In an election year, Washington, D.C. focused on Medicare Advantage oversight, and UnitedHealth Group (UNH) has become a prime target. Senators Elizabeth Warren and Ron Wyden have escalated their investigation into the company’s nursing home practices after reports and whistleblower claims that some seniors allegedly died when hospital transfers were delayed or denied under UnitedHealth-linked Medicare plans.

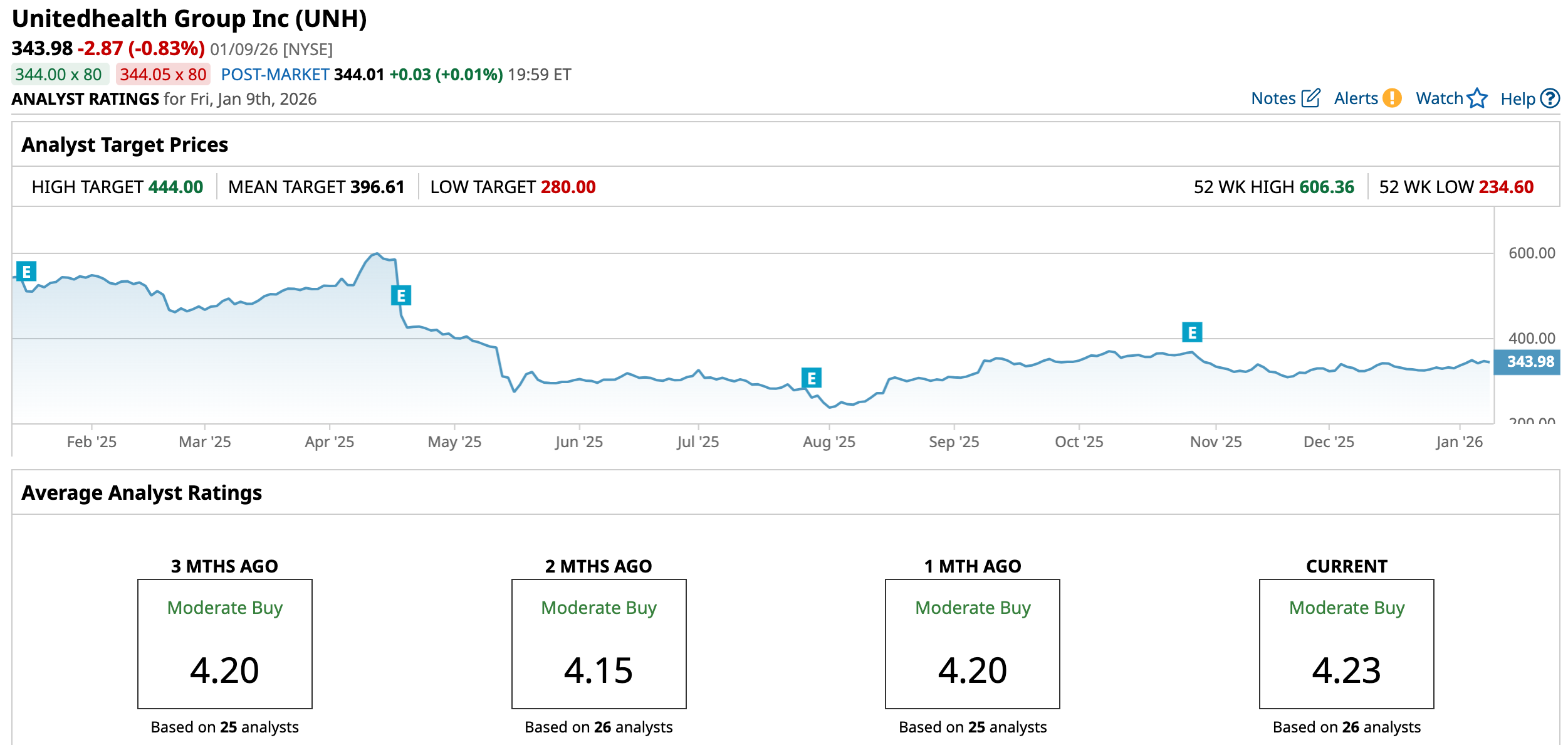

At the same time, federal agencies are tightening audits of Medicare Advantage contracts and billing, signaling a tougher line on private insurers' managed care and reimbursement for vulnerable patients. This scrutiny comes as UNH shares, while recovering some ground after a difficult 2025, still trade about 34% below their 52‑week high.

UnitedHealth, long seen as a defensive cornerstone in healthcare, now has to defend both its financials and the ethics of its nursing home care model. Is this the moment UNH’s regulatory risk finally starts to matter for the stock’s long-term story?

UnitedHealth’s Financial Performance

Minnesota-based UnitedHealth is a health insurance and healthcare services company with a market value of nearly $311.6 billion. Their forward annual dividend of $8.84 per share translates to a 2.53% yield.

UNH was priced at about $343.98 at the close of last week, up 4.2% year-to-date (YTD) but down 34.42% over the past 52 weeks.

Their third-quarter 2025 results, released in October, were solid on growth but showed clear cost and policy pressure. The company posted $113.2 billion in consolidated revenue, up 12% year-over-year (YOY), with adjusted EPS of $2.92 versus a $2.75 estimate, a 6.18% upside surprise that highlighted continued operational strength. This translated into $4.3 billion of earnings from operations and a 2.1% net margin, indicating that profitability is thinner than in prior years but still supported by scale.

The segment detail helps frame the risk around nursing homes more precisely. Their UnitedHealthcare unit generated $87.1 billion in revenue, up 16% YOY, and served 50.1 million domestic consumers, an increase of 795,000. This exposure is also what makes the scrutiny of nursing home incentives and care decisions so important for the stock.

