Tesla (TSLA) just flipped the switch on one of its most consequential business moves in years, and investors are trying to figure out what it means for the stock. Earlier this week, Tesla ended the option to buy its Full Self-Driving (Supervised) software, or FSD, as a one-time purchase in the U.S. and other key markets.

Now, new customers pay $99 per month instead of a flat $8,000 fee. The shift appears to be a surface-level pricing tweak. But it signals something much bigger: Tesla is officially repositioning itself as a software and autonomy company, and the question for investors is whether that's enough to justify holding TSLA stock.

Tesla now charges a monthly fee, creating recurring, predictable income that can grow as the fleet grows. It is a much more attractive model for Wall Street than one-time hardware sales.

Tesla's automotive revenue dropped 10% in 2025, and the company posted its first-ever annual revenue decline, with total revenue falling 3% to $94.8 billion, according to the company's earnings report. Vehicle deliveries have slipped three straight years, from 1.81 million in 2023 down to roughly 1.64 million in 2025.

With the car business under pressure, Tesla needs a new engine for growth. FSD subscriptions could be part of that engine. Still, the math needs work. Tesla's chief financial officer, Vaibhav Taneja, told investors on the company's third-quarter earnings call that the paid FSD customer base represented only “around 12% of our current fleet.”

Tesla's Bets Big on Robotaxis, Optimus, and Autonomous Driving

FSD subscriptions are just one piece of a larger transformation Tesla CEO Elon Musk is engineering. On the company's fourth-quarter earnings call, Musk announced that Tesla will stop producing the Model S and Model X next quarter. The Fremont, California, factory that currently makes those vehicles will be converted to build Optimus humanoid robots instead. Musk's target: one million robots per year from that facility alone.

Capital expenditures are set to more than double to over $20 billion in 2026, up from $8.6 billion in 2025. That money will fund six new factories, AI infrastructure, and expansion of its robotaxi fleet, according to a company statement.

Tesla launched a robotaxi pilot service in Austin, Texas, in 2025 and plans to expand to seven more markets in the first half of 2026. The Cybercab, a two-seat driverless vehicle, is also scheduled to begin production in April.

FSD usage is accelerating, too. So far in the first quarter of 2026, Tesla drivers have averaged more than 20 million miles per day using FSD (Supervised), a roughly 30% increase from just a few months ago, according to a company statement.

Vehicles equipped with FSD recorded one major collision every 5.3 million miles, compared with one every 660,000 miles for U.S. drivers overall. That safety data is a key selling point as Tesla pushes regulators and consumers to trust its technology. But the company still faces serious headwinds.

Alphabet's (GOOG) (GOOGL) Waymo is the clear leader in U.S. robotaxi operations, with more than 450,000 weekly paid rides as of December, according to an investor letter from Tiger Global reported by CNBC.

What Is the TSLA Stock Price Target?

Here's the honest picture.

The bull case rests on software margins, autonomy at scale, and the robotics opportunity. If FSD subscriptions gain traction and the Cybercab launches on schedule, Tesla's revenue mix could look very different, and more valuable, in two to three years.

The bear case is harder to ignore right now. Tesla's brand value fell 36% in 2025, declining by $15.4 billion, according to Brand Finance, which cited a lack of new EV models, higher prices than competitors', and CEO Elon Musk's political activities.

Consumer recommendation scores in the U.S. fell to four out of 10, down from 8.2 in 2023. Net income in the fourth quarter dropped 61%. The stock currently sits at a market cap of $1.54 trillion, a premium that prices in a future that hasn't arrived yet.

