- Offers broad choice with gas, hybrids and EVs: Ford to offer range of hybrids to complement efficient gas engines. Universal EV Platform will underpin multiple models. By 2030, about 50% of Ford’s global volume will be hybrids, extended-range EVs and electric vehicles, versus 17% today

- Fills U.S. plants with affordable new models: New “Built Ford Tough” pickups to be assembled at BlueOval City in Tennessee, new gas and hybrid van to be produced at Ohio Assembly Plant; Ford to hire thousands of new employees in the U.S. in next few years

- Launches battery energy storage business: Ford will leverage wholly owned plants in Ky. and Mich. and leading LFP technology to provide solutions for energy infrastructure and growing data center demand. Ford plans to begin shipping BESS systems in 2027 with 20 GWh of annual capacity

- Improves profitability: Actions will drive robust accretive returns and accelerate margin improvements across Ford Model e, Ford Pro and Ford Blue. Ford Model e now expected to reach profitability by 2029 with improvements beginning in 2026

- Rationalizes U.S. EV-related assets and product roadmap: Ford expects to record about $19.5 billion in special items with the majority in the fourth quarter. The company expects about $5.5 billion in cash effects with the majority paid in 2026 and the remainder in 2027

- Raises guidance: Company raises 2025 adjusted EBIT guidance to about $7 billion given continued underlying business strength, including cost improvement. Reaffirms adjusted free cash flow guidance range, trending towards the high end of $2 billion to $3 billion

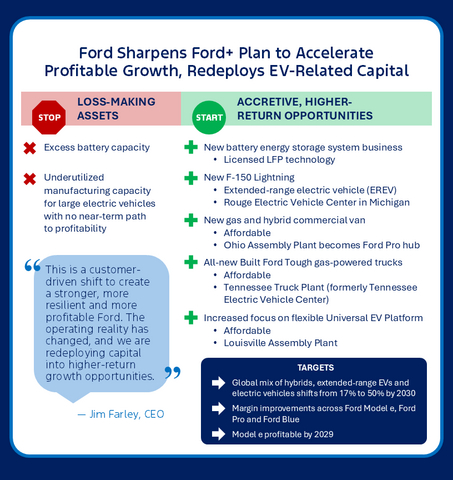

Ford Motor Company today announced a series of actions to sharpen its Ford+ plan, executing a decisive redeployment of capital to meet customer demand and drive profitable growth.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20251215095165/en/

The company is shifting to higher-return opportunities, including leveraging its U.S. manufacturing footprint to add trucks and vans to its lineup and launch a new, high-growth battery energy storage business. As part of these actions, Ford no longer plans to produce select larger electric vehicles where the business case has eroded due to lower-than-expected demand, high costs and regulatory changes.

This approach prioritizes affordability, choice and profits. Ford will expand powertrain choice – including a range of hybrids and extended-range electric propulsion – while focusing its pure electric vehicle development on its flexible Universal EV Platform for smaller, affordable models.

“This is a customer-driven shift to create a stronger, more resilient and more profitable Ford,” said Ford president and CEO Jim Farley. “The operating reality has changed, and we are redeploying capital into higher-return growth opportunities: Ford Pro, our market-leading trucks and vans, hybrids and high-margin opportunities like our new battery energy storage business.”

These actions provide a path to profitability in Model e by 2029, targeting annual improvements beginning in 2026. The actions will also improve profits in Ford Blue and Ford Pro over time with early signs of benefits in 2026. As a result, Ford expects to record about $19.5 billion in special items, the majority in the fourth quarter of 2025, with the remainder in 2026 and 2027. As part of these special items, the company expects approximately $5.5 billion in cash effects, with the majority paid in 2026 and the remainder in 2027.

To support these actions, Ford and its subsidiaries plan to hire thousands of people across America, reinforcing the company’s leadership as the top employer of U.S. hourly autoworkers.

The evolved strategy is built on four key pillars.

Expanding Customer Choice with Gas, Hybrids and Low-Cost Electric Vehicle Platform

By 2030, Ford expects approximately 50% of its global volume will be hybrids, extended-range EVs and fully electric vehicles, up from 17% in 2025.