UnitedHealth’s Key Growth Drivers

UnitedHealth’s near-term growth story still leans heavily on Optum. The company is expanding its Optum Rx model, pushing a cost-based pharmacy reimbursement structure that lets pharmacy services administration partners plug into Optum’s platform and reach more customers in more communities.

That long-term angle is one reason big money is still willing to bet on the name, even after a rough stretch. Berkshire Hathaway (BRK.B) bought 5,039,564 UNH shares in Q2 2025, stepping in after the stock became one of the S&P 500 Index’s ($SPX) weakest names. Warren Buffett has long warned that insurance companies “only” sell promises, but his UnitedHealth stake suggests he views today’s weakness as mispricing, not a broken model.

Also, an innovation layer is building around the core insurance and services engine. UnitedHealth has been testing a new AI-driven system aimed at improving medical claims processing which may lower costs and improve patient care.

What Wall Street Expects Next

The market will not have to wait long for the next checkpoint, with UNH scheduled to report on January 27, before the market opens. For the current quarter ending 12/2025, the average EPS estimate sits at $2.09 versus $6.81 a year earlier, implying a steep YOY decline of about -69.31%. Looking ahead to the next quarter, 03/2026, consensus points to EPS of $6.31 compared with $7.20 in the prior year, a drop of roughly -12.36%.

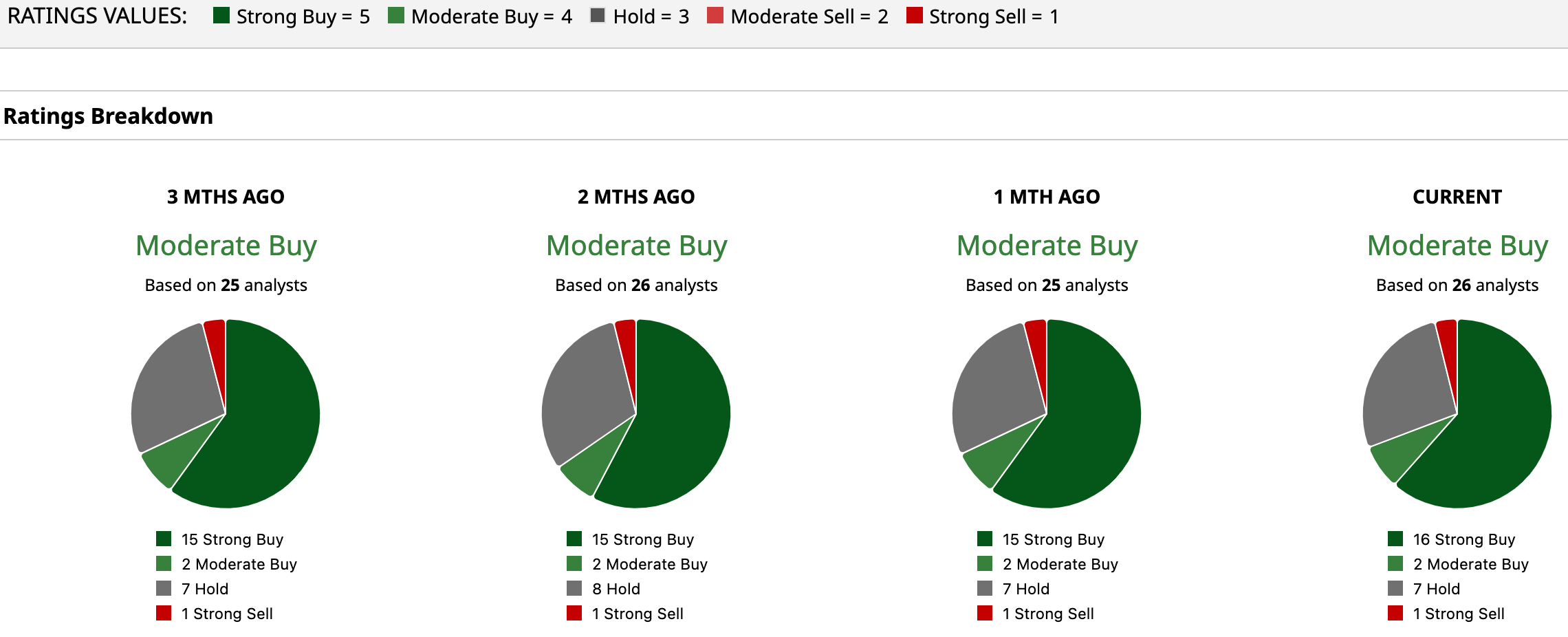

Analyst stance lines up with that cautiously constructive earnings path. The current consensus rating sits at “Moderate Buy” based on 26 opinions, with 16 “Strong Buys,” two “Moderate Buys,” seven “Holds,” and one “Strong Sell.” Price targets echo that tone, with the average 12‑month figure at $396.61, implying an upside of 15.3%.

Conclusion

UNH looks less like a broken story and more like a high‑quality business working through a messy regulatory chapter. The core engines, UnitedHealthcare and Optum, are still growing, cash flow is solid, and analysts see earnings stabilizing into 2026 with mid‑teens upside to the current share price. In the near term, headlines around nursing home practices can easily cap the multiple, but odds still favor the stock grinding higher rather than breaking down from here.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Gamble on Huge Gains with These 3 Best Biotech Stocks to Buy for 2026

- These Are the 3 Best Dividend Stocks to Buy for 2026

- Nvidia’s Jensen Huang Warns ‘China Has Twice the Amount of Energy We Have,’ but Trump’s Pro-Energy Plan is the ‘Greatest Thing’ for America

- Gold Rallies, VIX Spikes as Fed Chair Powell Responds to Criminal Indictment