UnitedHealth (UNH) shares tanked nearly 20% on Jan. 27, after the largest U.S. health insurer said its annual revenue will decline for the first time in over three decades in 2026.

The company posted better-than-expected financials for Q4 this morning but guided for $439 billion in full-year revenue, reflecting a 2% decline on a year-over-year basis.

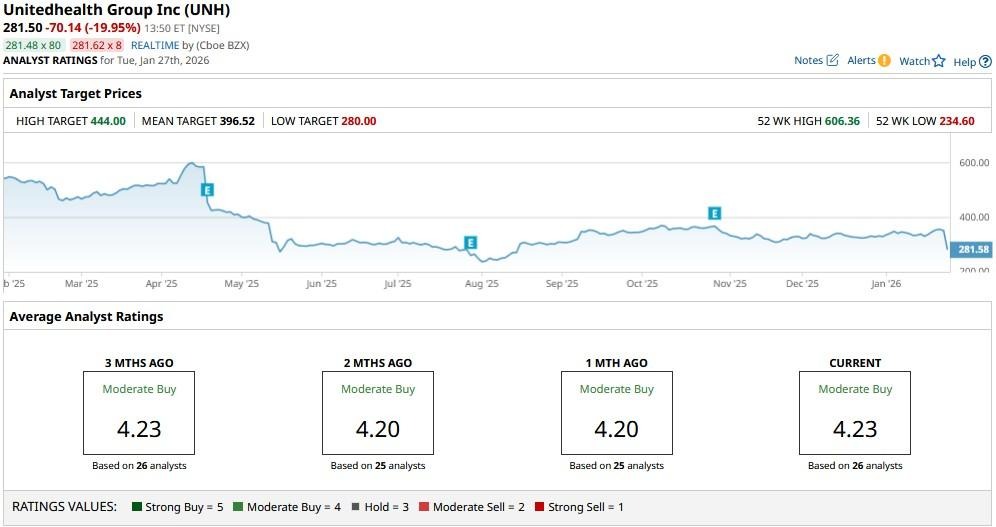

Versus its 52-week high, UnitedHealth stock is now down more than 50%. But there’s still reason to practice caution in buying it on the post-earnings dip today.

Should You Invest in UnitedHealth Stock Today?

UNH stock isn’t particularly exciting to own despite attractive valuation mostly because the Centers for Medicare & Medicaid Services (CMS) has effectively closed a loophole that the insurer used to boost its revenue.

In its latest update, the federal agency said it will no longer reimburse UnitedHealth for diagnoses that patients aren’t receiving treatment for in any given year.

Additionally, the government argued costs were flattening out as it announced a 0% increase in what it pays UNH to run Medicare Advantage plans.

These are all structural headwinds that could weigh meaningfully on UnitedHealth’s insurance unit moving forward.

UNH Shares Have Tanked Below Key Support Levels

UnitedHealth shares remain unattractive also because the firm’s medical loss ratio (MLR) went up about 3% in the fourth quarter, indicating elevated health care costs remain an notable overhang.

Investors must remain wary of investing in UNH also because it crashed below its major moving averages (50-day, 100-day, 200-day) on Tuesday, signaling bears have firmly taken control across multiple timeframes.

What’s also worth mentioning is that historically (over the past five years), UnitedHealth has lost over 4% on average in February. This seasonal trend makes its stock even less appealing in the near term.

Together with a potential squeeze from new CMS policies, these technicals warrant steering clear of UNH after its Q4 earnings on Jan. 27.

How Wall Street Recommends Playing UnitedHealth

Heading into the earnings release, Wall Street analysts had a consensus “Moderate Buy” rating on UNH shares.

However, it’s conceivable that at least some of them will downwardly revise their estimates in the coming weeks, given UnitedHealth expects U.S. membership decline to exceed 3 million in 2026.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- GameStop Stock Is Now in Overbought Territory as Michael Burry Buy Shares. Is It Too Late to Chase GME Stock Here?

- 2 ‘Strong Buy’ Growth Stocks With Upside of Around 200%

- This Analyst Warns Palantir Stock Could Plunge to $50. Should You Sell Shares Now?

- New Report Slams Ubiquiti for Products That Keep Showing Up on the Front Lines of the Russia-Ukraine War: What Investors Should Know