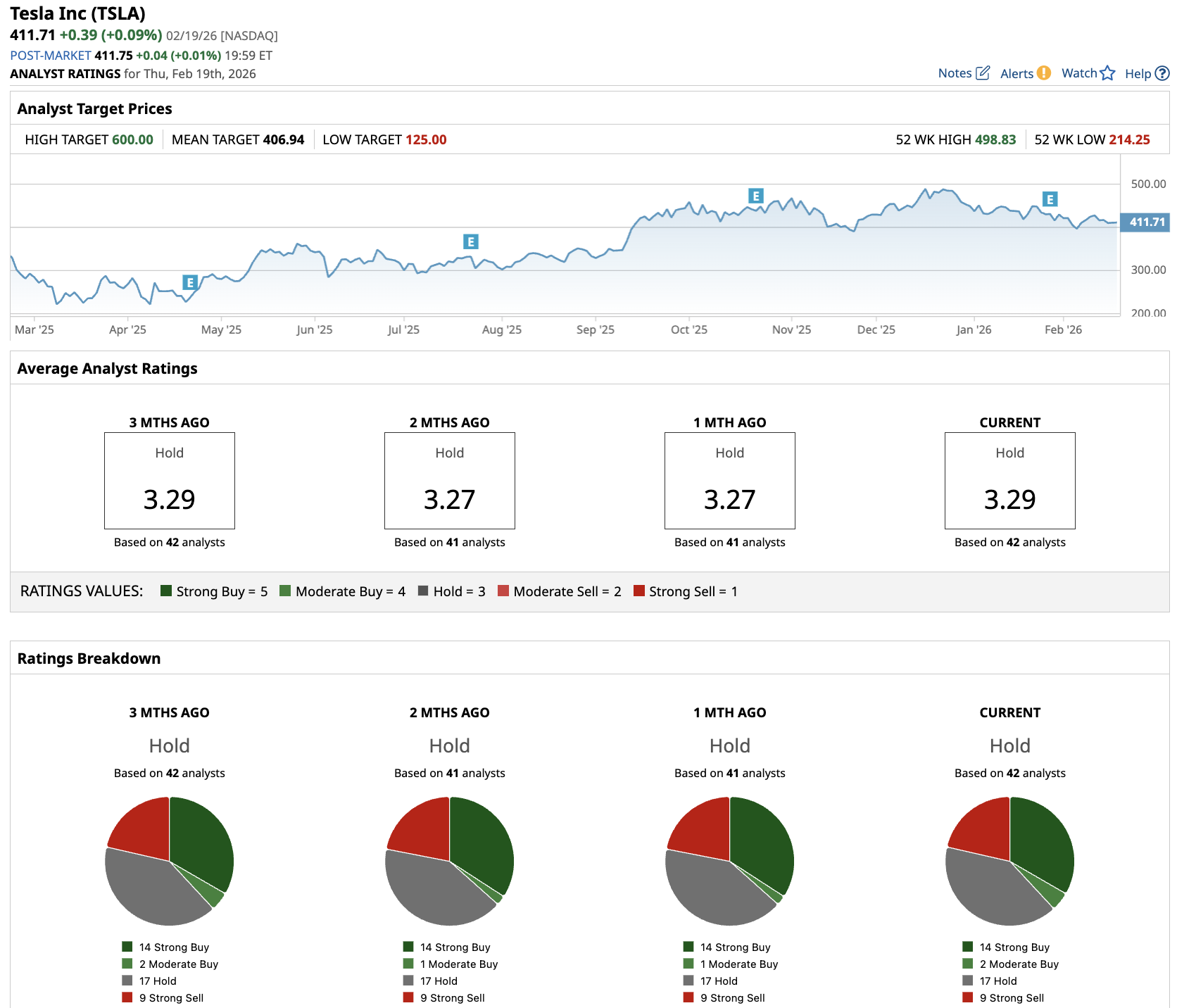

Out of the 42 analysts covering TSLA stock, 14 recommend “Strong Buy,” two recommend “Moderate Buy,” 17 recommend “Hold,” and nine recommend “Strong Sell.” The average TSLA stock price target is $406.94, below the current price of about $412.

For patient investors who believe Musk can execute on autonomy and robotics, holding or buying on weakness could make sense. For those focused on near-term fundamentals, the risk-reward is harder to defend at current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- David Einhorn Is Buying the Dip in This Penny Stock: Should You Too?

- Opendoor Jumps on iBuying Surge Despite Big Earnings Miss

- This Stock Lets You Collect a Dividend While on Vacation

- You’ll ‘Make More Money When Snoring Than When Active’: Warren Buffett Says Stop Trading Stocks, and You’ll Make More Money with Less Effort