Ford will concentrate its North American electric vehicle development on its new, low-cost, flexible Universal EV Platform. This next-generation architecture is engineered to underpin a high-volume family of smaller, highly efficient and affordable electric vehicles designed to be accessible to millions of customers.

The first vehicle from the Universal EV Platform will be the fully connected midsize pickup truck assembled at Louisville Assembly Plant starting in 2027.

Ford plans to expand hybrids with a range of executions based on customer needs and duty cycle – economical, performance hybrids and hybrids with exportable power. Ford is enhancing its strategy for larger trucks and SUVs to better align with customer demand for capability, towing and range, which includes adding extended-range electric options to its lineup.

As part of this plan, Ford’s next-generation F-150 Lightning will shift to an extended-range electric vehicle (EREV) architecture and be assembled at the Rouge Electric Vehicle Center in Dearborn, Michigan. Production of the current generation F-150 Lightning has concluded as Ford redeploys employees to Dearborn Truck Plant to support a third crew for F-150 gas and hybrid truck production as a result of the Novelis fires.

“The F-150 Lightning is a groundbreaking product that demonstrated an electric pickup can still be a great F-Series,” said Doug Field, Ford’s chief EV, digital and design officer. “Our next-generation Lightning EREV is every bit as revolutionary. It keeps everything customers love – 100% electric power delivery, sub-5-second acceleration – and adds an estimated 700+ mile range and tows like a locomotive. It will be an incredibly versatile tool delivered in a capital-efficient way.”

The company no longer intends to produce a previously planned new electric commercial van for Europe but will continue to maintain its full lineup of electrified vans for that market. Ford also plans to replace a planned electric commercial van for North America with a new, affordable commercial van –with gas and hybrid models – to meet the needs of commercial customers. This new van will be manufactured at Ford’s Ohio Assembly Plant.

These moves complement the company’s plan to launch five new affordable vehicles by the end of the decade, four of which will be assembled in the U.S. The company also plans to expand gas, hybrid and extended-range electric options across its portfolio with nearly every vehicle featuring a hybrid or multi-energy powertrain choice by the end of the decade.

Recently, Ford announced a series of changes to its business in Europe, including new leadership to drive the strategic direction, and a European product offensive that will bring a new generation of multi-energy vehicles to customers in Europe. Ford also announced a strategic partnership with Renault to collaborate in the development of electric vehicles in both the commercial and passenger segments.

Expanding Ford’s Truck and Van Leadership with New U.S. Production

This strategy reinforces Ford’s commitment to American manufacturing by repurposing its facilities in Tennessee and Ohio to expand its truck and van lineup leadership.

- Tennessee Truck Plant: On the BlueOval City campus, the Tennessee Electric Vehicle Center is renamed Tennessee Truck Plant. The facility will produce all-new Built Ford Tough truck models with production starting in 2029. These new affordable gas-powered trucks will broaden Ford’s truck family and extend its market leadership, replacing the previously planned next-generation electric truck.

- Ohio Assembly Plant: The plant will become a central hub for Ford Pro, assembling the new gas- and hybrid-powered commercial van starting in 2029, alongside Super Duty chassis cabs, strengthening Ford’s commercial vehicle dominance.

Launching a Battery Energy Storage System Business

Ford is launching a new business – including sales and service – to capture the large demand for battery energy storage from data centers and infrastructure to support the electric grid. Ford plans to repurpose existing U.S. battery manufacturing capacity in Glendale, Kentucky, to serve the rapidly growing battery energy storage systems market. This strategic initiative will leverage currently underutilized electric vehicle battery capacity to create a new, diversified and profitable revenue stream for Ford. The company also plans to invest roughly $2 billion in the next two years to scale the business.

The Kentucky site will be converted to manufacture 5 MWh+ advanced battery energy storage systems. Ford plans to produce LFP prismatic cells, battery energy storage system modules and 20-foot DC container systems at this facility. These systems are at the heart of the energy storage solution market for data centers, utilities, and large-scale industrial and commercial customers.

