minecraft owned by Microsoft Co. (NASDAQ: MSFT).

Games Aren’t Just for Kids Anymore

Most of Roblox’s users are minors, which means it's the parent’s credit cards that are driving revenues. However, the demographic continues to expand to older age groups as more applications are developed for its platform, including interactive training, tours, and education programs.

The fastest-growing demographic is the 13-and-older group, which amounts to 58% of total users but grew at 26% YoY in the second quarter of 2024. Roblox is a metaverse with an in-game currency called Robux.

The company wants the platform to function as a metaverse where 80% of users come to play games, but the rest come to shop, consume entertainment, and socialize with each other.

Roblox Experiences Drive Growth

Like Alphabet Inc. (NASDAQ: GOOGL) YouTube, Roblox's content is mostly user-generated. In this case, it's the games and in-game products, including avatars, decorations, virtual clothing, perishables (1-time use items), and virtual environments collectively referred to as Roblox experiences. More and more brands are being attracted to the Roblox platform as 60% of its users are Gen Z. Major brands, including Nike Inc. (NYSE: NKE), Forever 21 and Gucci owned by Kering SA (OTCMKTS: PPRUY), attempt to engage with Gen-Zs and even Gen-Alpha’s through the platform through virtual stores and advertising.

Can Advertising Take Roblox’s Growth to the Next Level?

Roblox has recently pivoted to growing its advertising revenues by prioritizing immersive ads that blend seamlessly into the platform's user experiences. This includes:

- Immersive 3D Billboards: Dynamic billboards featuring the brand and products, along with interactive features, can be placed within the experiences.

- Portal Ads: These digital ads actually transport users to branded experiences on the platform.

- Video Ads: Immersive video ads appear in user-generated content. Roblox launched third-party adtech platforms like Pubmatic Inc. (NASDAQ: PUBM) and Integra Ad Science Holdings Co. (NASDAQ: IAS).

Major Brands Are Launching Virtual Stores in the Roblox Metaverse

Advertising is currently a tiny sliver of revenues, but the company expects its initiative to help it become a growth contributor by 2026 to 2027. The company has also been testing its shopping experiences to drive commerce revenue by having real-life employees from major brands, including Walmart Inc. (NYSE: WMT) e.l.f. Beauty Inc. (NYSE: ELF) and IKEA manage and operate virtual stores on the platform.

Leveraging Its Developers

Roblox is leveraging its developers and content creators to help generate more revenue by incentivizing them with higher splits on their sales. Its Creator Affiliate Program lets developers monetize their non-Roblox audience by signing up for Roblox to earn commissions. Furthermore, Roblox has partnered with Shopify Inc. (NYSE: SHOP) to enable real money transactions, enabling developers to earn cash for their products instead of having to convert Robux into cash.

Top-Line Miss and Lowered Guidance Caused Stock Drop

Roblox shares dived after the company reported its Q2 2024 EPS of a loss of 32 cents, which still beat consensus estimates by 7 cents. Revenues exploded by 31.2% YoY to $893.5 million, coming in shy of the $897.88 million consensus estimates.

The nail in the coffin was its downside guidance for Q3 2024 revenue to be between $860 million and $885 million versus the consensus of $967.08 million. Adjusted EBITDA is expected to be between $22 million and $42 million.

Even worse was its full-year 2024 downside guidance for revenues of $3.49 billion to $3.53 billion versus $4.08 billion consensus estimates. Adjusted EBITDA is expected to be between $92 million and $132 million, with free cash flow between $505 million and $535 million. This caused shares to fall 12% in the following days to a low of $35.30. However, investors piled back into the stock shortly after.

Roblox Developers Conference Stimulates Sentiment

On Sept. 5, 2024, the company hosted its 10th annual Roblox Developers Conference to unveil new products and provide business updates. The company stated that it wants 10% of gaming content revenue, which can be achieved once Roblox hits 300 million DAUs. Roblox also announced it will introduce premium games on its platform with developers keeping up to 70% of the revenue split. Next year, Roblox will enable eligible creators to sell their physical merchandise directly within their experiences using various e-commerce platforms, including Shopify.

