Analysts are continuing to raise their price targets for McDonald's Corp. (MCD) stock ahead of the company's earnings announcement. In addition, shorting out-of-the-money (OTM) puts is a great way to set a lower potential buy-in point.

MCD is at $307.08 in midday trading on Friday, Jan. 16. That's up from a recent low of $299.86 on Jan. 5 and a peak of $319.65 on Dec. 18, 2025.

Higher Price Targets (PTs) for McDonald's Stock

However, the company's value continues to grow. This is apparent from higher stock analysts' price targets (PTs).

I discussed this a month ago in a Dec. 7 Barchart article, “McDonald's Stock Looks Cheap - Analysts Are Lovin' MCD and Raising Their PTs.”

I discussed how MCD could be worth $371.30 per share based on its strong free cash flow (FCF) and FCF margins. That is over 20.9% higher than today's price.

Moreover, at the time, I showed that analysts had been hiking their price targets (PTs). Since then, average PTs have been rising again.

For example, Yahoo! Finance now reports that the average PT of 37 analysts is $332.87 per share. That's up from $331.20 a month ago and $330.10 in November 2025.

Similarly, Barchart's mean survey PT is now $339.00, up from $337.53 a month ago and $336.43 a month earlier than that.

However, AnaChart's survey of 23 analysts is now $349.98, slightly lower than $352.03 in Dec., although it's still over $338.35 in November.

The bottom line is that the average of these analyst survey PTs is now higher at $340.62. That implies potential upside of almost 11% from today's price.

One way to play this is to sell short out-of-the-money (OTM) puts. That way, an investor can get paid while waiting for a potentially lower buy-in price.

Shorting OTM MCD Put Options

I discussed this in my Dec. 7, 2025, Barchart article. I suggested shorting the $300.00 strike price put option contract expiring last Friday, Jan. 9. At the time, MCD was at $311.23. As it turned out, MCD closed at $307.32 on Jan. 9.

So, the $2.01 premium collected by the short-sellers of this put option was kept for a 0.67% ($2.01/$300.00) one-month yield. In addition, the investor's collateral (i.e., $30,000 or $300 x 100 shares per put contract) was not assigned to buy shares at $300.00.

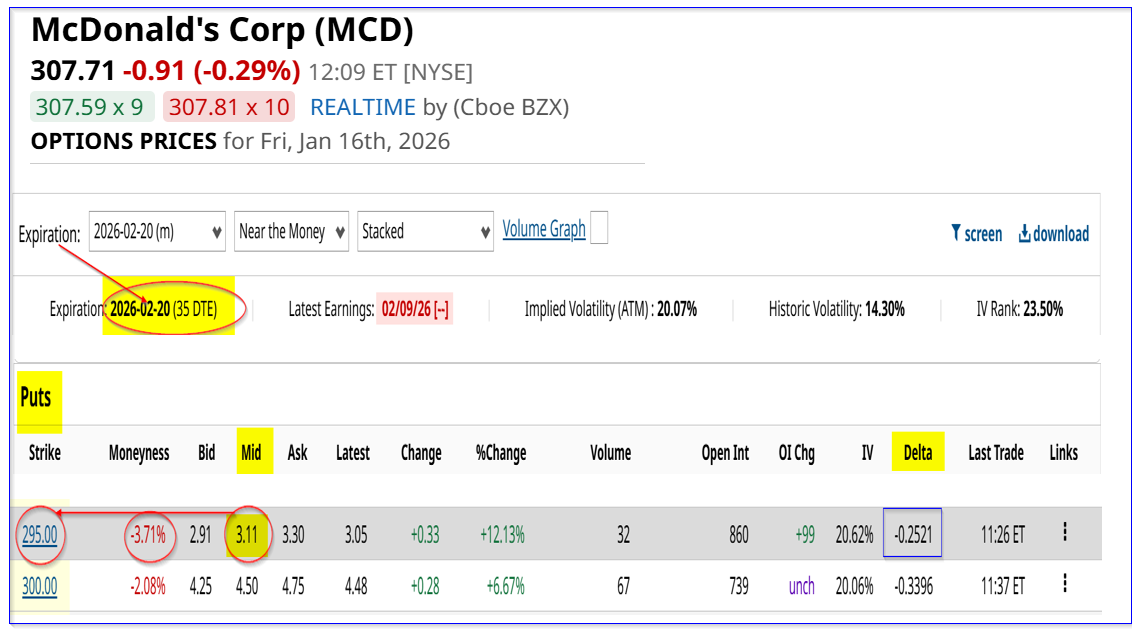

This play can be repeated for the next month. For example, the Feb. 20, 2026, put expiry period shows that the $295.00 strike price contract has a $3.11 premium. That works out to a one-month yield of 1.05% (i.e., $3.11/$295.00).

In other words, an investor who secures $29,500 with their brokerage firm can immediately collect $311 in their account by entering an order to “Sell to Open” this contract.

That also provides a potentially lower breakeven buy-in point:

$295.00 - $3.11 = $291.89 breakeven point (B/E)

$291.89 / 307.71 -1 = -0.0514 = -5.14% below today's price

That means that if MCD falls to 295.00, and the collateral is used to buy 100 shares, the investor's actual breakeven is still lower (i.e., over 5% below today's price).

That helps set a lower cost for existing investors and also gives them extra income. For new investors, this is a great way to set a buy-in point, along with getting paid to wait for this to happen.

The bottom line is that, ahead of the company's earnings release expected on Feb. 11, 2026, this is an attractive way for investors to play MCD stock.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Why Selling Costco and 3 Other Unusually Active Puts Could Save You From Overpaying

- McDonald's Is Worth Even More, Say Analysts - MCD Stock Looks Cheap Ahead of Earnings

- How to Dial In on the Best Option Strategy and Strike for Your Trading Goals

- Why Unity Software (U) Stock Could Be Due for a Big Earnings Surprise