Leveraging more than a century of manufacturing expertise and licensed advanced battery technology, Ford plans to bring initial capacity online within 18 months, positioning the company to capture share in the growing U.S. battery energy storage systems market. Ford currently plans to deploy at least 20 GWh annually by late 2027.

Last week, Ford, SK On, SK Battery America and BlueOval SK entered into a joint venture disposition agreement. Under this mutual agreement, a Ford subsidiary will independently own and operate the Kentucky battery plants. SK On will fully own and operate the Tennessee battery plant.

Separately, Ford will utilize BlueOval Battery Park Michigan in Marshall, Michigan, to produce smaller Amp-hour cells for use in residential energy storage solutions. This plant remains on track to begin manufacturing LFP prismatic battery cells in 2026 to power Ford’s upcoming midsize electric truck, the first model on the new Universal EV Platform.

Building a Stronger, More Sustainable Future

Today’s actions are consistent with Ford’s goal of becoming carbon neutral across its vehicles, manufacturing facilities and supply chain no later than 2050.

The company will continue its environmental leadership with investments in cleaner manufacturing, sustainable supply chains and breakthrough technologies that reduce emissions across its entire ecosystem.

Updated 2025 Guidance

Company raises 2025 adjusted EBIT guidance to about $7 billion given continued underlying business strength, including cost improvement. Reaffirms adjusted free cash flow guidance range, trending towards the high end of $2 billion to $3 billion.

Ford plans to report its fourth-quarter and full-year 2025 financial results Tuesday, Feb. 10.

About Ford Motor Company

Ford Motor Company (NYSE: F) is a global company based in Dearborn, Michigan, committed to helping build a better world, where every person is free to move and pursue their dreams. The company’s Ford+ plan for growth and value creation combines existing strengths, new capabilities, and always-on relationships with customers to enrich experiences for customers and deepen their loyalty. Ford develops and delivers innovative, must-have Ford trucks, sport utility vehicles, commercial vans and cars and Lincoln luxury vehicles, along with connected services. The company offers freedom of choice through three customer-centered business segments: Ford Blue, engineering iconic gas-powered and hybrid vehicles; Ford Model e, inventing breakthrough electric vehicles (“EVs”) along with embedded software that defines always-on digital experiences for all customers; and Ford Pro, helping commercial customers transform and expand their businesses with vehicles and services tailored to their needs. Additionally, the Company provides financial services through Ford Motor Credit Company. Ford employs about 170,000 people worldwide. More information about the company and its products and services is available at corporate.ford.com.

Adjusted EBIT and adjusted free cash flow are non-GAAP financial measures. When Ford provides guidance for adjusted EBIT and adjusted free cash flow, the company does not provide guidance for net income or net cash provided by/(used in) operating activities, the respective most comparable GAAP measures, because they include items that are difficult to predict with reasonable certainty. See pages 75-76 of Ford's Annual Report on Form 10-K for the year ended December 31, 2024, for the definitions of adjusted EBIT and adjusted free cash flow.

Cautionary Note on Forward-Looking Statements

Statements included or incorporated by reference herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on expectations, forecasts, and assumptions by our management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those stated, including, without limitation:

- Ford’s long-term success depends on delivering the Ford+ plan, including improving cost and competitiveness;

- Ford’s vehicles could be affected by defects that result in recall campaigns, increased warranty costs, or delays in new model launches, and the time it takes to improve the quality of our vehicles and services and reduce the costs associated therewith could continue to have an adverse effect on our business;

- Ford is highly dependent on its suppliers to deliver components in accordance with Ford’s production schedule and specifications, and a shortage of or inability to timely acquire key components or raw materials can disrupt Ford’s production of vehicles;

- Ford’s production, as well as Ford’s suppliers’ production, and/or the ability to deliver products to consumers could be disrupted by labor issues, public health issues, natural or man-made disasters, adverse effects of climate change, financial distress, production difficulties, capacity limitations, or other factors;

- Ford may not realize the anticipated benefits of existing or pending strategic alliances, joint ventures, acquisitions, divestitures, or business strategies or the benefits may take longer than expected to materialize;

- Ford may not realize the anticipated benefits of restructuring actions and such actions may cause Ford to incur significant charges, disrupt our operations, or harm our reputation;

