Teradyne, Inc. (TER) is a technology company that designs, develops, manufactures, and sells automated test equipment and advanced robotics systems used to test semiconductors and other electronic components worldwide. Its products are critical in ensuring the quality and performance of chips and electronic systems across industries, including automotive, communications, industrial, cloud computing, consumer electronics, and more. The company is headquartered in North Reading, Massachusetts, and has a market cap of around $35.4 billion.

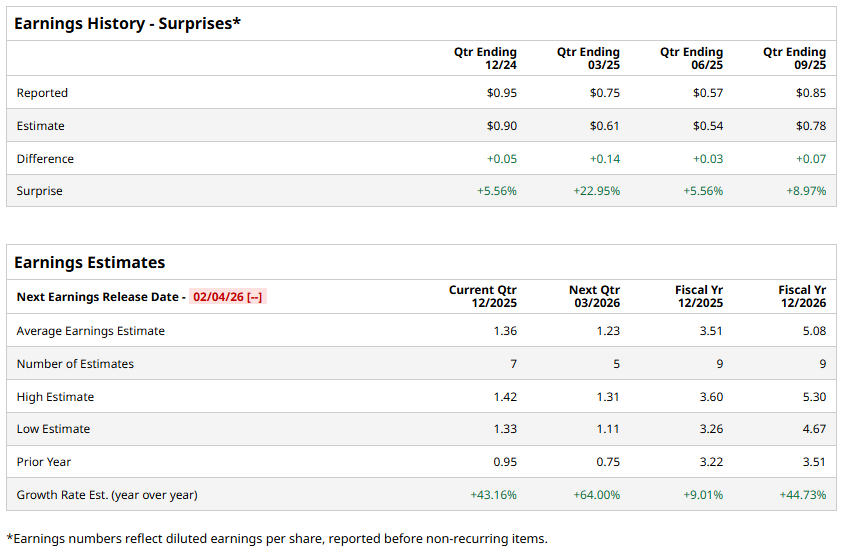

The company is preparing to roll out its fourth-quarter earnings soon. Ahead of this event, analysts are looking for Teradyne to post earnings of $1.36 per share in the upcoming report, representing a 43.2% rise from the $0.95 per share in the same quarter last year. It has a strong earnings track record, having topped Wall Street’s profit estimates in four straight quarters.

Furthermore, for the full year, earnings are expected to grow 9% to $3.51 per share from $3.22 in fiscal 2024, and again climb 44.7% to $5.08 per share in fiscal 2026.

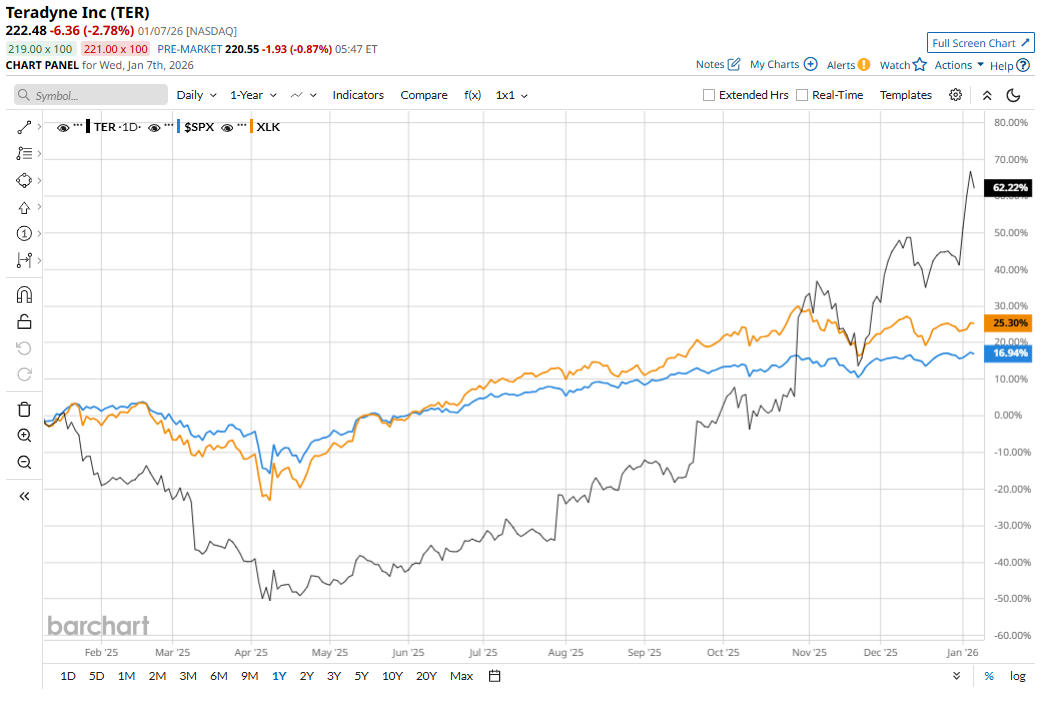

Over the past year, Teradyne’s stock has advanced 60.3%, outperforming the broader S&P 500 Index ($SPX), which is up 17.1%, and the Technology Select Sector SPDR Fund (XLK), which has surged 25.3%.

Teradyne’s stock is rising strongly, largely because of surging demand for its automated test equipment tied to the booming AI and semiconductor markets as customers rapidly expanded production of AI accelerators, memory, networking and power chips, lifting investor confidence.

Moreover, the stock hit a fresh 52-week high of $229.7 on Jan. 6, with intraday gains of 4.3%, confirming the bullish trend.

Wall Street remains bullish on the stock, with an overall “Strong Buy” rating. Among 17 analysts covering the stock, 12 recommend a “Strong Buy,” one indicates a “Moderate Buy,” and four advise a “Hold.” While the stock is trading at a premium to its mean price target of $202, the Street-high target of $240 suggests that TER can still rally 7.9% from here.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Covered-Call Google ETF Yields 41%. These 2 Option Trades Are Even Better.

- Here’s How You Can Intercept IONQ Stock’s Play-Action Pass for a 127% Payout

- Can This New ETF Be a Game-Changer in a Market Stuck Waiting for the AI Bubble to Burst?

- Nvidia CEO Jensen Huang Warns ‘Everyone’s Job Will be Affected by AI,’ But Hopes It Will ‘Enhance’ Most Jobs, Not Destroy Them