With a market cap of $39.3 billion, Crown Castle Inc. (CCI) owns, operates, and leases around 40,000 cell towers and 90,000 route miles of fiber that support small cells and fiber solutions across major U.S. markets. This extensive communications infrastructure connects cities and communities to vital data, technology, and wireless services, enabling the flow of information and innovation nationwide.

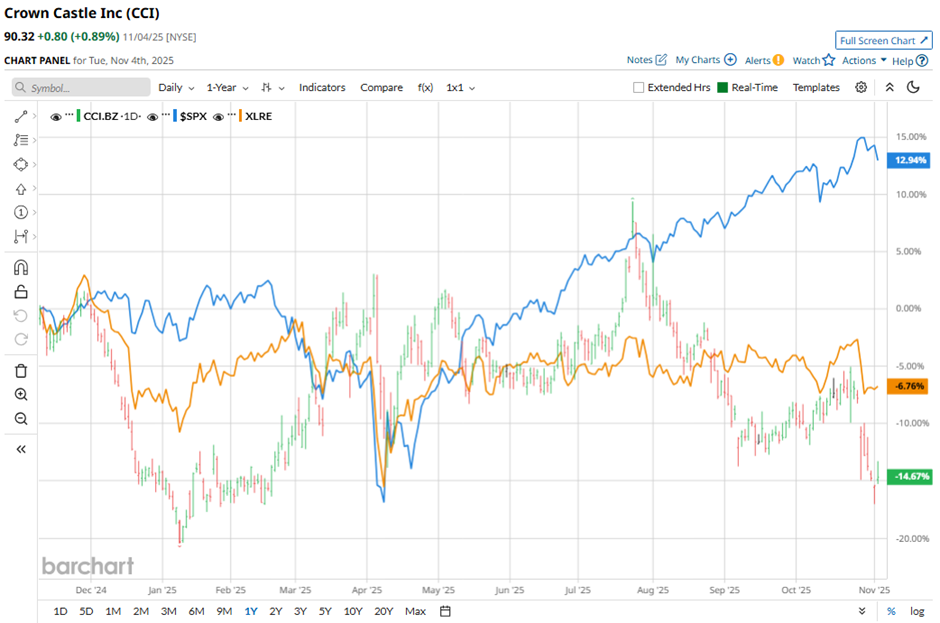

Shares of the Houston, Texas-based company have lagged behind the broader market over the past 52 weeks. CCI stock has dropped 16.7% over this time frame, while the broader S&P 500 Index ($SPX) has increased 18.5%. Moreover, shares of the wireless tower operator are down marginally on a YTD basis, compared to SPX’s 15.1% rise.

Zooming in further, CCI stock’s underperformance becomes more evident when compared to the Real Estate Select Sector SPDR Fund’s (XLRE) 5.3% decline over the past 52 weeks.

Shares of Crown Castle recovered marginally following its Q3 2025 results on Oct. 22. The company reported AFFO of $1.12 per share and revenue of $1.07 billion, beating estimates. Additionally, it raised its annual site rental revenue forecast to $4.01 billion - $4.05 billion, signaling steady demand from major carriers upgrading to 5G.

For the fiscal year ending in December 2025, analysts expect Crown Castle’s AFFO per share to dip 41.1% year-over-year to $4.11. However, the company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

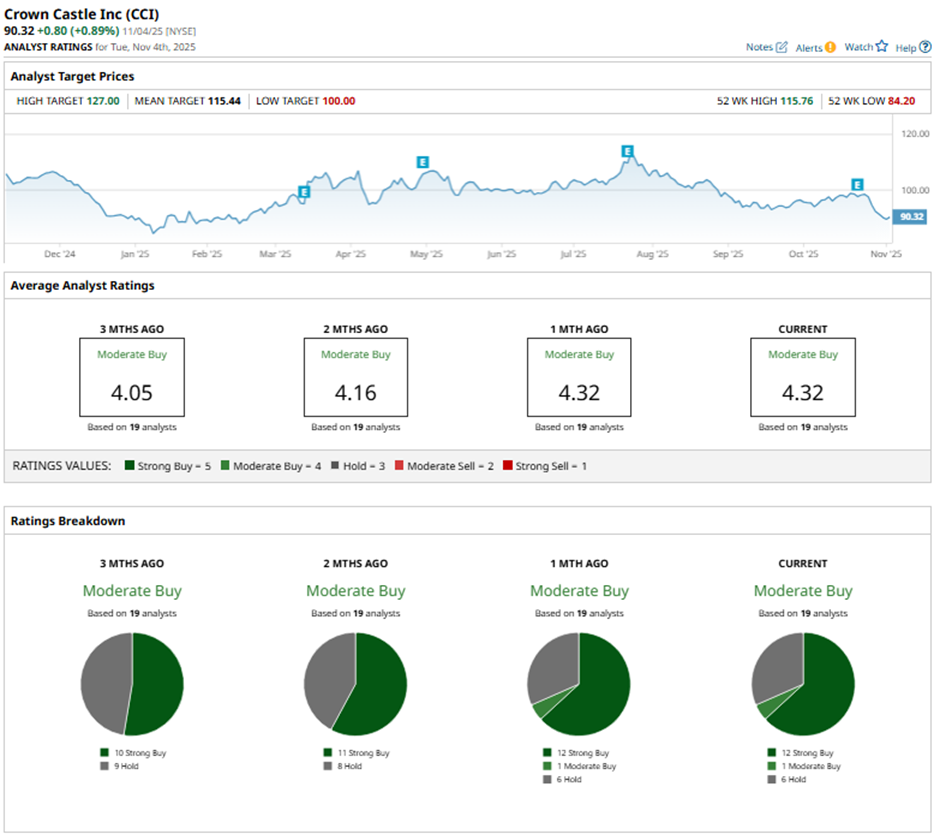

Among the 19 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, one “Moderate Buys,” and six “Holds.”

This configuration is more bullish than three months ago, with 10 “Strong Buy” ratings on the stock.

On Oct. 23, JPMorgan lowered its price target on Crown Castle to $115 while maintaining a “Neutral” rating.

The mean price target of $115.44 represents a 27.8% premium to CCI’s current price levels. The Street-high price target of $127 suggests a 40.6% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart