Tesla (TSLA) shares are trending down on Jan. 20 after the company’s chief executive, Elon Musk, started a poll on X asking whether he should buy Ireland-based Ryanair (RYAAY).

The billionaire’s social media poll is an extension of his public spat with the airline’s CEO, Michael O’Leary, over the cost and value of teaming up with Starlink for in-flight WiFi.

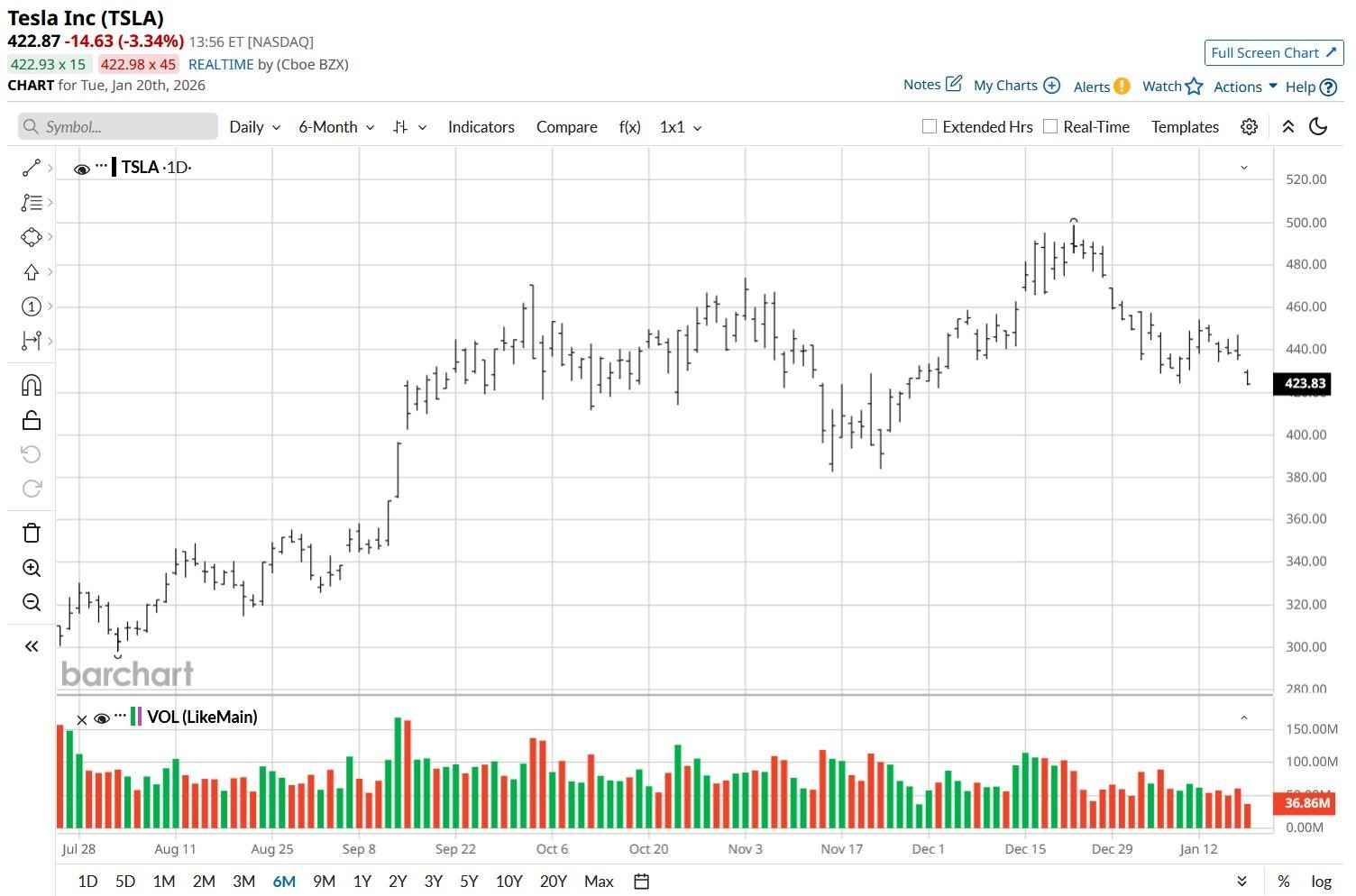

Following today’s decline, Tesla stock is down nearly 13% versus its 52-week high.

Why Is the Ryanair News Concerning for Tesla Stock?

TSLA stock are inching down today primarily because investors view Musk’s surprise social media poll about buying Ryanair as a sign of him getting distracted again by a non-core side project.

Memories of the Twitter acquisition still linger in their minds, making them worried that managing a major airline would further dilute his focus on Tesla’s production and artificial intelligence (AI) goals.

Additionally, a potential purchase of Ryanair – valued at about $36 billion – raises alarms that the billionaire may sell large blocks of Tesla stock to fund the deal, creating massive downward price pressure.

All in all, in a market already sensitive to Tesla’s margin contraction and slowing demand, seeing Musk entertain side battles undermines confidence, reinforcing fears that the company’s leadership is spread too thin.

Bernstein Maintains Bearish Stance on TSLA Shares

While Tesla shares are currently up some 90% versus their 52-week low, Bernstein’s senior analyst Toni Sacconaghi sees the performance as “heavy on the narrative with fundamentals seemingly an afterthought.”

According to him, the EV stock is priced for immediate AI perfection even though the firm’s full autonomous driving and humanoid robot ambitions are “long-dated” prospects with significant regulatory and technical hurdles.

In his research note, Sacconaghi cited shrinking auto margins and rising competition, particularly from Chinese companies as major headwinds as well.

Note that TSLA slipped below its 100-day moving average (MA) for the first time in roughly six months on Tuesday, signaling potential for accelerated bearish momentum in the weeks ahead.

What’s the Consensus Rating on Tesla in 2026?

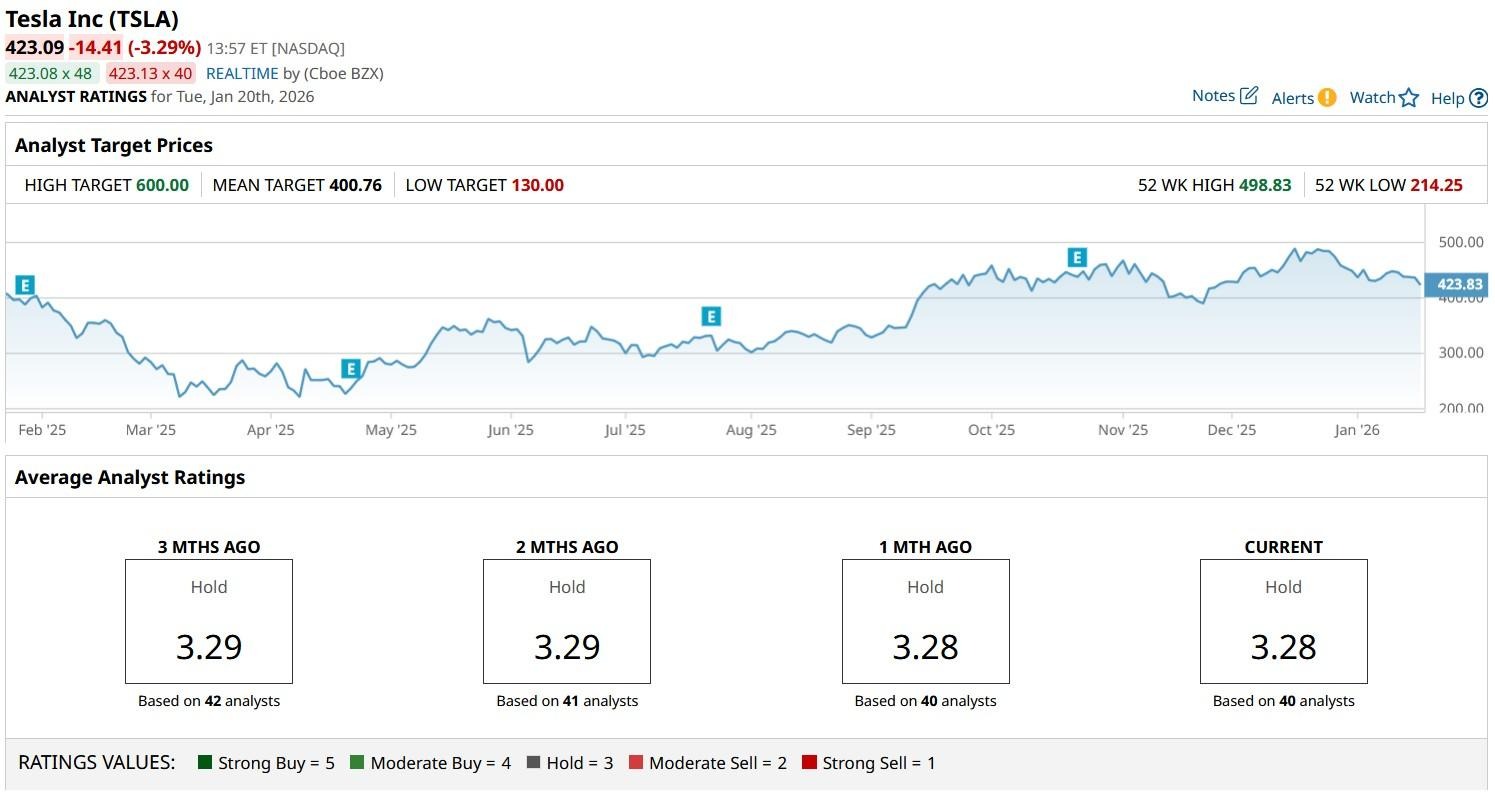

Other Wall Street analysts also recommend caution in playing TSLA shares at current levels.

The consensus rating on Tesla stock remains at “Hold” only with the mean target of about $401 indicating potential downside of more than 5% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Intel Stock Is Already Up 19% in 2026. Can Q4 Earnings Propel It Higher in 2026?

- TSLA Stock Falls 3% as Musk Spats with Ryanair CEO Michael O’Leary. How Should You Play Tesla Here?

- ‘I’m Also Very Nervous’ TSMC CEO C.C. Wei says on AI Demand. Here’s the $56 Billion ‘Disaster’ Taiwan Semi Wants to Avoid in 2026.

- 3 Software Stocks to Sell Before AI Replaces Them Entirely