With a market cap of $90.3 billion, Freeport-McMoRan Inc. (FCX) is a U.S.-based mining company engaged in the exploration and production of copper, gold, molybdenum, silver, and other metals across North America, South America, and Indonesia. It operates major mining assets including the Grasberg minerals district in Indonesia and several large-scale mines in the United States, Peru, and Chile.

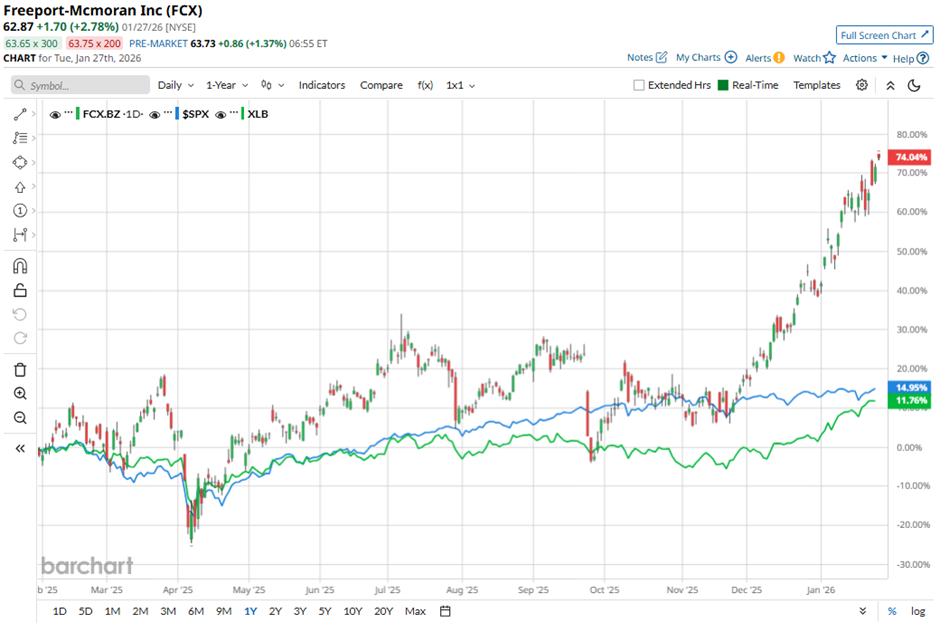

Shares of the Phoenix, Arizona-based company have outperformed the broader market over the past 52 weeks. FCX stock has surged 71.5% over this time frame, while the broader S&P 500 Index ($SPX) has gained 16.1%. Moreover, shares of the company have increased 23.8% on a YTD basis, compared to SPX's 1.9% rise.

Looking closer, shares of the copper miner have also outpaced the State Street Materials Select Sector SPDR ETF's (XLB) 12.3% return over the past 52 weeks.

Despite reporting better-than-expected Q4 2025 adjusted EPS of $0.47 and revenue of $5.63 billion, Freeport-McMoRan shares fell 2.9% on Jan. 22. The company cut its 2026 copper production outlook by 50 million pounds to 3.4 billion pounds and flagged a weaker-than-expected 2028 outlook following a fatal accident at the Grasberg mine, where copper output plunged 38.5% year-over-year to 640 million pounds and gold production dropped about 85% to 65,000 ounces.

For the fiscal year ending in December 2026, analysts expect FCX's adjusted EPS to increase 27.7% year-over-year at $2.26. The company's earnings surprise history is strong. It beat or met the consensus estimates in the last four quarters.

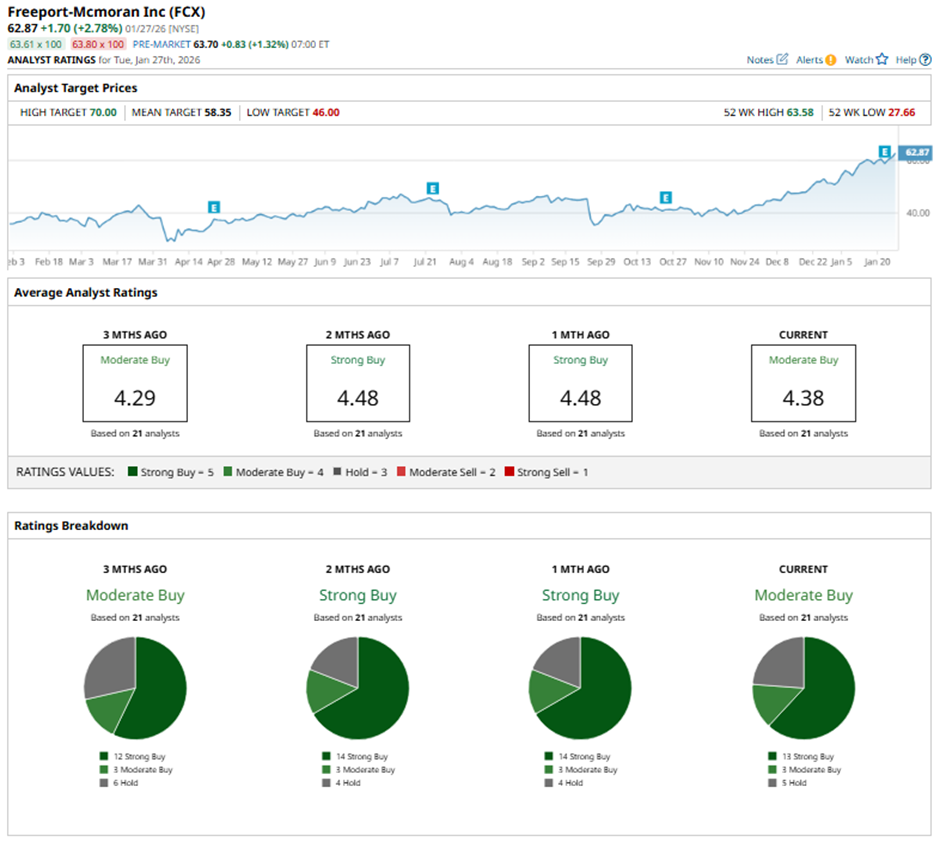

Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, three “Moderate Buys,” and five “Holds.”

This configuration is slightly more bullish than it was three months ago, when FCX had 12 “Strong Buys” in total.

On Jan. 27, Morgan Stanley raised its price target on Freeport-McMoRan to $70 and maintained an “Overweight” rating.

As of writing, it is trading above the mean price target of $58.35. The Street-high price target of $70 suggests a 11.3% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart