GameStop (GME) stock has inched higher in recent sessions after the “Big Short” investor Michael Burry confirmed he’s been buying it in 2026.

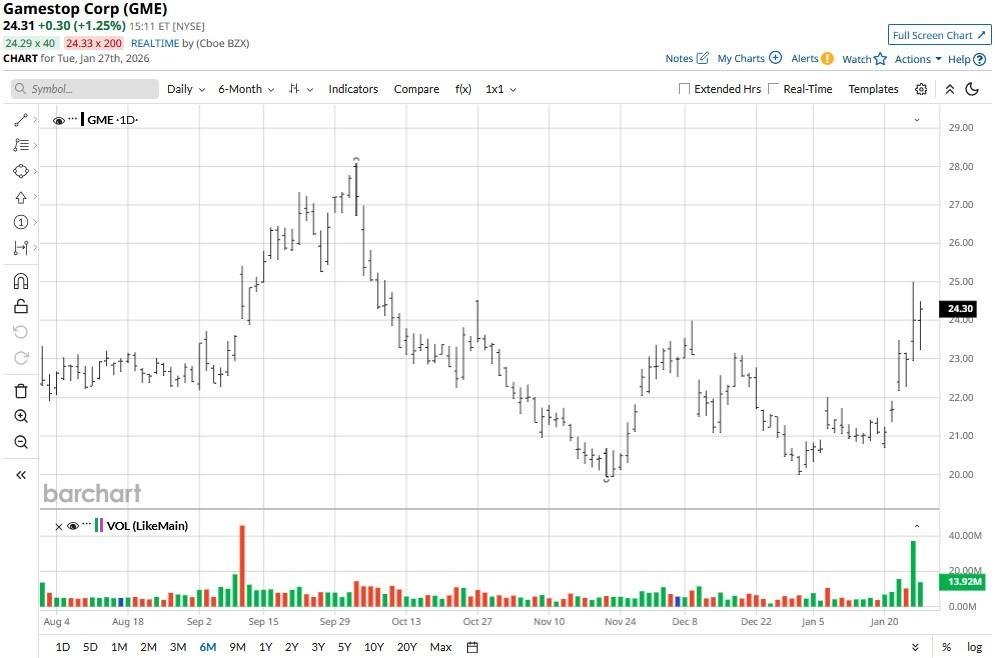

The subsequent surge has pushed GME’s relative strength index (14-day) up to nearly 73, signaling overbought conditions that often precede a notable selloff. At the time of writing, GameStop stock is up more than 20% versus the start of this year.

Should You Invest in GameStop Stock Too?

While the technicals warrant selling and GME’s reputation as a meme stock means excessive volatility, there’s reason for high-risk investors to keep at least some exposure to GameStop in 2026.

For one, Burry, who correctly predicted the financial crisis in 2008, says he sees long-term value in GME stock and is not merely “counting on a short squeeze”.

“I believe in Ryan, I like the setup, the governance, the strategy,” he wrote on his Substack.

Moreover, while the RSI appears bearish, GameStop rallied past its 200-day moving average (MA) this morning, indicating the broader trend remains upward.

Insider Trades Warrant Buying GME Shares

Ryan Cohen’s recent purchase of 1 million GameStop shares makes up for another strong reason to invest in the gaming merchandise retailer in 2026.

Earlier in January, the company’s chief executive agreed to a performance-based pay plan that will see him bank billions if GME’s market cap hits $100 billion within the next 10 years. And his latest investment reinforces that Cohen believes the target isn’t over ambitious, especially after GameStop launched a Bitcoin treasury strategy last year.

Finally, the mere possibility of another short squeeze that may push GME well past its 52-week high keeps the stock exciting for investors with aggressive risk tolerance in 2026.

Where Options Data Suggests GameStop is Headed

On the downside, GME shares no longer receive coverage from Wall Street analysts, which means investors are on their own in evaluating the company’s future prospects.

According to options data, however, there’s a real possibility that GameStop will be trading near $29 within the next three months.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- GameStop Stock Is Now in Overbought Territory as Michael Burry Buys Shares. Is It Too Late to Chase GME Stock Here?

- 2 ‘Strong Buy’ Growth Stocks With Upside of Around 200%

- This Analyst Warns Palantir Stock Could Plunge to $50. Should You Sell Shares Now?

- New Report Slams Ubiquiti for Products That Keep Showing Up on the Front Lines of the Russia-Ukraine War: What Investors Should Know