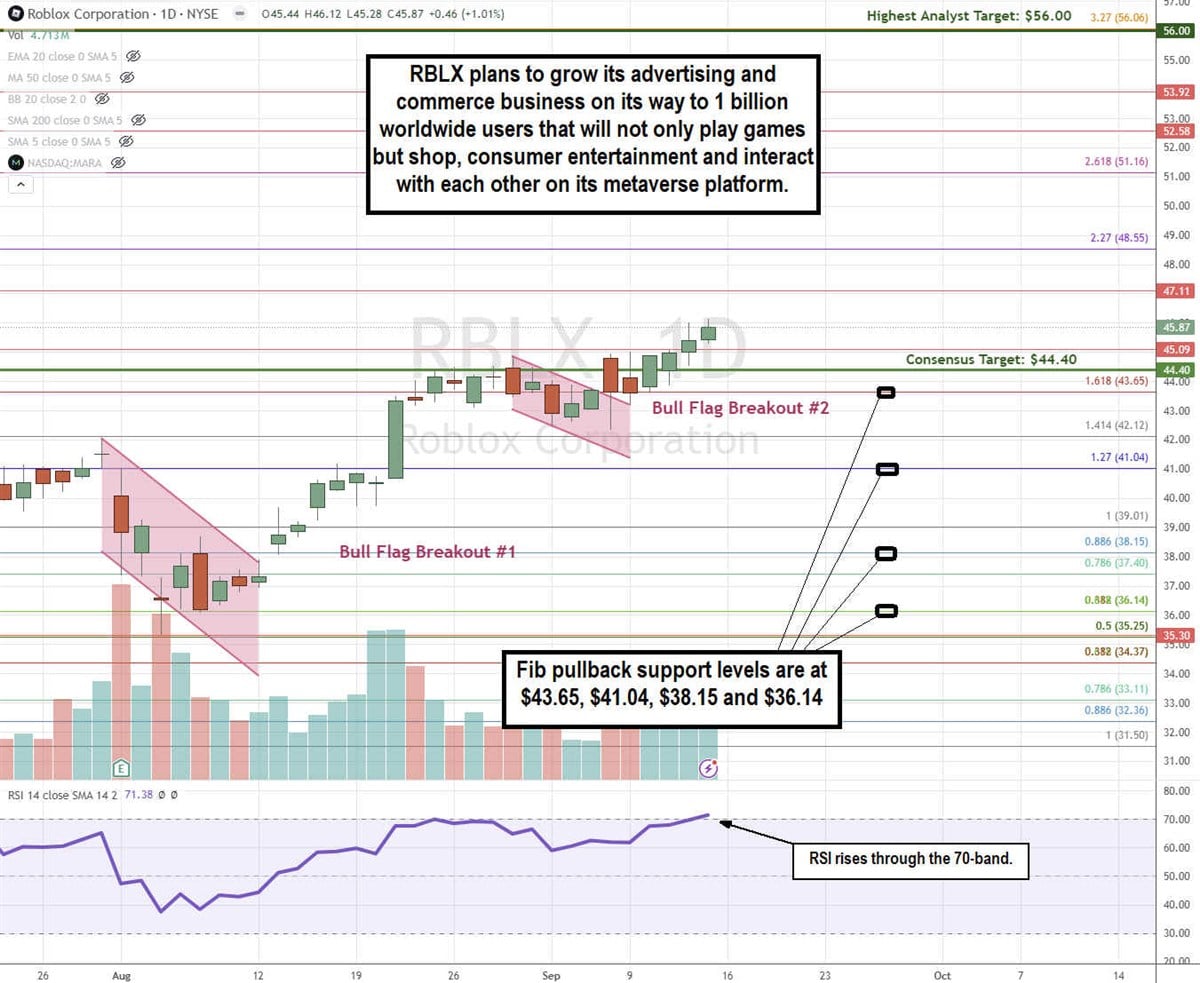

RBLX Stock Triggers Another Bull Flag Breakout

A bull flag occurs when a stock rises through the parallel descending upper trendline resistance, which forms after the flagpole peaks.

RBLX initially formed its first bull flag breakout after falling to the $35.30 low following its Q2 2024 earnings results and lowered guidance. RBLX managed to stabilize and trigger the bull flag breakout through the $38.15 Fibonacci (Fib) resistance. RBLX reached the $44.40 consensus price target, where it peaked and formed another flag. The second bull flag breakout triggered upon breaking out through the $43.65 fib resistance. The daily relative strength index (RSI) has continued climbing through the 70-band. Fib pullback support levels are at $43.65, $41.04, $38.15, and $36.14.

RBLX’s average consensus price target is $44.40, and its highest analyst price target sits at $56.00.

Actionable Options Strategies

Bullish investors can buy on pullbacks using cash-secured puts at the fib pullback support levels to buy the dip and write covered calls to execute a wheel strategy for income.

A Poor Man’s Covered Call (PWCC) strategy is a less capital-intensive way to enter a position and collect income by buying deep-in-the-money (ITM) back-month calls and selling out-of-the-money (OTM) front-month calls.