Valued at a market cap of $18.4 billion, Tyson Foods, Inc. (TSN) is one of the world’s largest food companies and a leading producer of protein-rich foods. The Springdale, Arkansas-based company operates a fully integrated supply chain that spans livestock management, feed production, processing, packaging, and distribution. It serves both retail and foodservice customers through its portfolio of well-known brands, including Tyson, Jimmy Dean, Hillshire Farm, Ball Park, Wright, Aidells, and State Fair.

This food company has considerably underperformed the broader market over the past 52 weeks. Shares of TSN have declined 10.8% over this time frame, while the broader S&P 500 Index ($SPX) has surged 18.5%. Moreover, on a YTD basis, the stock is down 9.4%, compared to SPX’s 15.1% uptick.

However, zooming in further, TSN has outpaced the First Trust Nasdaq Food & Beverage ETF’s (FTXG) 14.7% loss over the past 52 weeks and 10.1% drop on a YTD basis.

On Aug. 4, shares of Tyson Foods soared 2.4% after its Q3 earnings release. Due to strength in its multi-protein, multi-channel portfolio and relentless focus on operational excellence, its quarterly revenue improved 4% year-over-year to $13.9 billion, while its adjusted EPS of $0.91 increased 4.6% from the prior-year quarter and surpassed the consensus estimates by a notable margin of 26.4%.

For the current fiscal year, which ended in September, analysts expect TSN’s EPS to grow 24.5% year over year to $3.86. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

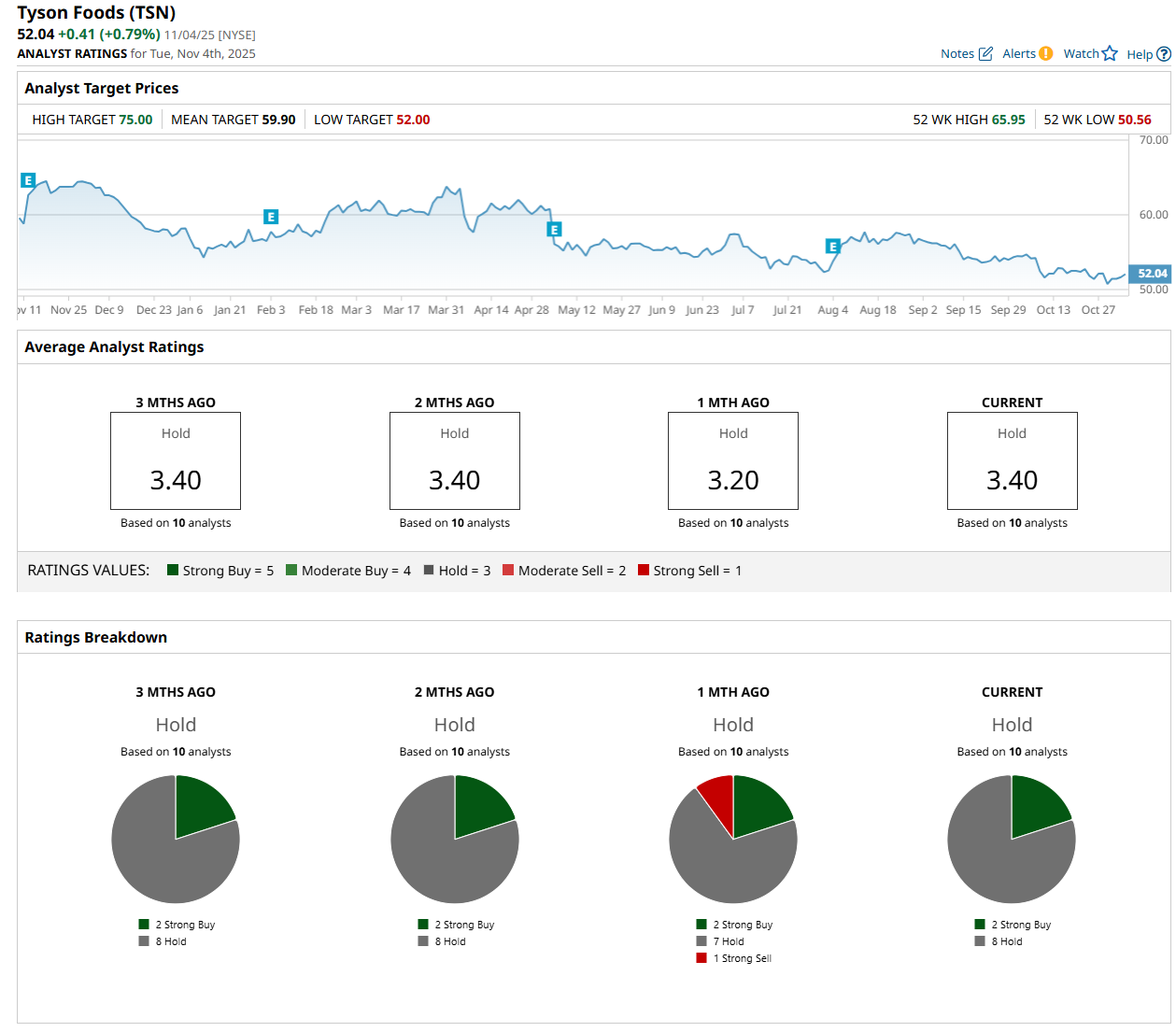

Among the 10 analysts covering the stock, the consensus rating is a "Hold,” which is based on two “Strong Buy” and eight “Hold” ratings.

This configuration is slightly less bearish than a month ago, with one analyst suggesting a “Strong Sell” rating.

On Oct. 22, Thomas Palmer from JPMorgan Chase & Co. (JPM) maintained a "Hold" rating on TSN, with a price target of $58, indicating an 11.5% potential upside from the current levels.

The mean price target of $59.90 represents a 15.1% premium from TSN’s current price levels, while the Street-high price target of $75 suggests an upside potential of 44.1%.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart