TORONTO, March 12, 2025 (GLOBE NEWSWIRE) -- The Healthcare of Ontario Pension Plan (HOOPP) announced today that it delivered a 9.7% return in 2024. Net assets were at $123 billion (as of Dec. 31, 2024), up from $112.6 billion in 2023. The Plan’s funded status remains strong at 111%, continuing HOOPP’s long history of ensuring stability for our members, now and in the future. This means for every dollar owed in pensions, the Plan has $1.11 in assets.

The 2024 funded status takes into account some important initiatives brought in during the year that improved members’ pensions: the HOOPP Board of Trustees approved a benefit formula improvement for eligible active members who had service in the Plan in 2023, and retired and deferred members received a full cost of living adjustment (COLA).

In keeping with new research published by the Canadian Institute of Actuaries, HOOPP has also increased its pension liabilities to reflect that Canadians – including our members – are expected to live and draw from their retirement savings for a longer period in the future. While this change led to a decrease in the Plan funded status, it provides an important updated view of future obligations, which helps HOOPP deliver the pension promise.

“At HOOPP, we are dedicated to ensuring our members have peace of mind when it comes to planning for their retirement,” said Jeff Wendling, HOOPP’s President and CEO. “A realistic understanding of pension liabilities and future obligations allows the Plan to be prepared to fulfill our pension promise for years to come.”

2024 was a unique time in the economy, with large fluctuations in the markets and global geopolitical instability.

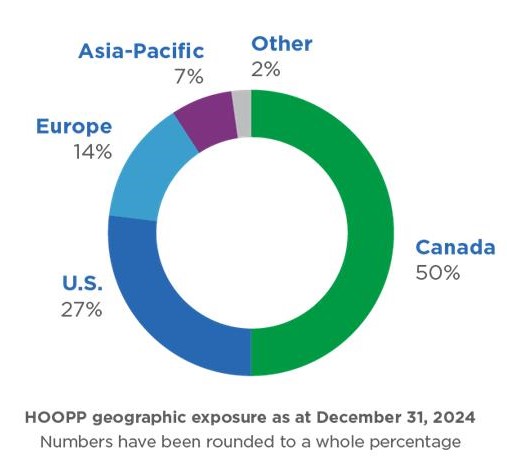

Over $60 billion of HOOPP’s assets – 50 per cent – are invested in Canada. HOOPP is one of the biggest investors in Canadian bonds, with over $40 billion in total government bond holdings as of Dec. 31, 2024.

Canadian bonds remain the backbone of the Fund’s investing strategy. As markets fluctuate, bonds serve as liquid collateral, which supports other investments. Having liquidity also allows HOOPP to continue diversifying its portfolio across asset classes and geographies.

“As I like to say, HOOPP is a buyer when others are sellers,” said Michael Wissell, HOOPP’s Chief Investment Officer. “As a result of our focus on ensuring liquidity, the global economic volatility we saw in 2024 was an opportunity for us rather than a barrier to success.”

Geographic exposure breakdown

Performance by asset class

| Asset Class | 2024 % Return |

| Fixed Income – Bonds | 1.9% |

| Public Equities | 17.9% |

| Private Equity | 12.7% |

| Real Estate | 1.4% |

| Infrastructure | 12.3% |

| Private Credit | 11.3% |

Operational advancements were also a highlight of 2024 for HOOPP, with the creation of an internal investment Centralized Relationship Management (CRM) system. The new CRM system consolidates external party information and interactions across our investment portfolios.

HOOPP also built out our Artificial Intelligence (AI) lab where we are testing potential use cases and challenges associated with this new technology.

Advancements like the CRM system and AI lab support HOOPP’s continued growth, allowing the Plan to make more informed and data-driven decisions, ultimately leading to better outcomes for our members. Despite these significant advancements, HOOPP’s operating costs remain one of the lowest among the Maple 8 at 0.4%.

“HOOPP continues to evolve our operations to align with the growth of our Plan assets and our membership,” added Wissell. “Being able to perform at our best as investment professionals requires a lot of teamwork from our internal partners who are working with and developing these new technologies.”

Other highlights from the year included:

- London office: Our London office opened in June 2024, giving the Plan space to grow and cultivate meaningful and scalable partnerships with UK and European entities.

- Employer growth: The Plan grew by an additional 32 employers since the end of 2023. Many of the new employers are from the small healthcare space, including hospices, mental health clinics and community services organizations.

- Member growth: HOOPP now has more than 478,000 active, deferred and retired members.

- Opening the Plan to physicians: The Plan announced that incorporated physicians would be eligible to become members of HOOPP as of Jan. 2, 2025.

- Retirement security research: HOOPP continues to conduct important research that advocates for increasing pension access and retirement security for all Canadians, including a report with the Conference Board of Canada that looked at the economic impact of defined benefit pensions in Ontario.

About the Healthcare of Ontario Pension Plan

HOOPP serves Ontario’s hospital and community-based healthcare sector, with more than 700 participating employers. Its membership includes nurses, medical technicians, food services staff, housekeeping staff, and many others who provide valued healthcare services. In total, HOOPP has more than 478,000 active, deferred and retired members.

HOOPP is fully funded and manages a highly diversified portfolio of more than $123 billion in assets that span multiple geographies and asset classes. HOOPP is also a major contributor to the Canadian economy, paying more than $3 billion in pension benefits to retired Ontario healthcare workers annually.

HOOPP operates as a private independent trust, and its Board of Trustees governs the Plan and Fund, focusing on HOOPP’s mission to deliver on our pension promise. The Board is made up of appointees from the Ontario Hospital Association (OHA) and four unions: the Ontario Nurses’ Association (ONA), the Canadian Union of Public Employees (CUPE), the Ontario Public Service Employees' Union (OPSEU), and the Service Employees International Union (SEIU). This governance model provides representation from both employers and members in support of the long-term interests of the Plan.

Contact:

Scott White, Senior Director, Media Relations and External Communications

swhite2@hoopp.com

Photos accompanying this announcement are available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/77955931-6d4a-46ab-a849-7f28998c03b2

https://www.globenewswire.com/NewsRoom/AttachmentNg/82e03a88-a562-4e63-9b49-94f10a9251aa

https://www.globenewswire.com/NewsRoom/AttachmentNg/bcf9189d-2b46-4ca1-8038-10c39d1ba299