- Failure to develop and deploy secure digital services that appeal to customers and grow our subscription rates could have a negative impact on Ford’s business;

- Ford’s ability to maintain a competitive cost structure could be affected by labor or other constraints;

- Ford’s ability to attract, develop, grow, support, and reward talent is critical to its success and competitiveness;

- Operational information systems, security systems, vehicles, and services could be affected by cybersecurity incidents, ransomware attacks, and other disruptions and impact Ford, Ford Credit, their suppliers, and dealers;

- To facilitate access to the raw materials and other components necessary for the production of electric vehicles, Ford has entered into and may, in the future, enter into multi-year commitments to raw material and other suppliers that subject Ford to risks associated with lower future demand for such items as well as costs that fluctuate and are difficult to accurately forecast;

- With a global footprint and supply chain, Ford’s results and operations could be adversely affected by economic or geopolitical developments, including protectionist trade policies such as tariffs, or other events;

- Ford’s new and existing products and digital, software, and physical services are subject to market acceptance and face significant competition from existing and new entrants in the automotive and digital and software services industries, and Ford’s reputation may be harmed based on positions it takes or if it is unable to achieve the initiatives it has announced;

- Ford may face increased price competition for its products and services, including pricing pressure resulting from industry excess capacity, currency fluctuations, competitive actions, or economic or other factors, particularly for electric vehicles;

- Inflationary pressure and fluctuations in commodity and energy prices, foreign currency exchange rates, interest rates, and market value of Ford or Ford Credit’s investments, including marketable securities, can have a significant effect on results;

- Ford’s results are dependent on sales of larger, more profitable vehicles, particularly in the United States;

- Industry sales volume can be volatile and could decline if there is a financial crisis, recession, public health emergency, or significant geopolitical event;

- The impact of government incentives on Ford’s business could be significant, and Ford’s receipt of government incentives could be subject to reduction, termination, or clawback;

- Ford and Ford Credit’s access to debt, securitization, or derivative markets around the world at competitive rates or in sufficient amounts could be affected by credit rating downgrades, market volatility, market disruption, regulatory requirements, asset portfolios, or other factors;

- Ford Credit could experience higher-than-expected credit losses, lower-than-anticipated residual values, or higher-than-expected return volumes for leased vehicles;

- Economic and demographic experience for pension and OPEB plans (e.g., discount rates or investment returns) could be worse than Ford has assumed;

- Pension and other post retirement liabilities could adversely affect Ford’s liquidity and financial condition;

- Ford and Ford Credit could experience unusual or significant litigation, governmental investigations, or adverse publicity arising out of alleged defects in products, services, perceived environmental impacts, or otherwise;

- Ford may need to substantially modify its product plans and facilities to comply with safety, emissions, fuel economy, autonomous driving technology, environmental, and other regulations;

- Ford and Ford Credit could be affected by the continued development of more stringent privacy, data use, data protection, data access, and artificial intelligence laws and regulations as well as consumers’ heightened expectations to safeguard their personal information; and

- Ford Credit could be subject to new or increased credit regulations, consumer protection regulations, or other regulations.

We cannot be certain that any expectation, forecast, or assumption made in preparing forward-looking statements will prove accurate, or that any projection will be realized. It is to be expected that there may be differences between projected and actual results. Our forward-looking statements speak only as of the date of their initial issuance, and we do not undertake, and expressly disclaim to the extent permitted by law, any obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events, or otherwise. For additional discussion, see “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2024, as updated by our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.

For news releases, related materials and high-resolution photos and video, visit www.media.ford.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251215095165/en/

Contacts

Media

Inquiries

David Tovar

1.773.682.7954

dtovar9@ford.com

Equity Investment Community

Lynn Antipas Tyson

1.203.616.5689

ltyson4@ford.com

Fixed Income Investment Community

Sean Moore

1.313.248.1587

smoor192@ford.com

Shareholder

Inquiries

1.800.555.5259 or

1.313.845.8540

stockinf@ford.com

Battery Energy Storage

Sales Inquires

Joanna Kalis

energy@ford.com