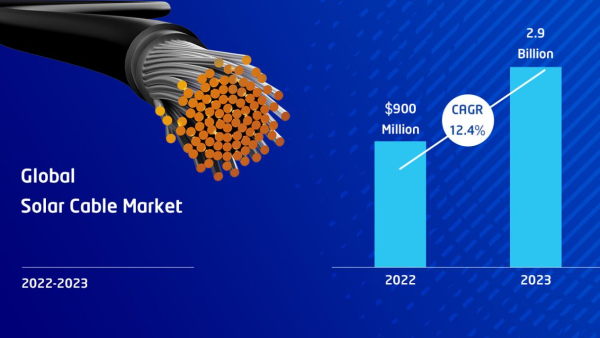

Along with the development of PV industry, the solar cable market has reached a climax. According to statistics, the PV cables market was valued at USD 900 million in 2022. The global solar cables market reached USD 2.9 billion by 2023, growing at a CAGR of 12.4%.

With peak carbon time approaching and the energy crisis caused by geopolitical conflicts, renewable energy is gradually playing a more important role in Europe, and its unique position makes PV the most reliable new energy option. In 2022 alone, PV product purchases in Europe accounted for two-fifths of the global market, and are expected to maintain a growth rate of more than 12% in 2023. Among them, PV panels, racks, inverters, etc. are the main building blocks for project laying, while PV-specific DC and AC cables receive less attention.

Although solar cables typically account for only 2 per cent of the cost of laying a PV project, they play a crucial role in power generation efficiency and safety, with numerous power generation failures and fires caused by PV cables and fittings in 2022 alone, which has led to a growing focus on the quality of cables and the supply chain.

Diverse choices, aligned standards

Today, Chinese manufacturers supply more than 80 per cent of the world's PV panels and accessories, while the players in solar cables are diversified, mainly from regions such as Germany, Italy, China, India and Turkey. End customers tend to be polarised in their choice of supply chain. For example, more economically developed regions such as Germany and the UK have more stringent quality controls, while less developed regions such as Romania will focus on the price side of the comparison, and will even opt for the PV1-f implementation standard, which has been discarded by the market.

At present, the main solar cable standards implemented in Europe are EN 50618 and IEC62930, and a few countries will also have the fire rating requirements of the Code for Construction Products (CPR). Therefore, purchasers are advised to refer to the EU quality enforcement standards, and at the same time strictly examine the qualifications of suppliers.

Local or imported, each has its own merits

From solar4all and other online retail malls, as well as rooftop and PV farms, you can learn that the mainstream European market is using PV cables mainly from local and Chinese manufacturers, Prysman, ElandCable, Lapp as a large integrated cable giant, the quality of the more easily trusted. While the Chinese manufacturers, although there is still a mixed situation, but still gave birth to a number of competitors with strength, while based on a more complete supply chain system and cost advantages quickly gained market recognition, such as: KUKA CABLE, HUATONG and so on.

For the European demand side, choosing local suppliers can provide a stronger sense of security, while importing cables of the same quality from China can save more than 20% of the cost, and how to choose is more based on the company's past purchasing habits. On the other hand, as solar cables account for a relatively small proportion of the overall laying cost, large EPCs and contractors tend to pay less attention to the cost difference of cables, and convenience, delivery and brand familiarity are the key to decision-making.

Take the more common German brand KBE and Shanghai's KUKA CABLE as an example, the former as a comprehensive cable manufacturing enterprise, has more than 40 years of development history, has a wider visibility in the customer base, easier to be known and accepted by customers. While KUK CABLE started late but focuses on the photovoltaic field, with certifications such as TUV, IEC and CPR, exported to more than 120 countries with supply chain optimisation capabilities and good price/performance ratios, but the company needs a longer cycle to build trust with it, reviewing samples, etc., but this does not hide its market advantage.

In summary, I believe that in the "global village" supply chain environment, the PV market is still booming with a variety of possibilities, enterprises can appropriately broaden the horizons of the co-operation region, the integration of supply chain advantages in different regions, to enhance the competitiveness of their own products and brands in the market is essential.

Media Contact

Company Name: KUKA CABLE

Contact Person: Media Relations

Email: Send Email

Phone: 0086-18317109559

Address:Building 15, No. 9655, Tingwei Highway, Tinglin Town, Jinshan District

City: Shanghai

Country: China

Website: https://www.kukacable.com/